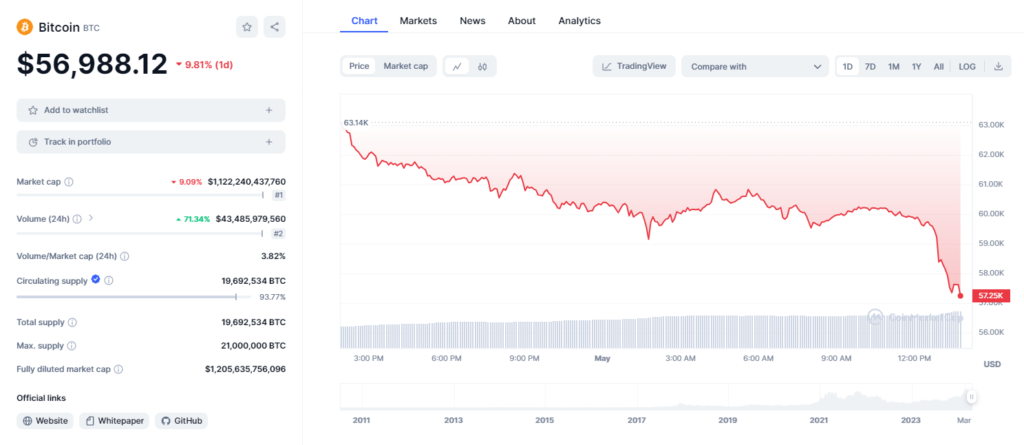

The cryptocurrency market is indeed enduring a severe downturn, propelled by Bitcoin slump for the third consecutive day. In the last 24 hours alone, the overall market capitalization has plummeted by 5.38% to $2.21 trillion. Bitcoin, in particular, has suffered a more pronounced decrease of 9.81%, currently valued at a precarious $56,988.12. This represents a worrisome 22.78% decrease from its peak in March, firmly establishing it within the feared bear market realm.

Despite the Bitcoin slump interms of price, its trading volume surged by a surprising 71.34%. Analysts interpret this as a sign of activities due to increased selling pressure, with investors likely cashing in on their holdings.

The downturn in investors’ sentiment is backed by the net outflow of US Bitcoin ETFs, totaling $161.6 million on Tuesday, right before the significant Federal Open Market Committee (FOMC) meeting. The FOMC’s decisions regarding interest rates can impact riskier assets such as Bitcoin, and the withdrawal of funds before the meeting implies investor apprehension.

The outflows from US Bitcoin ETFs paint a concerning picture. This marks the fifth consecutive day of decline, with a cumulative outflow of $635 million from Bitcoin investment funds since April 24th. This trend reflects growing uncertainty within the market, fueled by a confluence of factors. The Fed’s reluctance to cut interest rates, a policy shift that could inject liquidity into the market and potentially boost asset prices, is a major cause for concern. Additionally, static inflows into ETFs, which typically indicate waning investor interest, further worsen the situation.

“Increased profit-taking and static ETF inflows have undeniably pressured Bitcoin’s price,” stated Matteo Greco, a research analyst at Fineqia.

Adding to the market jitters is the “Fear and Greed Index,” a popular metric used to gauge investor sentiment. The index currently sits precariously in neutral territory, indicating a lack of clear direction among investors. Some remain bullish, clinging to the hope of a rebound, while others are gripped by fear, unsure of the next move.

The downturn in cryptocurrency market also triggered liquidations worth a staggering $453.19 million over the past 24 hours led by Bitcoin slump. While long positions, representing bets on a price increase, saw the brunt of the liquidations ($388.46 million), short positions, which profit from price declines, also faced some selling pressure ($64.74 million). This suggests that even short-sellers, who are typically positioned to benefit from a bear market, are wary of overextending themselves in the current volatile environment.

Despite the prevailing gloom, some analysts remain optimistic about Bitcoin’s future. Michaël van de Poppe, a renowned cryptocurrency analyst, believes Bitcoin’s price correction is nearing its end, although he anticipates some further declines. He points to the significant 20% drop from recent highs and suggests the downward movement may have limited room left.

Only time will tell how long this correction will last and what the future holds for Bitcoin and the broader cryptocurrency market. However, the current situation underscores the inherent volatility of this asset class and the importance of investor caution. The coming days will be crucial in determining the market’s direction, and investors should closely monitor developments, particularly any announcements from the FOMC meeting, before making any investment decisions.

Also See: HK Bitcoin and Ethereum ETFs Shines, US ETFs Fade