Bitcoin has achieved a hystoric milestone by surging past the $69,000 mark, setting a new all-time high for the cryptocurrency. This noteworthy financial achievement, previously reached on November 10, 2021, reinforces the increasing investor interest and confidence in Bitcoin as a leading digital asset. The recent surge in value is attributed to the launch of new U.S.-based spot Bitcoin Exchange-Traded Funds (ETFs), marking a pivotal moment in the cryptocurrency’s market dynamics.

The introduction of spot Bitcoin ETFs in the United States on January 11 played a crucial role in Bitcoin’s impressive price performance. Despite an initial dip to the $39,000 range due to a common market reaction known as “sell the news,” Bitcoin quickly regained momentum. By mid-February, it soared above $50,000 and, after a consolidation period of around $51,000, firmly established its new peak above $69,000.

This surge in Bitcoin’s value towrds new all-time high not only points to growing investor enthusiasm but also signifies the integration of cryptocurrency into more traditional financial products like ETFs. The trend reflects the increasing acceptance of Bitcoin in mainstream finance, suggesting a bullish outlook for its future market performance.

BlackRock’s decision to pursue a Bitcoin ETF has significantly influenced the current surge in Bitcoin activity and value. As the largest asset manager globally, BlackRock’s involvement underscores the growing recognition of Bitcoin as a corporate investment asset through ETFs. This development, coupled with favorable macroeconomic shifts, has played a crucial role in fueling Bitcoin’s ascent.

Aurelie Barthere, an analyst at Nansen, highlighted key factors, such as the Federal Reserve’s pause in interest rate increases and the buoyancy in the technology sector, contributing to Bitcoin finding its footing in 2022. The anticipation surrounding the Bitcoin Halving event has also positively influenced cryptocurrency prices, with historical trends suggesting exceptional returns during these periods.

Despite the momentary new all-time high, some experts caution about a potential correction in Bitcoin’s price. The Market Value to Realized Value (MVRV) ratio, indicating potential overvaluation, raises concerns about a possible price correction. Analysts from Bitfinex predict Bitcoin reaching between $100,000 and $120,000 by the end of 2024, with spot ETFs smoothing out price fluctuations and making future declines less severe.

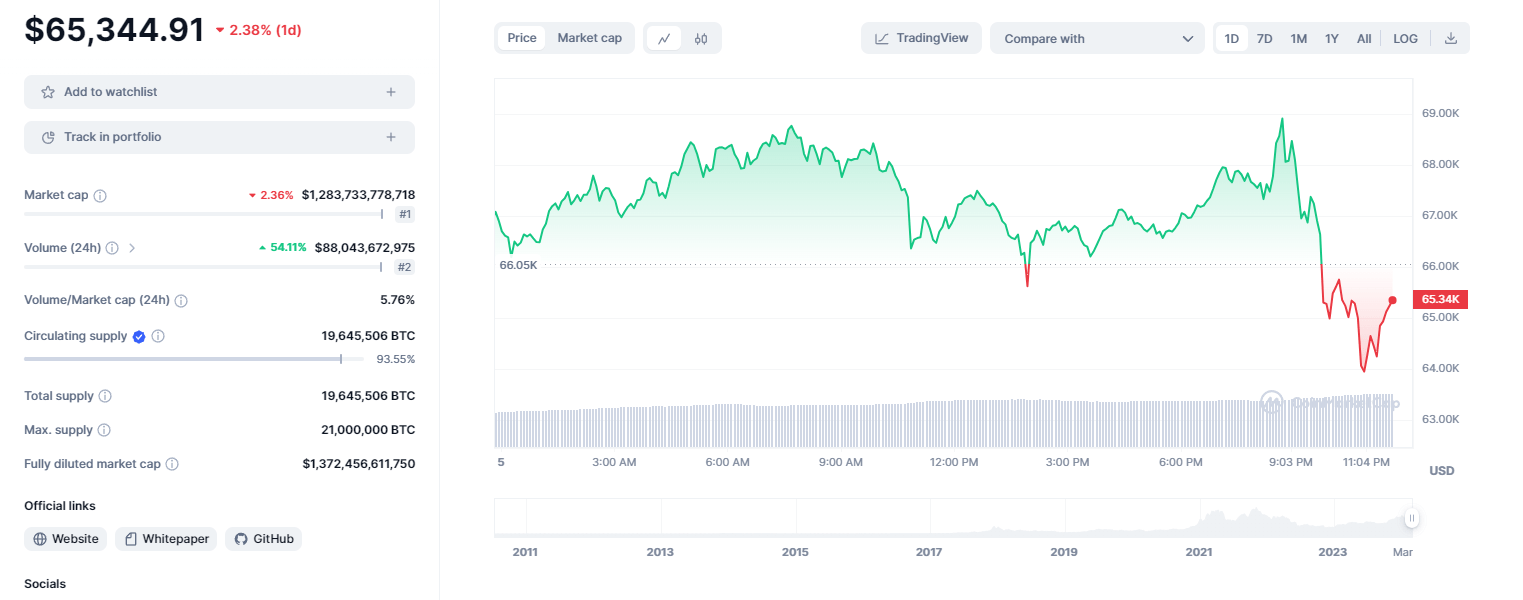

While the current surge echoes the bullish market of 2021, driven by retail investors, experts warn of potential profit-taking that could influence market dynamics and temporarily pull Bitcoin below $65,000 Currently trading dip at $65,344.91 aligning with experts’ warning of profit-taking actions from traders.

Also See: Mox Bank Joins Global Trend with Bitcoin ETF Services