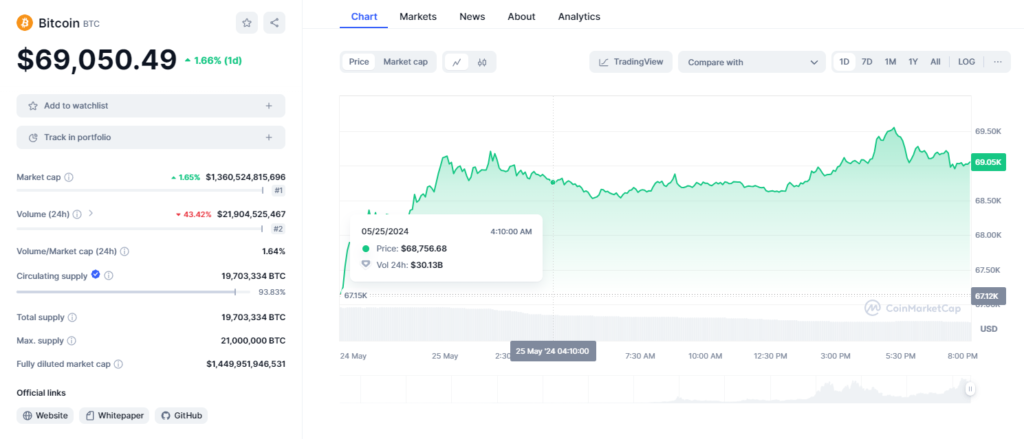

In an exciting turn of events, the Bitcoin market has seen its price briefly above the $69,000 mark. This milestone comes despite a noticeable decrease in trading volume compared to the previous day. Meanwhile, Strike CEO Jack Mallers forecasted Bitcoin price to hit $1 million in the near future amidst uncertainty due to increasing US debt.

Bitcoin Price Rally and Market Sentiment

The recent surge in Bitcoin’s price is propelled by the positive trends across the cryptocurrency market. Two key factors driving this rally are the surge in U.S. Spot Bitcoin ETF inflows on Friday and the recent approval of the Spot Ethereum ETF by the Securities and Exchange Commission (SEC). These developments have significantly boosted investors’ confidence, pushing the Bitcoin price upwards.

US spot Bitcoin ETFs continued their hot streak, recording their ninth consecutive inflow day on May 24. As per Fireside ETF traker data, these inflows totaled $251.9 million with BlackRock’s IBIT leading the charge at $182.1 million. Notably, the outflow of GBTC also paused that day followed by five other issuers, including Invesco Bitcoin ETF, Franklin Bitcoin ETF, and Valkyrie Bitcoin Fund with zero outflows.

Jack Mallers’ Bold Bitcoin Price Prediction

In a interview with Anthony Pompliano, Jack Mallers, CEO of Strike, has further boosted the bullish sentiment around Bitcoin with a bold prediction about Bitcoin’s future. Mallers forecasts a staggering price increase for Bitcoin, projecting it to reach between $250,000 and $1 million within the next 10 to 18 months. His optimistic outlook is based on several key factors.

Firstly, Mallers points to the potential for significant money printing by the Federal Reserve to address increasing US debt, which he believes could lead to greater financial instability. In such an environment, Bitcoin’s appeal as a safe haven asset is expected to grow, attracting more investors seeking refuge from inflationary pressures impacting traditional currencies. Additionally, Bitcoin’s fixed supply makes it an attractive alternative to inflation-prone fiat currencies.

Supporting Evidence for Jack Mallers’ Prediction

Jack Mallers’ prediction is backed by strong evidence. One of the most compelling indicators is the recent inflow of over $1 billion into the U.S. Spot Bitcoin ETF in a week. This substantial investment highlights the growing confidence in Bitcoin’s potential for substantial returns. Moreover, the ongoing positive trends observed in the broader cryptocurrency market further validate Mallers’ optimistic forecast.

Overall Sentiment in the Crypto Community

The prevailing sentiment within the crypto community is one of growing optimism regarding Bitcoin’s future. Jack Mallers’ prediction reflects a broader belief that Bitcoin’s unique properties, such as its fixed supply and status as a hedge against economic instability, coupled with the current economic conditions, could lead to unprecedented price levels.

Additionally, the SEC’s recent approval of Exchanges to list spot Ethereum ETFs has further boosted investors’ sentiment in the broader cryptocurrency market. Although trading these spot Ethereum ETFs has not yet started, approval for listing confirms that they will be available sooner or later.

Bitcoin gained 1.66% over the past 24 hours, currently trading at $69,050.59. Positive market trends and bullish predictions by analysts are fueling investors and enthusiasm. However, due to inherent risks associated with cryptocurrency, careful research and evaluation of own risk tolerance are essential for investors to make effective investment decisions.

Also Read: Ethereum ETFs Closer: SEC OKs Exchange Listing