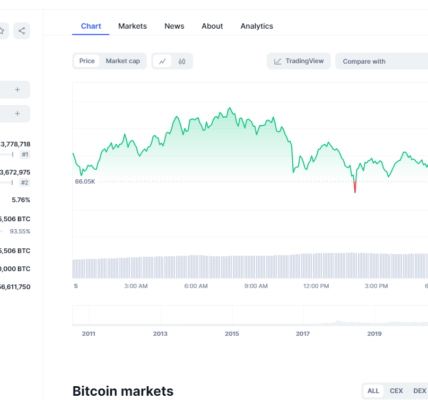

Investors are on edge after the broader crypto market suffered with its most severe three-day downturn in almost a year. The digital asset market shed a staggering $510 billion in value since August 2nd, mirroring a broader decline in traditional equities. The S&P 500 also suffered a significant drop of 4.4% during the same period.

The broader crypto market plunged dramatically over the past 24 hours, with Ethereum leading the decline. The leading cryptocurrency fell by 20.65% to $2,303.73, while Binance Coin (BNB) dropped 17.36% to $434.28. Solana and Bitcoin also suffered significant losses, declining by 16.23% to $120.07 and 12.94% to $53,746.24 respectively. The overall crypto market dipped by 13.18% during the same period.

The recent cryptocurrency market crash has sparked a frenzy of trading activity. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, saw its 24-hour trading volume skyrocket by 160.57%. Solana (SOL) followed closely behind with a 110.05% increase. Bitcoin (BTC) and Binance Coin (BNB) also experienced significant trading volume surges, at 80.56% and 68.12% respectively.

A combination of economic factors is being blamed for the recent broader crypto market crash. Weak employment figures, coupled with slowing growth in the tech sector and mounting recession concerns, have eroded investor confidence. Disappointing quarterly results from tech giants like Microsoft and Intel have further dampened market sentiment. Additionally, speculation about potential interest rate cuts in September has led to a shift in investment focus away from market leaders like NVIDIA towards smaller, previously undervalued companies.

Moreover, ongoing geopolitical tensions in the Middle East have heightened uncertainty in the digital asset market. Investors fear potential sanctions and regulatory crackdowns amid the region’s instability.

Adding fuel to the fire, Arkham Intelligence pointed to a significant selling spree by Jump Crypto, a major trading firm. According to Arkham Intelligence data, Jump Crypto has offloaded hundreds of millions of dollars in assets over the past few days, potentially exacerbating the sell-off.

The Crypto Fear and Greed Index, a measure of market sentiment towards Bitcoin and cryptocurrencies, underscores the current anxiety. The index has dipped back into “fear” territory, currently hovering at a score of 42, according to CoinMarketCap.

The next week promises to be challenging for the crypto market. Recovery will likely hinge on increased spot and derivatives activity from traditional financial institutions. However, there’s a positive development for Bitcoin. Microstrategy, a major corporate Bitcoin holder, plans to raise $2 billion by selling Class A shares to buy even more Bitcoin. This could boost Bitcoin’s price and broader cryptocurrencies.

The combination of these factors is causing serious concern for the future of the broader crypto market in the near term. It’s possible that the recent drop in Bitcoin’s value after the halving is impacting the overall crypto market. Only time will tell if the market can rebound from these losses or if this is the start of a longer decline.

Also Read: Nvidia Claims Annual Return Victory Over Resilient Bitcoin