The wait is over for Bitcoin enthusiasts eager to access the cryptocurrency through traditional financial vehicles. Just six days after the long-awaited approval of spot Bitcoin ETFs, these funds have accumulated a staggering 95,000 Bitcoin, worth nearly $4 billion in combined assets under management (AUM).

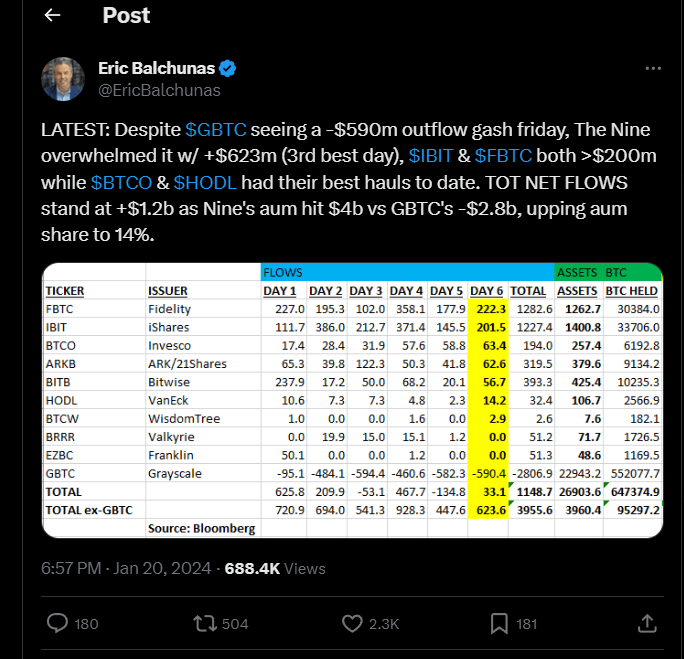

This rapid adoption has not gone unnoticed. Eric Balchunas, a senior ETF analyst at Bloomberg, highlighted that this capital influx into the new ETFs has actually surpassed the outflows from the established Grayscale Bitcoin Trust (GBTC), which saw a $2.8 billion decrease in AUM during the same period.

Leading the charge are Fidelity’s Wise Origin Bitcoin Trust (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT), both surpassing $1.2 billion in inflows. While FBTC boasts slightly higher inflows, IBIT takes the crown in terms of AUM with $1.4 billion to Fidelity’s near $1.3 billion.

Meanwhile, Invesco’s Galaxy Bitcoin ETF is showing steady growth, securing its best inflow day on Friday with over $63 million, though its total AUM remains just below $200 million. VanEck’s Bitcoin Trust also enjoyed a banner Friday, pushing its AUM past $100 million.

Data further reveals the sheer hunger for Bitcoin among investors. On their fifth day of trading, the combined Bitcoin ETFs absorbed a whopping $440 million in Bitcoin, according to CC15Capital, a cryptocurrency-tracking Twitter account. BlackRock’s IBIT again spearheaded this surge with 8,700 BTC, valued at nearly $358 million.

Furthermore, Balchunas emphasizes the remarkable growth of the “Newborn Nine” – his term for the new spot Bitcoin ETFs excluding GBTC – which experienced a 34% increase in daily trading volume by their fifth day of trading.

This rapid adoption presents a fascinating picture. The long-anticipated entry of spot Bitcoin ETFs appears to be drawing both traditional investors and crypto enthusiasts eager for a more accessible route to Bitcoin exposure. It remains to be seen whether this momentum will continue, but the signs point to a new dawn for Bitcoin and its integration into the mainstream financial landscape.

Also See: AI Humor Fuels MEMEAI Coin’s 96% Surge!