Key Takeaways

- Ether Accumulation Growth: $50 billion worth of Ether is locked, up 65% since early 2024.

- 19 Million ETH: Total ETH in accumulation addresses rose from 11.5M to 19M by October 2024.

- Spot Ether ETFs: The July launch of spot Ether ETFs has boosted institutional and individual interest.

- Supply Concerns: Increasing Ethereum supply despite high usage raises investor concerns about price impact.

- Leveraged Trading Risk: A 12% rise in Ether futures raises fears of potential market volatility.

Just over $50 billion worth of Ether is currently locked in Ethereum accumulation address, reflecting a sharp increase of nearly 65% compared to the beginning of 2024. This substantial growth highlights a rising confidence in the cryptocurrency’s long-term potential, according to a recent analysis from CryptoQuant.

In an analyst note released on October 20, 2024, CryptoQuant contributor Burakkesmeci revealed that the total Ethereum locked in accumulation addresses surpassed 19 million by October 18. This marks an impressive 11.5 million ETH increase in these wallets since January. With the current Ether price sitting at around $2,652.29, this equates to approximately $50.2 billion locked up by long-term investors.

65% Increase in Accumulation Addresses

Accumulation addresses are key indicators in the crypto market. These wallets belong to long-term investors without withdrawals, signaling strong belief in the future value of Ethereum. Burakkesmeci emphasized the significance of this trend, noting that the amount of Ethereum in these addresses has increased by 65% over the year, illustrating growing investor confidence in Ether.

He also predicted that the total ETH in these wallets could surpass 20 million by the end of 2024, driven by the excitement surrounding the launch of spot Ether ETFs in July. These ETFs, which allow direct exposure to Ether, have attracted significant interest from institutions and individual investors alike, indicating that Ethereum is no longer the domain of just tech enthusiasts.

“It’s becoming a key part of the financial future,” Burakkesmeci remarked, highlighting the role that Ethereum plays in the evolving digital finance landscape.

Challenges Ahead for Ethereum

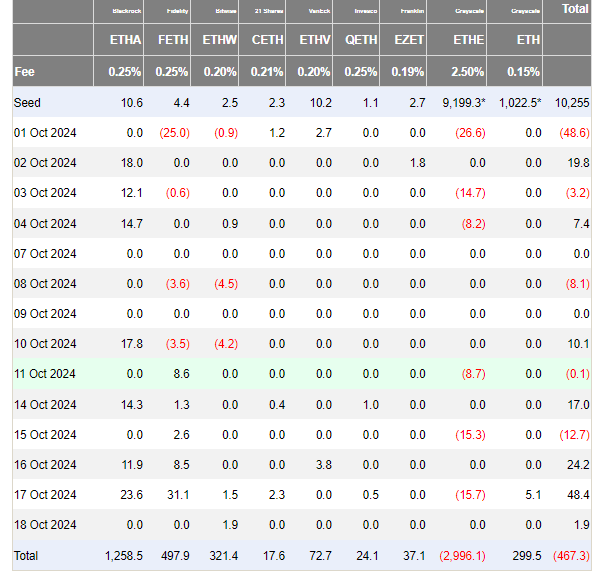

Despite the bullish sentiment around Ethereum accumulation addresses, not everything is smooth sailing. Since the launch of the spot Ether ETFs on July 23, there have been net outflows totaling $467.3 million, according to Farside data. These outflows reflect some investor uncertainty about Ethereum’s future prospects.

Moreover, some investors have expressed concerns over the increasing supply of Ethereum, despite high network activity. This is a critical issue for Ethereum’s long-term value, as a growing supply can lead to downward price pressure, even in the face of robust demand.

In response to these concerns, Ethereum founder Vitalik Buterin addressed the issue in a recent blog post. He acknowledged the challenge and suggested that improving transaction speeds through solutions like single-slot finality could help alleviate these concerns and improve the user experience.

Rising Futures Market Raises Red Flags

On the same day that Buterin shared his thoughts, the aggregate Ether futures addressable market hit a new high, surpassing 5 million ETH for the first time. This marked a 12% increase in just four weeks. While this surge indicates growing interest in leveraged Ether positions, some traders are wary.

A rise in leveraged positions often signals that traders are expecting significant market movements. Historically, such trends have preceded sharp price corrections, raising concerns that Ethereum could face volatility in the near future.

In conclusion, while Ethereum accumulation addresses show growing confidence in the cryptocurrency, other factors, such as rising supply and leveraged trading, present challenges. Investors will need to keep an eye on both the bullish and bearish signals as Ethereum moves forward in 2024.

Also Read: DBS Token Services: Powerful Blockchain Solutions for Institutions