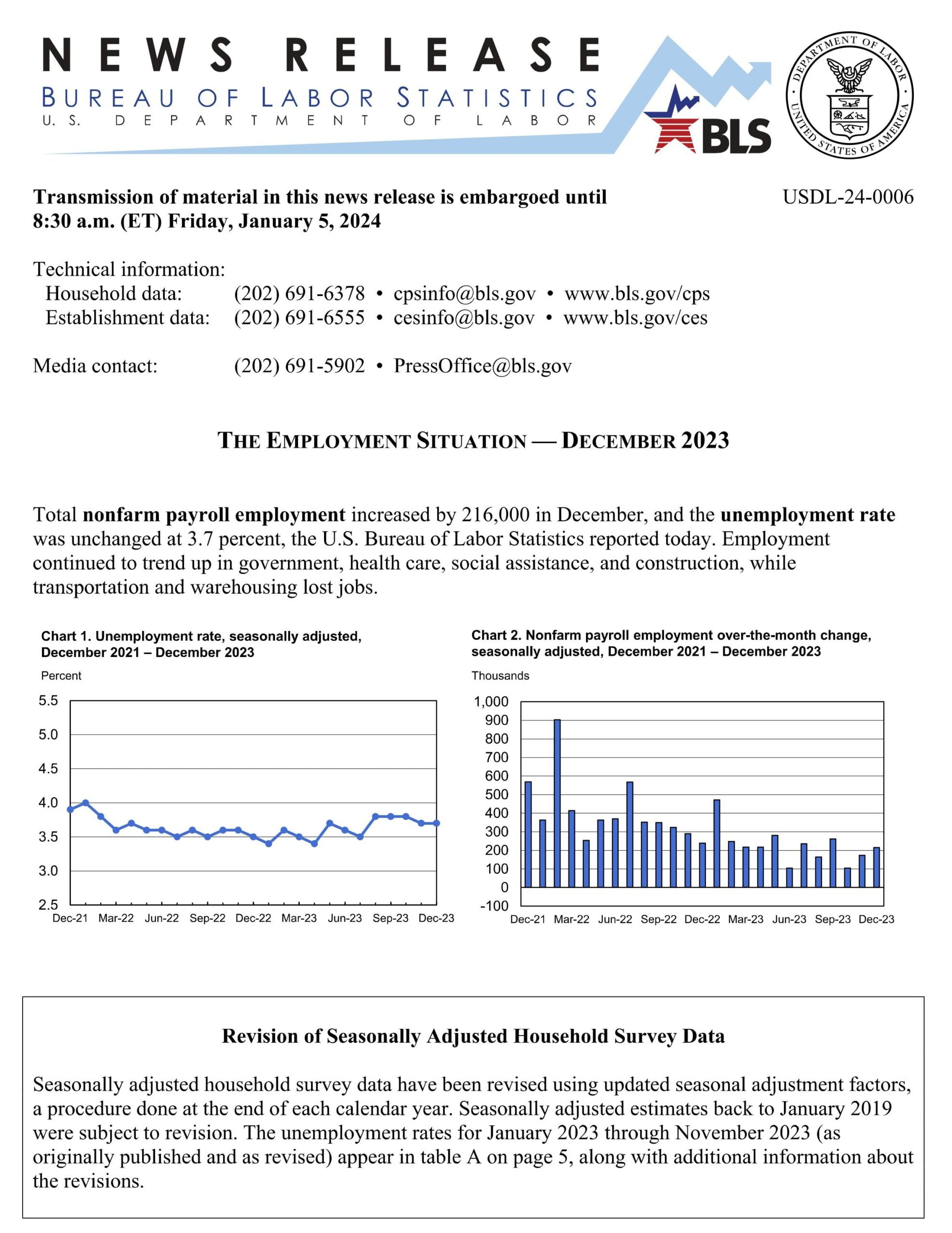

Boom in December jobs defied expectations, leaving economists and investors scratching their heads. The labor market added a robust 216,000 jobs, surpassing forecasts of 175,000 and marking a jump from November’s 173,000. Unemployment held steady at 3.7%, defying predictions of a slight increase.

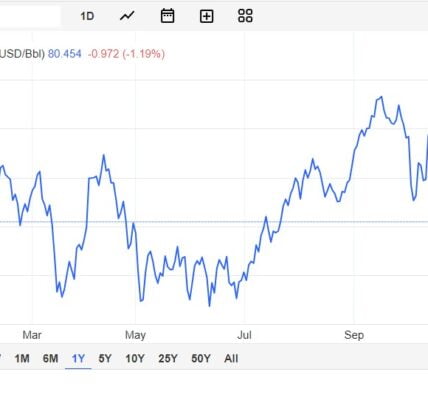

This surprise surge bolsters hopes for a “soft landing,” where inflation cools without triggering a recession. However, it also throws a wrench into the Federal Reserve’s rate cut timeline. A vibrant labor market could mean inflationary pressures linger, pushing back the possibility of rate reductions.

Key Takeaways:

- December jobs surge unexpectedly, exceeding forecasts.

- Uncertainty swirls around the Fed’s rate cut timeline.

- The labor market nears equilibrium, with job openings and wage growth cooling.

- Investors await clues from future data and Fed announcements.

Several factors contribute to the December surprise. Nela Richardson, ADP’s chief economist, highlights persistent hiring, particularly among small businesses. This hiring spree likely bolstered wages, which climbed 0.4% monthly and 4.1% annually, exceeding both forecasts.

However, not all metrics paint a rosy picture. The labor force participation rate dipped slightly, and average weekly hours worked edged down. Additionally, specific sectors like transportation warehousing and social assistance shed jobs.

Despite these mixed signals, the broader trend suggests a labor market nearing equilibrium. Wednesday’s JOLTS survey showed job openings declining to their lowest since March 2021, indicating cooling demand. Similarly, private payroll data from ADP suggests a moderating pace of wage growth.

The December jobs report throws the Fed’s policy path into question. While inflation appears to be cooling, a robust labor market might necessitate maintaining current rates for longer. Investors will be glued to upcoming economic data and Fed pronouncements to understand the future trajectory of monetary policy.

Related News: Fed Hints at Dovish Pivot, But Rate Cut Horizon Hazy