The cryptocurrency market is in turmoil following a steep decline in Bitcoin value, dipping under the pivotal $62,000 threshold. This drop has worried investors and analysts, prompting a close examination of the causes behind the fall and raising concerns about potential further decreases.

The digital asset market is highly volatile and unpredictable. The price changes in this market are closely tied to a mix of technical signals, investor emotions, and wider economic influences.

Market analysts have pointed out different factors that have dampened investor anticipation and contributed to a decline in Bitcoin value. These factors have contributed to the decline of Bitcoin as well as the entire cryptocurrency market.

Technical Resistance and Investor Caution

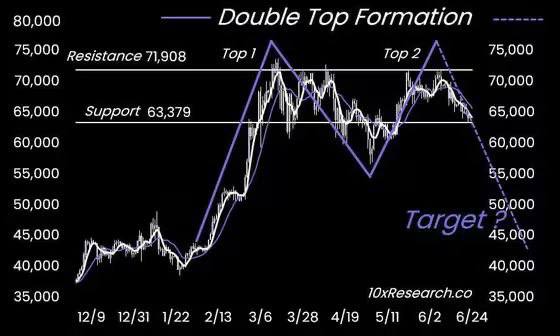

Bitcoin has already breached the critical support level of $61,500 whereas breaching the $62,000 threshold itself triggered alarm bells among traders. Technical analysts, like Markus Thielen of 10X Research, have pointed to a potential “double top” formation on Bitcoin’s chart, a technical indicator that often signals a potential trend reversal.

These patterns usually cause more selling as investors respond to key support levels being broken. This technical analysis, along with a cautious market mood, has pushed Bitcoin value closer to the important $60,000 mark.

Federal Reserve Policy and Interest Rate Jitters

The Federal Reserve’s upcoming interest rate decisions are uncertain and are another factor weighing heavily on Bitcoin’s recent performance. Investors are apprehensive about interest rate hikes as inflation concerns continue to linger. The Fed’s upcoming pronouncements, particularly those influenced by economic indicators like the PCE price index, will be pivotal in shaping market sentiment.

Speculative assets like cryptocurrencies are susceptible to changes in interest rate expectations. The anticipation of interest rate hikes can increase volatility and downward pressure on Bitcoin’s price.

Outflows from U.S. Spot Bitcoin ETFs

Huge outflows totaling $545 million from U.S. Spot Bitcoin ETFs show a change in investor sentiment toward digital assets. Institutional investors, cautious of market volatility and changing cryptocurrency regulations, are adjusting their positions in Bitcoin-related investments. This shift in funds has increased selling pressure, highlighting the significant impact institutional investors have on short-term price movements in the cryptocurrency market.

Inflation and the Broader Economic Picture

Despite recent CPI data indicating a slight moderation in inflation, concerns persist over rates exceeding the Fed’s targets. High inflation impacts market expectations of Fed policy, influencing asset values, including cryptocurrencies. The interplay between inflation trends, central bank policies, and economic indicators shapes investor sentiment and volatility in Bitcoin value.

Current Market Conditions and the Road Ahead

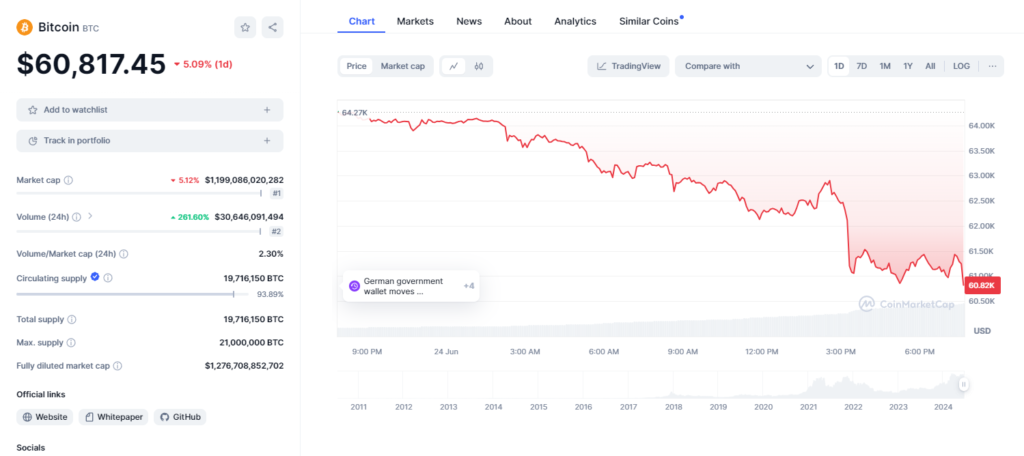

Currently, Bitcoin is priced at $60,817.45, showing a decrease of about 5.09% in the last 24 hours, with a trading volume of $30.64 billion. Despite its significant market capitalization of around $1.2 trillion, Bitcoin has recently seen a slight increase in open interest, now valued at $19.1 billion.

Traders are closely watching the expiration of over 105,000 Bitcoin options contracts on June 28th, particularly those centered around the $57,000 strike price. The concentration of options expiring at this level could intensify selling pressure as traders adjust their positions based on evolving market conditions.

Bitcoin’s recent price drop below the support level of $61,500 reminds investors of the risks involved in their investments. Given the ongoing volatility, it is prudent to stay vigilant and prepare for potential market-moving events shortly. With upcoming economic data releases and options expirations, the trajectory of Bitcoin value in the coming weeks remains uncertain.

Also Read: Toncoin Surges Amid Market Slump, But Future Uncertain