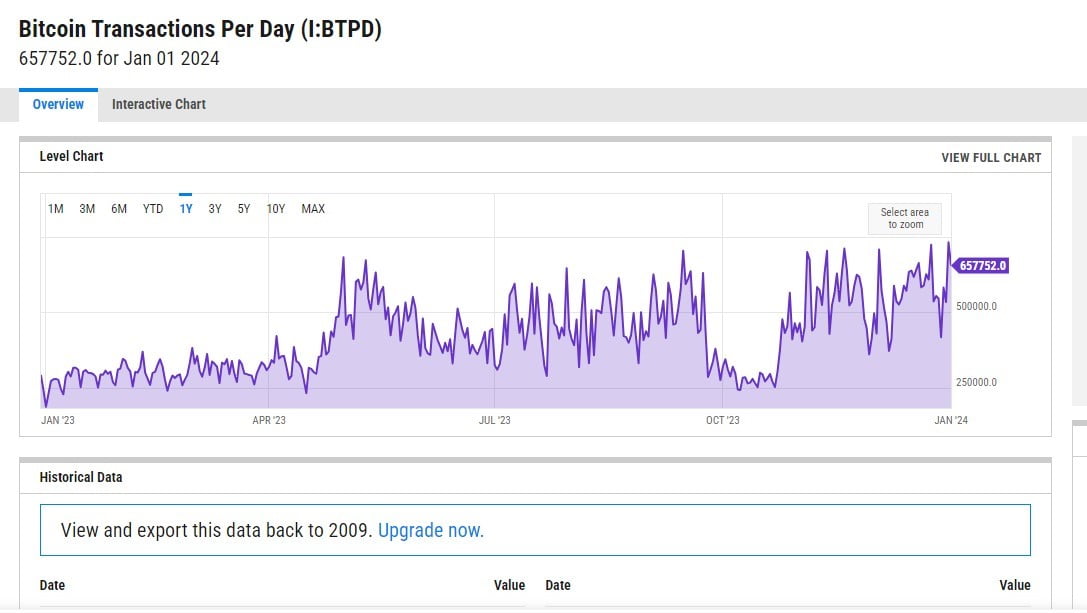

Bitcoin daily transaction Volume on New Year’s Eve 2023 saw a significant milestone, processing a record-breaking 731,000 transactions in a single day. This surpassed the previous record of 723,459 transactions set just a week earlier on Christmas Eve, i.e. 24 Dec 2023, showcasing the network’s resilience and continued growth.

Strength in Numbers

The consecutive breaking of Bitcoin daily transaction volume records highlights not only the expanding user base but also the robustness of the Bitcoin network. It indicates sustained enthusiasm and active participation from users, investors, and enthusiasts, reaffirming Bitcoin’s enduring appeal.

Scalability Takes Center Stage

The ability to handle such a high volume of transactions in a single day demonstrates Bitcoin’s rising popularity and the inherent scalability of its design. Scalability is crucial for any blockchain project, and Bitcoin’s capacity to accommodate such a surge underscores its reliability and adaptability.

Beyond Store of Value

The New Year’s Eve’s bitcoin daily transaction surge speaks volumes about Bitcoin’s evolving role beyond being solely a store of value. Its increasing involvement in everyday transactions reflects its gradual integration into mainstream financial activities. This aligns seamlessly with Bitcoin’s vision of being a decentralized and universally accessible cryptocurrency.

A Promising Trajectory

This milestone stands as compelling evidence of Bitcoin’s relevance and growing importance in the digital finance landscape. It sets the stage for a promising future, positioning Bitcoin as a frontrunner among cryptocurrencies and signaling the potential for sustained growth and innovation within the decentralized finance sector.

