Hong Kong stands at the precipice of a significant milestone in the cryptocurrency arena, with the potential approval of exchange-traded funds (ETFs) for Bitcoin and Ethereum expected as soon as next week, as reported by Bloomberg. This revelation has sparked a surge of optimism within the crypto community, drawing parallels to the success of U.S. Spot Bitcoin ETFs. The prospect of green-lighting these spot-crypto ETFs, which directly invest in the underlying digital currencies.

If the rumors are accurate, leading the charge could be big players like Harvest Fund Management and a partnership between Bosera Asset Management (International) Co. and HashKey Capital. The anticipated launch of these ETFs by the end of April hinges on approval from the Securities and Futures Commission (SFC) and finalizing listing particulars with the Hong Kong Exchanges & Clearing. Earlier speculation hinted that Harvest Fund Management was close to approval for a Bitcoin ETF, yet both the SFC and Harvest have remained tight-lipped on the matter.

While there’s excitement about the possible approvals, insiders warn that the timeline might change last minute. Interestingly, past reports hinted that Hong Kong might even roll out an Ethereum ETF before the US.

The potential green light for these ETFs (Bitcoin and Ethereum ETFs) could shake up the global crypto scene. The debut of Spot Bitcoin ETFs in the US this year already gave the market a boost, with assets under management hitting $59 billion. This surge in institutional investment is said to have propelled Bitcoin to new heights, topping over $73,700 in mid-March.

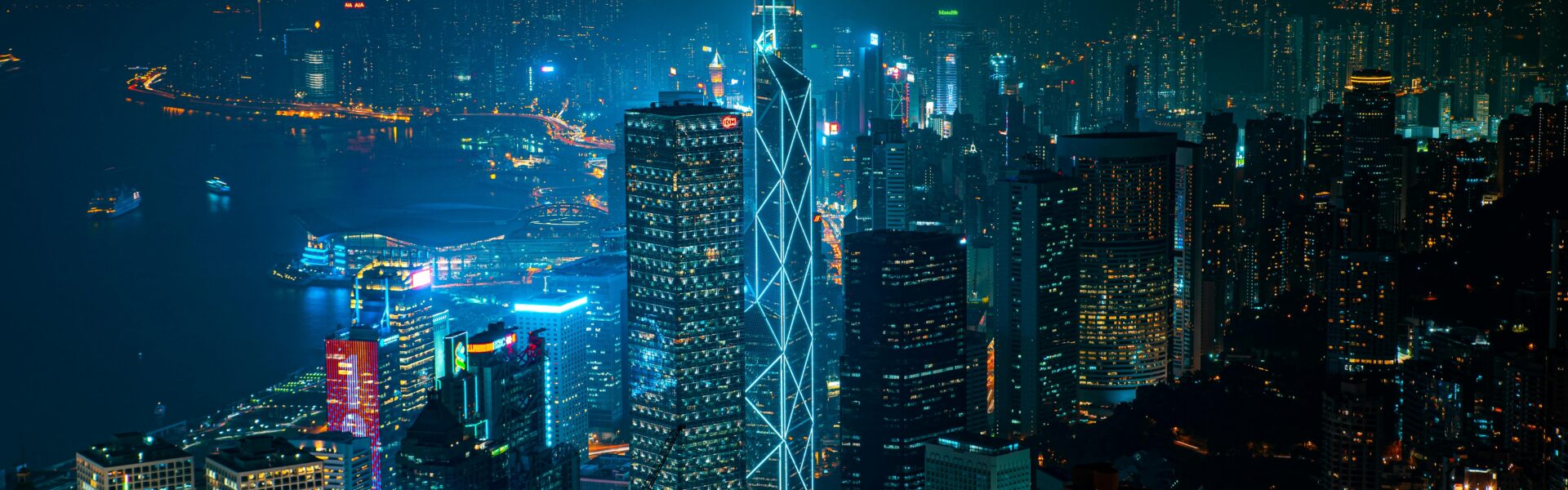

Hong Kong’s move to welcome crypto ETFs mirrors its rivalry with cities like Singapore and Dubai to become a top spot for digital asset firms. This lines up with China’s recent crackdown on crypto transactions, possibly giving Hong Kong a chance to draw in displaced businesses and investors.

Despite the positive vibes, Bitcoin’s price stayed pretty steady, around $70,000, with a 19.27% drop in trading volume in the last 24 hours. This could be chalked up to short-term market swings or investors playing it cautiously before reacting to the ETF news.

This step is a big deal for Hong Kong as it aims to lead in the digital asset scene. If Bitcoin and Ethereum ETFs get the green light, it could not only give the global crypto market a lift but also amp up the competition among financial hubs eyeing a slice of this growing industry. With clear regulations and solid financial groundwork, Hong Kong looks primed to seize this chance. But whether this will kick off another bull run for Bitcoin and Ethereum or if the market will take a more measured approach remains to be seen.

Also See: XRP Community in Frenzy as SEC Settlement Talks Begin!