The Great Bitcoin ETF War has taken a dramatic turn as two financial titans, BlackRock and Ark Investment Management, brandished their swords: lower fees. With the US Securities and Exchange Commission (SEC) poised to rule on a slew of ETF applications, these titans are locked in a fierce battle for dominance in this nascent yet potentially lucrative market.

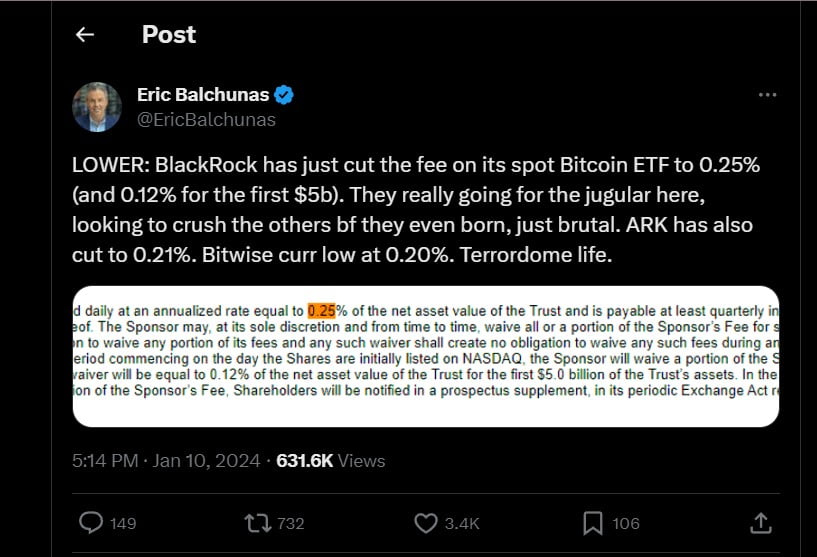

BlackRock, the world’s largest asset manager, has launched its iShares Bitcoin ETF with a competitive initial fee of 0.25%, down from the originally proposed 0.30%. To further sweeten the deal, they’re offering a promotional 0.12% rate for the first year or until the fund reaches $5 billion in assets. This aggressive move sends a clear message: BlackRock wants to be the king of Bitcoin ETFs.

Not to be outdone, Ark Investment Management, known for its bold bets on disruptive technologies, has teamed up with 21Shares to shave their ETF fee from 0.25% to 0.21%. This calculated adjustment shows Ark Investment’s determination to carve out a significant share of the pie, capitalizing on its reputation for innovation and its founder’s, Cathie Wood, vocal advocacy for Bitcoin.

These fee slashes have ignited a firestorm of speculation. Some see them as a bullish signal, suggesting confidence in the SEC’s eventual approval of Bitcoin ETFs. Others view them as tactical maneuvers, each titan trying to woo investors with the most attractive price tag. Whatever the interpretation, one thing is clear: the competition is fierce, and the prize – potentially billions of dollars in investor funds – is immense.

Adding fuel to the fire was the recent SEC Twitter fiasco. A rogue tweet mistakenly hinting at ETF approval sent Bitcoin skyrocketing before crashing back down once the error was clarified. While this incident highlights the SEC’s pivotal role in shaping the future of Bitcoin ETFs, it’s unlikely to derail the eventual decision, although the timing remains shrouded in uncertainty.

With the SEC sword hanging over their heads, the Bitcoin ETF gladiators are sharpening their axes, slashing fees, and preparing for the final showdown. Who will emerge victorious? Will BlackRock’s sheer size and reach prove decisive? Or will Ark’s innovative spirit and loyal fanbase tip the scales? Only time will tell, but one thing is for sure: the battle for Bitcoin ETF supremacy has only just begun.

Also See: Behind the Scenes: Challenges Threatening Bitcoin ETF Approval