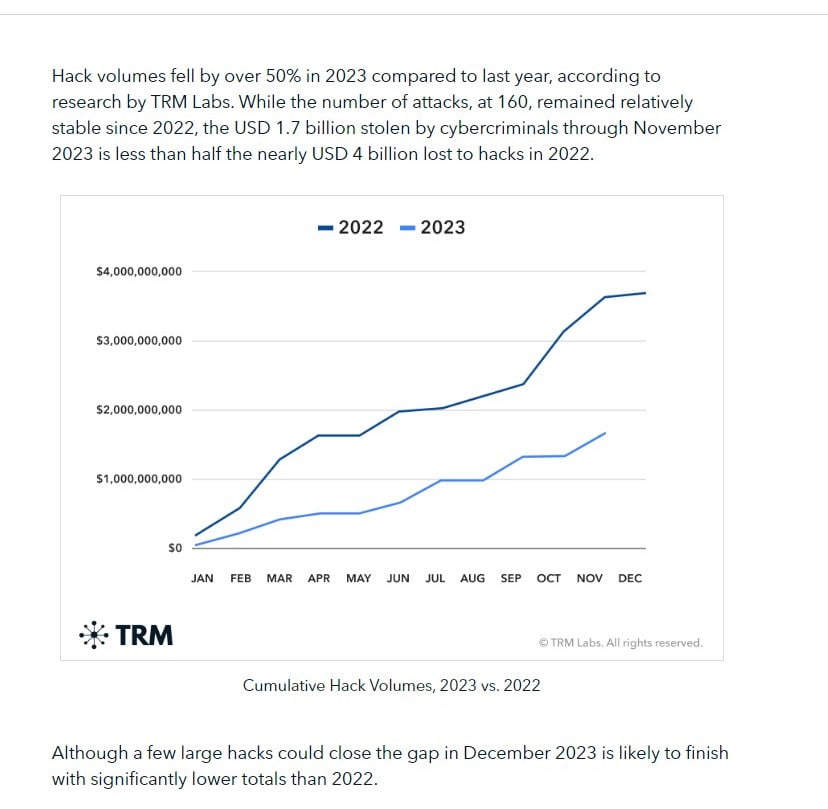

The cryptocurrency industry faced a significant decrease in crypto hacks and protocol exploits in 2023 compared to the previous year. According to TRM Labs, hackers stole an estimated $1.7 billion in cryptocurrency this year, less than half of the $4 billion recorded in 2022. Despite the overall decline, several high-profile attacks targeted prominent projects, highlighting the persistent security challenges facing the crypto world.

Biggest Crypto Hacks of 2023

Mixin Network: $200 million

The year’s largest crypto exploit occurred in September when hackers stole $200 million from users’ hot wallets on the Hong Kong-based project. The attack likely involved compromising the database of Mixin’s cloud service provider, potentially exposing private keys.

Euler Finance: $197 million

In March, a hacker exploited a vulnerability in the lending protocol’s stablecoin exchange rates, stealing $197 million. The attacker later returned most of the stolen funds, but the incident exposed potential security flaws in DeFi protocols.

Multichain: $125 million

This cross-chain bridge was hit for $125 million in July. The exact cause of the hack remains unclear, but security experts suspect the bridge’s private keys were compromised or that the team itself may have been involved.

Poloniex: $120 million

In November, suspected North Korean hackers siphoned $120 million from the centralized exchange’s hot wallets. Poloniex, acquired by Tron founder Justin Sun in 2019, is reimbursing affected users.

Atomic Wallet: $100 million

Hackers stole over $100 million worth of assets from roughly 5,500 users of this crypto wallet app in June. The cause of the attack remains under investigation, but North Korean involvement is suspected.

Heco Bridge and HTX: $99 million

The primary cross-chain bridge on the Heco blockchain and the HTX exchange collectively lost $99 million in November. The attacker gained control of the bridge’s smart contract and minted unauthorized tokens, which were then exchanged for Ether and transferred out.

Curve Finance: $73 million

A vulnerability in the Vyper programming language used by this DeFi platform allowed hackers to steal $73 million in July. The Curve team quickly patched the vulnerability and recovered about $50 million of the stolen funds.

CoinEx: $55 million

This Hong Kong-based centralized exchange reported a $55 million hack in September. The North Korean hacking group Lazarus is suspected of being involved.

KyberSwap: $54 million

This decentralized exchange aggregator was exploited for $54 million in November due to a vulnerability in its concentrated liquidity pools. The hacker refused a white hat bounty offer and made bizarre demands, including asking for complete control over the project.

Stake.com: $41 million

This crypto-based betting platform lost $41 million in September, likely due to a private key exploit. The FBI attributed the attack to the Lazarus group.

Key Takeaways:

- While the overall volume of crypto stolen in 2023 decreased significantly compared to 2022, major crypto hacks targeting prominent projects demonstrate the ongoing security challenges in the crypto industry.

- Private key exploits and vulnerabilities in smart contracts were common factors in many of these attacks.

- North Korean hacking groups, such as Lazarus, continue to pose a significant threat to crypto projects.

- The crypto industry needs to prioritize robust security measures and address vulnerabilities to build trust and mitigate future losses.

The decline in overall losses from hacks in 2023 is a positive sign for the crypto industry. However, the year’s major breaches highlight the need for continued vigilance and investment in security measures to protect user funds and build a more secure future for crypto.

See Aslo: Gamma Strategies Hack: A Negotiation Gamble Shakes DeFi