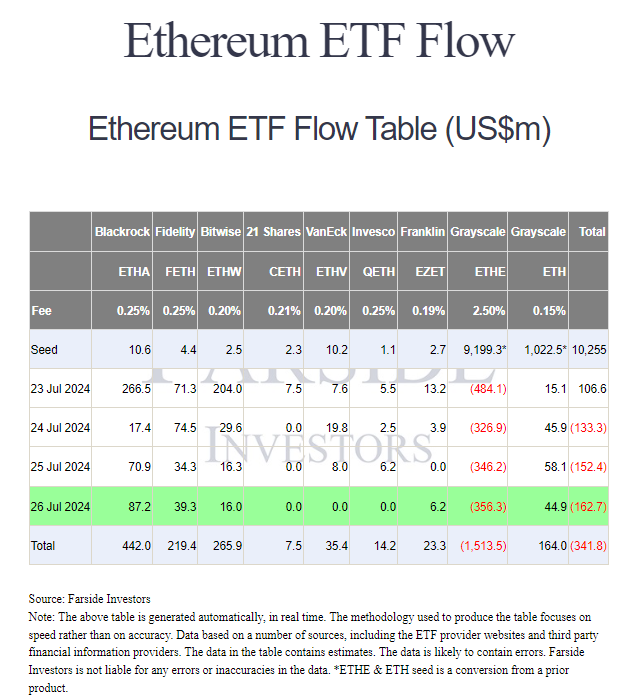

The launch of spot Ethereum ETFs, while long anticipated, encountered a tepid reception from investors, with a net outflow of $341 million in its first week of trading. This contrasts sharply with the success of Bitcoin-backed ETFs, which have seen robust demand fueled by Bitcoin’s solidified position as “digital gold” and its broader market acceptance.

Ethereum ETF Mirrored the Launch of Bitcoin ETF

Grayscale’s ETH ETF, which was also a primary contributor to the net outflow in Bitcoin ETFs, appears to be the main culprit in the Ethereum ETF’s poor performance. QCP Capital observed that the first week of trading for the US-listed ETH ETF closely mirrored the launch of the Bitcoin ETF product, with ETH prices fluctuating wildly between $3,565 and $3,086. This volatility is attributed to the substantial fees (2.5%) associated with Grayscale’s products, which have precipitated significant outflows within days of the launch.

In the weekly Telegram brief, QCP wrote:

“Despite Grayscale introducing a Mini ETF (ETH) with the most competitive fee of 0.15%, net outflows continue to dominate with only 10% of the initial ETHE being converted to ETH. Crypto market pulling the classic ‘buy the hype sell the news’. Over positioning into an event and rushing out when there’s a lack of positive reaction.”

Grayscale’s Ethereum ETFs Eclipse Spot ETH ETF Enthusiasm

Other ETH ETF issuers enjoyed net inflows during their first week of trading. BlackRock led the pack with a substantial $442 million, followed by Bitwise and Fidelity with $265.9 million and $219.4 million, respectively. Despite Grayscale’s Mini ETH ETF seeing a net inflow of $164 million, its ETHE product, burdened by a 2.5% fee, experienced a net outflow of $1,513.5 million which netted the overall outflow to $341 million.

The Ethereum ETF market may require additional time to gain traction. Unlike Bitcoin, which has been widely accepted as “digital gold” and a store of value, Ethereum remains a more abstract concept for traditional finance investors. Staking, a key feature of Ethereum, has been a significant selling point for the cryptocurrency. However, the absence of staking in spot Ethereum ETFs has likely dampened investor enthusiasm.

Bitcoin Conference Overshadows ETH ETFs

The Bitcoin Conference 2024 has overshadowed the excitement around Ethereum ETFs. Former and potential future US President Donald Trump’s pro-crypto stance, along with his highly anticipated speech at the conference on July 27th, has put Bitcoin (BTC) in the spotlight in the options market this week, pushing Ethereum (ETH) aside.

At the time of writing Ethereum is trading at $3,275.53 with 0.84% surge over the 24 hours while Bitcoin climed to $68,189.48 by 1.27% over the same time period.

Also Read: Withdrawal of Presidential Candidature by Joe Biden Sparks Powerful Shifts in Meme Coins