After a week of record net outflows from US spot Bitcoin ETFs, the market saw a dramatic reversal on May 3rd, 2024, with inflows exceeding outflows by $343 million. This positive shift in investor sentiment coincided with a surge in the Bitcoin price, which broke back above the $63,000 mark.

The previous week had been dominated by heavy net outflows, totaling over $1.2 billion across seven consecutive days. Grayscale Bitcoin Trust (GBTC), the largest Bitcoin ETF, bore the brunt of these net outflows, contributing a staggering $692.4 million, or 56.15% of the total.

However, the tide turned dramatically on May 3rd. For the first time since January, GBTC recorded a net inflow of $63 million. Notably, none of the 10 US spot Bitcoin ETFs saw net outflows on this pivotal day. Eight ETFs registered positive inflows, while two, Valkyrie Bitcoin Fund (BRRR) and Bitwise Bitcoin ETF (BTCW), maintained a neutral position with zero net flow.

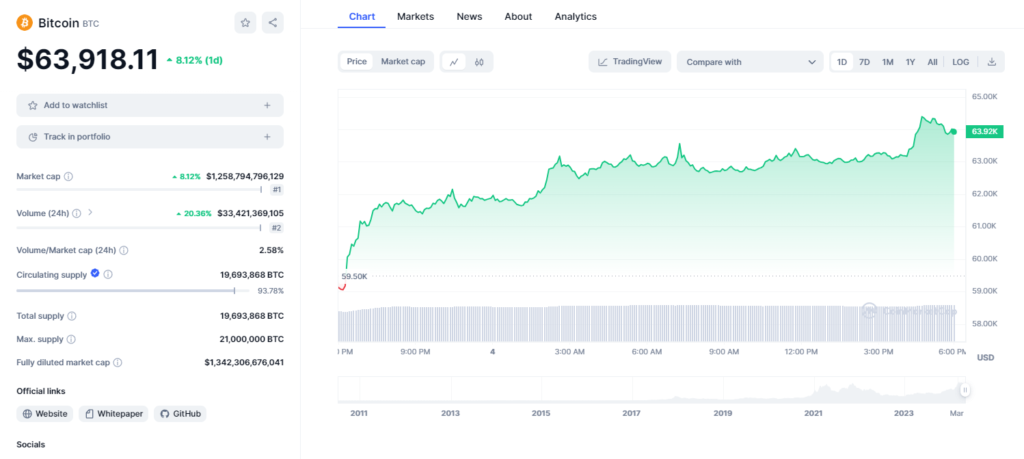

This shift in investor sentiment appears to be linked to a broader market recovery. Following a significant correction, the Bitcoin is currently trading at $63,918.11 experiencing a 8.12% surge over the past 24 hours. Additionally, trading volume rose by a staggering 20.36% during the same period.

Cryptoquant CEO Ki Young Ju, founder of the on-chain analytics platform Cryptoquant, fueled investor optimism further by sharing information regarding significant Bitcoin accumulation by whales. According to his post on X (formerly Twitter), whales acquired a staggering 47,000 Bitcoins, valued at $59,000 each, on May 3rd, for a total of $2.8 billion.

Investors are viewing the recent dip in Bitcoin price as a promising opportunity, driven by the limited supply of Bitcoin in the post-halving period. It appears they are seizing the heightened volatility surrounding the Bitcoin halving event to capitalize on potential gains.

Renowned crypto analyst Michael van de Poppe echoed the sentiment, stating, “Bitcoin bounces back upwards” in his X post dated 4th May 2024.

Further bolstering positive sentiment, data from Coinglass suggests increased activity in Bitcoin derivatives. Derivative volume jumped by 31.02% to $77.56 billion, while open interest rose by 8.34% to $38.38 billion. These positive indicators suggest a potential influx of new money into the Bitcoin market.

With a renewed positive outlook from investors, whales accumulating, and a surge in derivatives activity, the Bitcoin market appears to be recovering from its recent slump. However, it remains to be seen if this upward trend will continue in the long term.

Also Read: Pepe and Arweave on Fire: Impressive Performance Across All Timeframes