443,961 ETH deposited into Coinbase Prime, Paxos, and FalconX wallets on January 25th. This followed a similarly hefty haul of 575,081 ETH transferred the day before. Spotonchain, a blockchain analytics firm, first detected these whale moves. It was no other than Celsius Network behind these moves. The sheer volume – enough to purchase a small island or a fleet of Lamborghinis – has sparked fierce speculation about Celsius’s motives.

The crypto world is reeling after embattled Celsius Network, now in bankruptcy, unleashed a blizzard of Ethereum (ETH) onto major exchanges in just 24 hours. The sudden movement of nearly a billion dollars in the crypto market sent ripples of anxiety through both investors and creditors in the already volatile market.

Some experts suggest that Celsius Network is in a rush to collect enough coins, possibly for creditors, amidst their ongoing bankruptcy. The company is dealing with the challenging job of distributing assets to its upset users, starting in mid-February and lasting a year. Positive reports of successful user withdrawals provide a bit of optimism, indicating that Celsius might be making progress in meeting its financial responsibilities.

However, others interpret Celsius Network moving its ETH as a sign they might be getting ready for a quick sell-off, selling their digital cash to get immediate funds. According to Arkham Intelligence, Celsius sold more than $125 million worth of ETH from January 8th to 12th, raising doubts about the company’s financial stability in the long run. To make things more confusing, we don’t know who got the ETH. Spotonchain thinks it could be an over-the-counter (OTC) deal, while others are speculating about potential payouts to creditors using platforms like Coinbase.

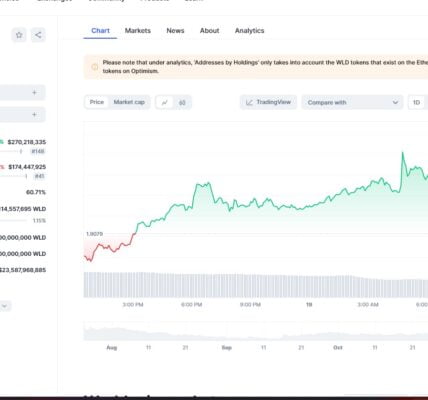

The market, understandably, is on edge. While ETH experienced a mild 1.75% bump in the last 24 hours, it’s still reeling from an 8.82% drop over the past week. However, trading volume in 24 hours has climbed by 16.00%, reflecting investors’ expectations. Yet, some fear Celsius Network’s actions could trigger a domino effect, sending ETH plummeting further as panicked investors flee the scene.

Yet, amidst the turmoil, flickers of hope remain. Some commentators view Celsius’s actions as a necessary albeit risky move to stay afloat during its turbulent restructuring. If the company successfully navigates this financial tightrope walk and delivers on its promises to creditors, it could emerge from the ashes as a phoenix, rekindling trust in the beleaguered Celsius community.

However, the path ahead is fraught with uncertainty. The success of Celsius’s distribution plan, the fate of ETH’s price, and the wider impact on the crypto ecosystem all hang in the balance. As this drama unfolds, one thing is certain: Celsius’s Ethereum exodus has irrevocably altered the crypto landscape, and the coming days will be crucial in determining whether it marks a seismic shift or a mere ripple in the digital tide.

Also See: Bittensor TAO Surges 24%: AI Decentralization Accepted!