Key Takeaways

- Bitcoin crossed $70,000 for the first time since June, showing renewed investor interest.

- Bitcoin ETFs saw $920 million in inflows, totaling $25.4 billion for the year.

- A “golden cross” chart pattern suggests potential for continued price growth.

- U.S. election dynamics and Middle East stability are influencing Bitcoin’s price.

The recent surge in Bitcoin price has made headlines, as it crossed the $70,000 mark for the first time since June. This increase follows two strong weeks marked by significant inflows into U.S. spot Bitcoin exchange-traded funds (ETFs), highlighting a growing interest in Bitcoin price movements and investments.

Bitcoin Price Breaks $70,000 Amid Strong ETF Inflows

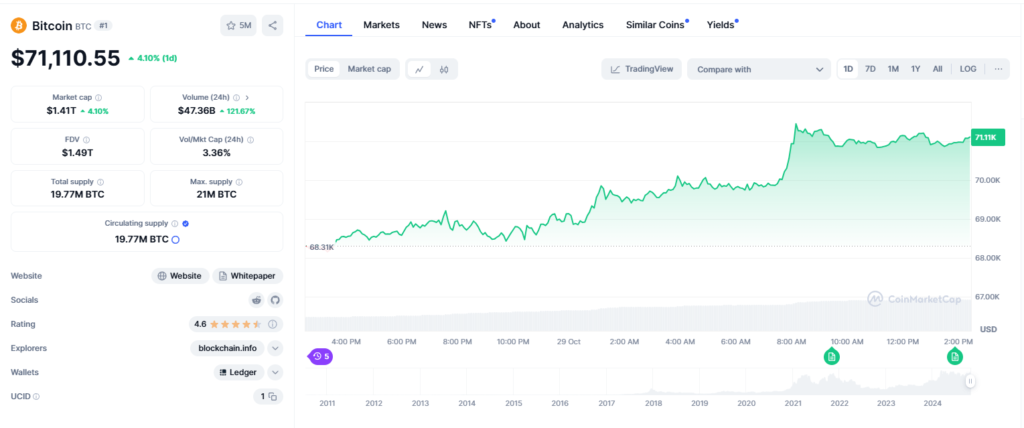

Per CoinMarketCap data, BTC reached a high of $71,450.95 on October 29, with a 4.90% surge within 24 hours, reflecting strong market sentiment and investor confidence. CoinShares reported that Bitcoin funds saw inflows of $920 million for the week ending October 25, boosting total inflows to an impressive $25.4 billion for the year.

For the week ending October 18, U.S. spot-based Bitcoin ETFs saw net inflows exceeding $2.1 billion, as reported by Farside Investors. However, inflows decreased to $997.6 million in the following week ending October 25. Still, a net inflow of $479.4 million on October 28 shows continued investor interest in Bitcoin ETFs. Overall, these steady inflows highlight the growing appeal of cryptocurrency as an asset class, especially during uncertain economic times.

Bitcoin’s “Golden Cross” Signals Potential for Further Gains

Several crypto analysts noted that Bitcoin recently experienced a “golden cross,” a chart pattern seen as a bullish indicator. In this pattern, Bitcoin’s 50-day moving average crosses above its 200-day long-term moving average. Traders often interpret this signal as a sign of upward momentum and potential for a further breakout, spurring even more buying interest.

Despite the recent spike, Bitcoin faced a brief setback on October 25, dropping to a low of $66,510 after reports that the U.S. Department of Justice had initiated a probe into Tether, a major stablecoin issuer. However, Bitcoin quickly rebounded, recovering investor sentiment.

Impact of Political Events on Bitcoin Price

Bitcoin price also appears to be reacting to the ongoing U.S. political climate. According to Polymarket data, recent projections suggest Republican candidate Donald Trump has gained a significant lead of 32 percentage points over Vice President Kamala Harris ahead of the November 5 U.S. presidential election. However, FiveThirtyEight’s polling data contradicts this, showing Harris leading Trump by a slim 1.3 percentage points.

Additionally, the stability in Bitcoin price may be influenced by the Middle East tensions, as Bitcoin’s rise followed reports that Iran refrained from retaliating against Israel after an October 26 incident. Such geopolitical stability can sometimes create a more favorable environment for risk assets like Bitcoin.

Bitcoin is currently trading at $71,110.55 with a 4.10% surge in market cap and a remarkable 121.67% surge in trading volume.

As Bitcoin rallies once again, it reflects broader trends in the cryptocurrency market, showing resilience amid regulatory scrutiny and political influences. Whether Bitcoin will maintain its momentum or face resistance remains a critical question for traders and investors alike as it hovers close to its all-time high.

Also Read: HKEX Launches New Virtual Asset Index Series to Strengthen Asia-Pacific Market

NEW: Solana saw $10.8M in net inflows from digital asset investment products, marking its fourth consecutive week of inflows.

NEW: Solana saw $10.8M in net inflows from digital asset investment products, marking its fourth consecutive week of inflows.