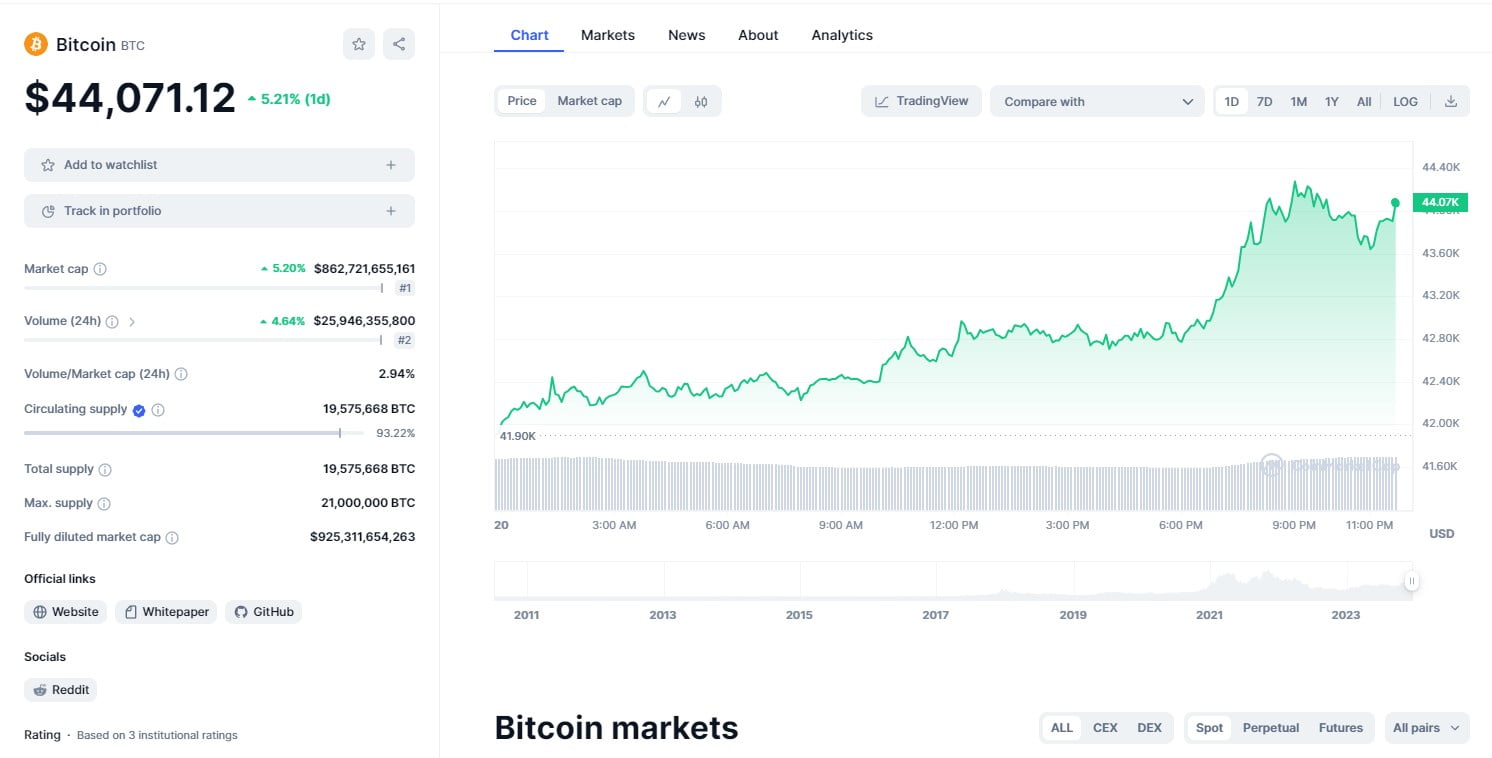

Yesterday evening saw a decline in Bitcoin, breaking its support at $42,000 and settling at $41,800. However, recent developments witnessed a significant surge in the Bitcoin price over the last few hours, resulting in a 4.80% uptick within the past 24 hours. Temporarily surpassing the crucial $44,000 mark, Bitcoin price surged to its highest point since December 9, peaking at $44,200 before stabilizing at $44,071 at the time of this report.

Along with the surge in Bitcoin price, Bitcoin miners have hit historic highs in daily fees following the high demand for block space. As per CryptoQuant, miners’ daily revenue and fees on 16th December exceeded $23.7 million.

Despite Spot Bitcoin holder’s gain, the surge in the last 24 hours triggered notable liquidations in futures transactions, with a total of $161 million in cryptocurrency assets liquidated. Of this amount, $92 million came from short positions, while long positions accounted for $69 million. Within the latest surge, a rapid liquidation of $45 million occurred, consisting mainly of $40 million from short positions and $5 million from long positions.

Bitcoin’s upward momentum reverberated across altcoins, albeit to a lesser extent. Ethereum, the leading altcoin, experienced a positive trend, gaining 3.60% in the past 24 hours. Among the top 10 cryptocurrencies, notable gainers included Solana (SOL) with a remarkable 14.19% increase, followed by Avalanche (AVAX) with 12.19% growth in market capitalization over the past 24 hours.

These market fluctuations underscore the inherent volatility within the cryptocurrency sphere. Bitcoin’s movements carry substantial influence not only within its domain but also across the broader spectrum of altcoins. The swift liquidations amid the surge emphasize the unpredictable nature of crypto trading, where fortunes can shift rapidly.

As investors and traders navigate this dynamic landscape, they remain vigilant, seeking opportunities for gains while acknowledging and managing the risks associated with such volatile markets.

Related News: First Trust Portfolio Unveils Bitcoin Buffer ETF: A Safety Net For Investment