Recent Bitcoin price plunge has reignited concerns about its unpredictability, prompting outspoken critic Peter Schiff to issue fresh cautions to investors. The primary cryptocurrency saw a staggering 7.47% drop today, settling at $64,825.19, casting doubt on its future trajectory.

Schiff, a renowned economist, voiced apprehensions about a potentially deeper decline in the wake of this plummet. He criticized Bitcoin’s allure to young investors, urging them to prioritize more stable investment avenues. Schiff said that investing in Bitcoin isn’t smart, comparing its unpredictable behavior with gold’s steady increase in value.

Crypto analyst Ali Martinez sees a silver lining in the recent crypto slump. He believes a 30% price drop for Bitcoin could actually be a bullish sign, suggesting a strong upswing might follow.

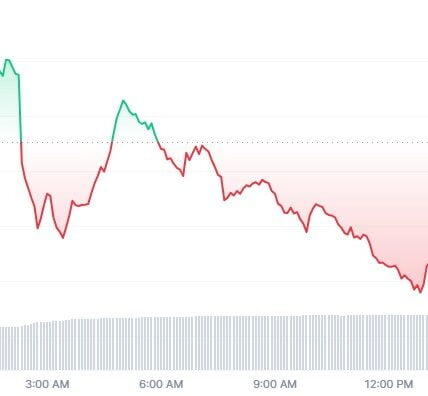

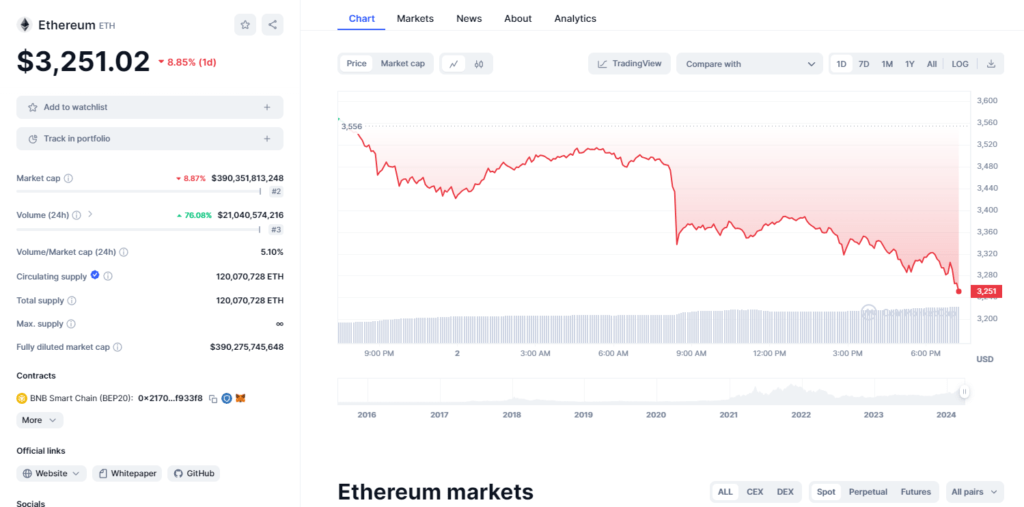

Crypto analyst Ali Martinez‘s tweet aligns with a notable downturn in major cryptocurrencies such as Bitcoin and Ethereum. Bitcoin (BTC), the dominant force in the crypto market, has witnessed a Bitcoin price plunge to a $64,000 level, indicating a significant volatility. Similarly, Ethereum (ETH) has also been affected by the market slump, dipping below the crucial $3,300 threshold.

This downturn wasn’t exclusive to Bitcoin and Ethereum; major altcoins like Solana (SOL), XRP, and Cardano (ADA) also witnessed substantial drops, exacerbating the prevailing bearish sentiment. Overall, cryptocurrency market witnesed a 6.13% decrease in the market capitalization.

Amidst the market turmoil, crypto analyst Ali Martinez shared an unexpected insight on Twitter, suggesting, “A 30% price correction is the most bullish thing that could happen to Bitcoin!”

In contrast to the prevailing pessimism, cryptocurrency trader Crypto Rover highlights a symmetrical triangle pattern observed on Bitcoin’s daily chart. As mentioned in Crypto Rover’s tweet, this pattern suggests a period of stability may ensue before a potential uptick in price volatility.

Crypto trader Crypto Rover has spotted a symmetrical triangle formation on Bitcoin’s daily chart. This pattern, characterized by converging trendlines, often signifies a period of consolidation preceding a significant price breakout, hinting at potential volatility ahead.

While some perceive Bitcoin as a groundbreaking financial instrument, others, like Schiff, regard it with skepticism. Only time will reveal how this digital asset will evolve and what role it will assume in the global financial landscape.

Also See: The Purge: Making Running an Ethereum Node Easier?