Fueled by anticipation surrounding the impending Bitcoin halving, the crypto market rally has seen Bitcoin (BTC) prices climb upto $72,797. However, analysts warn of potential roadblocks that could prevent a surge towards $80,000. Some even predict a correction or even a crash if historical price patterns for BTC hold true. This suggests cautious undercurrent on Bitcoin price trajectory despite the recent rally, with the possibility of price swing in either direction.

Correction or Crash? Echoes of the Past

The impending Bitcoin halving event is anticipated to fuel another spike in the cryptocurrency’s price, although analysts such as Benjamin Cowen are advocating for prudence. Cowen suggests that if Bitcoin mirrors the price trends observed during the launch of spot Bitcoin ETFs, a correction in price is probable. He forecasts a potential post-halving trajectory, reaching a new all-time high and a steep correction below the $60,000 threshold on the charts. Nonetheless, Cowen remains convinced that historical patterns do not replicate precisely.

Looking at halving history, veteran trader Peter Brandt agrees with the possibility of historical patterns influencing the current market. He points out Bitcoin’s tendency to follow similar price movements in past halving events.

Market Jitters Before May Halving

With the May halving approaching, the crypto market is experiencing a mix of anticipation and apprehension. The possibility of a price surge due to the halving is countered by the potential for a correction or crash based on historical trends. Investors will be closely watching Bitcoin’s price movements in the coming weeks.

Headwinds Hinder $80,000 Bitcoin Price Trajectory

Despite the recent rally, some analysts predict headwinds that could prevent Bitcoin price trajectory of $80,000. These headwinds could be various market forces that push the price down or create hesitation among investors.

Market-Wide Drop Feared if Bitcoin Crashes

A significant drop in Bitcoin’s price could have a ripple effect, triggering a decline across the entire cryptocurrency market. This scenario resembles past halving events and the recent approval of spot Bitcoin ETFs, both of which were followed by broader market dips.

Bitcoin Price Volatility

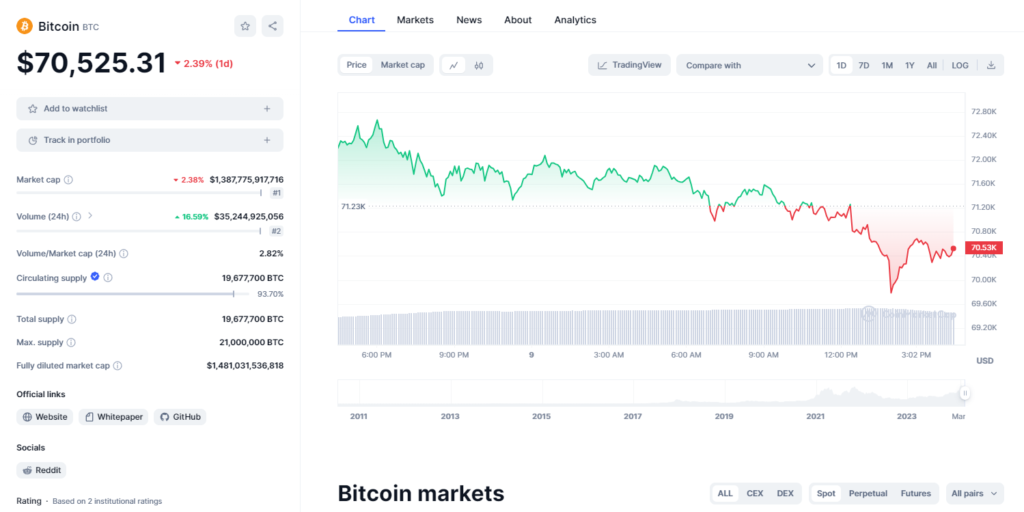

Bitcoin price plunged by 2.39% in the past 24 hours and currently trading at $70,525.31. Meanwhile, trading volume increased by 16.59% within the same period indicating investors anticipation of price surge after halving event. However, volatility in Bitcoin price highlights the uncertain market sentiment among bitcoin holders before the halving.

Mixed Signals from Options Market

Options trading expert Greekslive revealed a Bitcoin pullback as traders mainly sold short-term Bitcoin options. However, a giant whale’s purchase of long-term options contracts expiring in March 2025 suggests bullish sentiment from some investors.

The coming weeks will be crucial for Bitcoin and the broader cryptocurrency market. Whether the halving triggers a price surge or a correction/crash remains to be seen.

Also See: NYSE Bitcoin ETFs Options on Hold: SEC Delays Decision