A lucky crypto trader recently made headlines by turning a $1,300 investment into a jaw-dropping $3.4 million, a return of 2,554 times. The investor’s success story has taken the crypto world by storm, especially given the token involved—Moo Deng (MOODENG), a hippo-themed cryptocurrency. While many are celebrating this incredible feat, it has also raised some eyebrows and sparked concerns within the crypto community.

Moo Deng Token’s Meteoric Rise

On September 25, the onchain analytics firm Lookonchain identified a trader who made this incredible profit on the Solana blockchain. The lucky crypto trader used 9.8 Solana (worth around $1,331) on September 10 to buy 38.7 million MOODENG tokens. Over the next two weeks, the value of this hippo-themed memecoin soared, leading to the investor’s holdings reaching an astonishing $3.4 million.

However, the excitement surrounding this rapid rise in value has been tempered by concerns of potential insider trading or manipulation by the token’s developer. These suspicions stem from the fact that MOODENG’s liquidity pool was only $1.8 million. In simple terms, this means the investor cannot cash out the entire $3.4 million without affecting the market price and liquidity.

Concerns of Insider Trading

While some in the crypto community are thrilled by the investor’s success, others are questioning whether luck played a role, or if there was something more behind the scenes. The low liquidity of the MOODENG pool has only added fuel to these speculations.

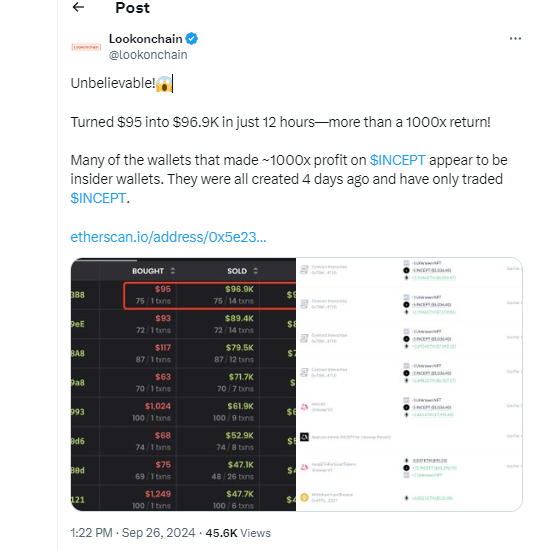

To further fan the flames of suspicion, Lookonchain revealed another shocking win on September 26. A separate lucky crypto trader turned a $95 investment in INCEPT tokens into $96,900 in just 12 hours. According to the analytics firm, several wallets tied to similar INCEPT investments appear to be linked to insiders, suggesting possible unfair trading practices.

High-Risk vs. Long-Term Crypto Strategies

While these rapid gains from high-risk tokens like MOODENG and INCEPT have captured attention, they are not the only way crypto investors are finding success. Other traders have profited through more traditional investment strategies, such as holding onto major cryptocurrencies over the long term.

One such example is a trader who earned $151.5 million by holding onto Ethereum during the 2022 bear market. This investor bought 96,639 Ether (ETH) in early September 2022 when the price was around $1,567. By following a patient “hodl” strategy, the trader weathered market fluctuations and ultimately reaped significant rewards.

These contrasting stories illustrate the diverse paths that crypto investors can take. Whether it’s riding the waves of high-stakes memecoins or sticking to well-established cryptocurrencies for the long term, the world of crypto continues to offer both risks and rewards for those willing to take the plunge.

Also Read: eToro Partnership With DLTF: German Traders Gain Direct Crypto Access