The Bitcoin spot ETF market is experiencing intense competition and changing investor Sentiments. On April 22nd, the total net inflow for Bitcoin spot ETFs reached $62.09 million, showing ongoing interest in these investment options. However, a closer look reveals a story with two big players and a new challenger.

BlackRock’s iShares Bitcoin Trust (IBIT) has quickly gained attention. It marked its 69th consecutive day of net inflows with a single-day net inflow of $19.7 million on 22nd of April, accumulating an impressive $15.4 billion worth of Bitcoin. This outstanding performance has elevated IBIT close to the top ten ETFs with the longest streak of daily inflows. Experts, such as Bloomberg’s Eric Balchunas, suggest that if IBIT maintains its current momentum, it could become the leading Bitcoin fund.

However, IBIT faces competition from other contenders seeking investor interest. Fidelity’s FBTC has been gaining momentum quietly. In the past three trading sessions, FBTC surpassed IBIT in daily inflows, gathering a net inflow of $34.83 million on April 22nd. This increase suggests that Fidelity is attracting a significant portion of the Bitcoin spot ETFs market.

Meanwhile, Grayscale’s Bitcoin Trust (GBTC), a well-established player in Bitcoin investments, is facing challenges. Despite the overall positivity in the Bitcoin spot ETF market, GBTC continues to experience ongoing outflows. Just on April 22nd, it saw a net outflow of $34.99 million. This pattern indicates that investors might be leaning towards the transparency and regulatory compliance offered by newer ETFs like IBIT and FBTC, rather than Grayscale’s comparatively less transparent structure.

The overall sentiment towards ETFs remains bullish. One step ahead of IBIT’s ETF, the JETS ETF maintains its 10th position by achieving 70 consecutive days of inflows. However, the record for the longest daily inflow streak belongs to the JPMorgan Equity Premium Income ETF (JEPI), spanning a remarkable 160 days.

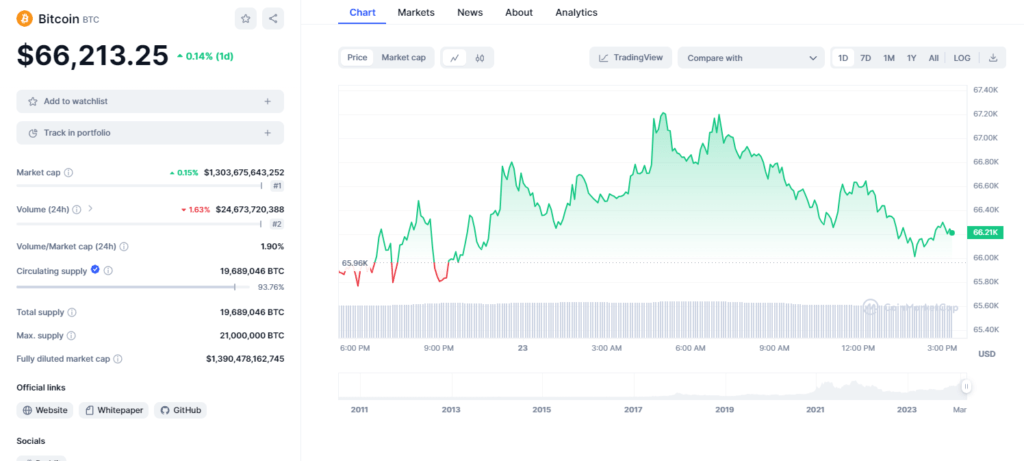

Investors’ confidence in Bitcoin spot ETFs is coincide with broader crypto market surge following the anticipation of Bitcoin post-halving price surge. As of now, Bitcoin is trading at $66,213.25 showing 0.14% increase over the past 24 hours and generating $24.67 billion trading volume. Furthermore, it has experienced a 5.63% weekly surge as its attempt for upside trajectory.

To sum up, the Bitcoin spot ETFs scene has seen notable changes. BlackRock’s IBIT stands out as a strong player, drawing consistent inflows. Fidelity’s FBTC shows strong performance, while Grayscale deals with investor outflows. As the market grows and competition heats up, investors can expect more transparency, regulatory compliance, and possibly lower fees from these evolving Bitcoin investment options.

Also See: Polkadot Runtime Upgrade Experiences Unexpected Hiccup