New Year, New Highs

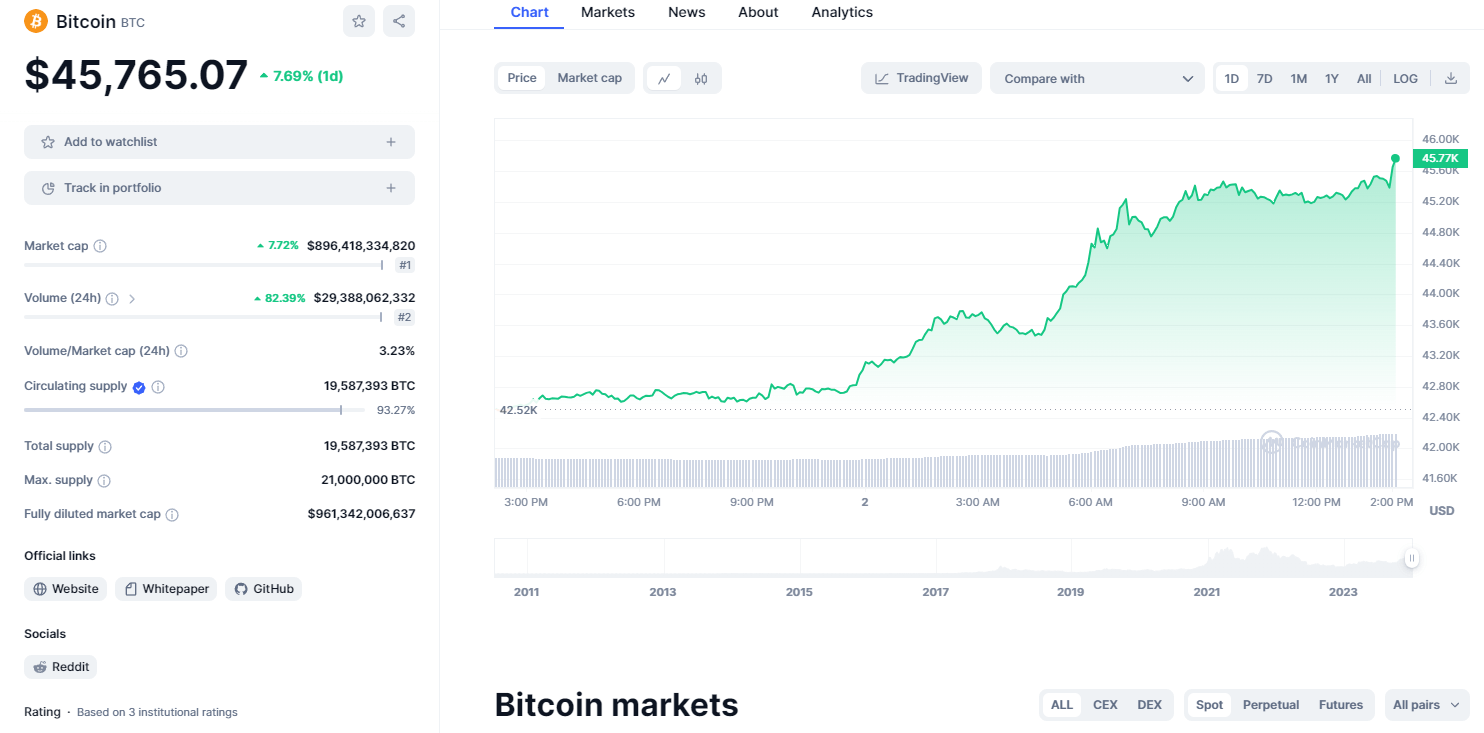

As the new year commenced, Bitcoin broke through the $45,000 mark, a threshold not seen since April 2022. This impressive surge in value, marking a 7.69% increase within 24 hours (currently trading at $45.765.07), signaled a bullish trend and sparked enthusiasm within the crypto market.

ETF Anticipation Fuels the Fire

The driving force behind this recent upward movement is the anticipation surrounding the potential approval of spot Bitcoin Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). Reports suggest that the SEC might begin informing ETF sponsors about their approval as early as January 1st. This news has significantly contributed to the positive sentiment in the market, reflecting widespread optimism regarding Bitcoin’s potential mainstream adoption and acknowledgment.

A Word of Caution

Amid this positive outlook, market analysts warn about a potential price correction following the approval of a Bitcoin ETF issuer. This cautionary stance reminds investors of the inherent volatility in cryptocurrency markets and the possibility of market adjustments after major regulatory announcements.

Eyes on the Horizon

As the new year unfolds, market observers are closely monitoring Bitcoin’s response to the changing regulatory environment. The anticipation is palpable, and stakeholders are eager to witness whether the current positive trend persists or transitions into a correction phase. This scrutiny highlights the significance of regulatory developments in shaping the trajectory of Bitcoin and the broader cryptocurrency market in the months ahead.

Bitcoin’s journey in 2023 has been nothing short of remarkable. From record-breaking transaction volumes to a potential surge in mainstream adoption, the future of this digital asset appears bright. As the regulatory landscape continues to evolve, it will be fascinating to see how Bitcoin navigates the coming year and cements its position in the ever-evolving financial landscape.

Related News: Major Crypto Whale Makes a Splash with $379 Million Bitcoin Acquisition