Bitcoin’s recent price surge, despite a red candle in August, is indicative of growing Bitcoin FOMO. Bitcoin has broken out of its recent downtrend and has gained momentum as per the 10x Research report. The recent surge of Bitcoin price over the $65,000 mark is now setting its sights on a new milestone of $70,000. The report suggests that Bitcoin could reach this target within the next two weeks, with even higher all-time highs expected by the end of October.

The recent surge in Bitcoin’s price is attributed to a mix of factors, including a substantial inflow of stablecoin liquidity and a general recovery in the global cryptocurrency market. These elements have created favorable conditions for Bitcoin’s price to rise.

Stablecoin Inflows Boost Bitcoin

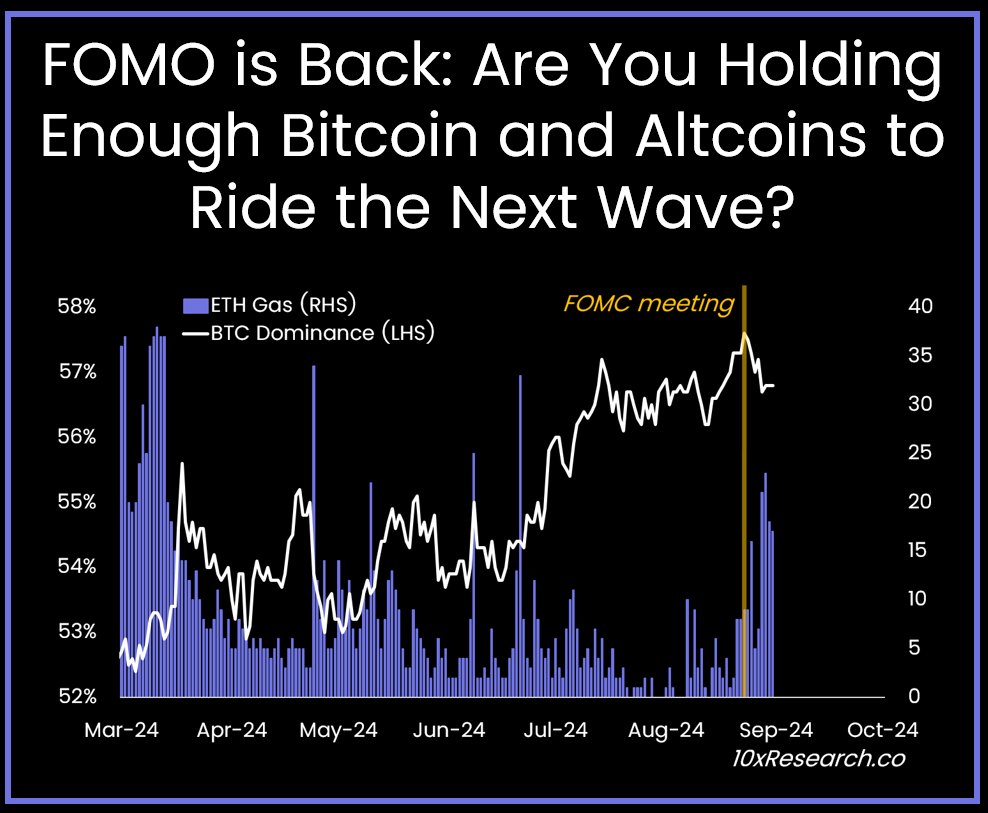

A key factor driving Bitcoin’s recent surge is the influx of stablecoins into the market following the Federal Reserve’s Federal Open Market Committee (FOMC) meeting on July 31. The meeting postponed a critical decision on interest rate cuts, leading to the issuance of nearly $10 billion in stablecoins in the weeks that followed.

Stablecoins are digital assets that are often pegged to a stable currency like the U.S. dollar. They play a crucial role in facilitating quick fund transfers between different cryptocurrencies. The total value of outstanding stablecoins has now exceeded $160 billion, with a significant portion linked to Circle’s USD Coin (USDC), which is becoming increasingly popular among institutional investors.

China’s Stimulus Ignites Bitcoin FOMO

In addition to stablecoin inflows, China’s recent stimulus measures are also igniting Bitcoin FOMO. The 10x Research report points to the country’s $278 billion stimulus plan as a potential trigger for a parabolic rally in cryptocurrency prices. The report highlights that Chinese crypto brokers have seen over $40 billion in inflows during the first half of the year, with 55% of the volume coming from large transactions of over $1 million.

This influx of liquidity from China is expected to continue supporting the upward trajectory of Bitcoin and other cryptocurrencies in the coming months.

Institutional Interest Grows as Volatility Declines

While Bitcoin’s price is climbing, its volatility has remained relatively low. The report notes that the 30-day realized volatility of Bitcoin is currently below the five-year average, sitting at 41%. This reduced volatility is making Bitcoin more attractive to institutional investors, who typically require strict risk management strategies before entering the market.

As a result, institutions are now able to take larger positions in Bitcoin, potentially driving the price higher in the coming months. The 10x Research report concludes that a fourth-quarter rally is likely, with gains expected to be “front-loaded.”

This influx of stablecoins and China’s stimulus, combined with declining volatility, are fueling Bitcoin FOMO, driving the price to new highs.

Meanwhile, Bitcoin is currently trading at $65,722.47 with a minimal drop of 0.48% over the past 24 hours. If these predictions hold true, Bitcoin could surpass the $70,000 mark within weeks, potentially setting the stage for new all-time highs by the end of 2023.

Also Read: Will Shiba Inu Coin Reach $1?: FOMO Grips the Crypto Market