While major cryptocurrencies like Bitcoin and Solana face a turbulent day marked by significant dips, Ethereum finds itself in the eye of the storm. A surge in whale activity has thrust Ethereum into the spotlight, sparking debates about its future price trajectory.

One whale investor has made a bold move, purchasing a hefty $121 million worth of ETH on Binance. This significant purchase stands in stark contrast to the broader market selloff, where major digital assets are experiencing price declines. Analysts are grappling to understand the investor’s motives – is it a strategic play to capitalize on the current market dip or a sign of strong confidence in Ethereum’s long-term potential?

Further bolstering the bullish sentiment is the investor’s ongoing accumulation pattern. Over the past five days, they have amassed a staggering $208 million worth of ETH. Despite experiencing a current loss due to the recent market decline, the investor’s actions suggest a long-term view. This bold move comes just ahead of the potential Ethereum ETF approval in Hong Kong on April 15th, a development that could attract new institutional investors and potentially impact the price.

But adding to the story is another big investor making a different move. This investor sold off a large amount of ETH worth $158.95 million. This shows how different big players are using various strategies in the unpredictable crypto market. The sell-off brings in uncertainty, maybe because the investor wants to make sure they don’t lose money or they’re trying to lock in their gains.

Although the recent market ups and downs from the sell-off might seem worrying, they might also open doors for different investors. With more ETH coming into the market, there’s a chance to buy in at a cheaper rate. This shows how whale activity can be both risky and offer chances to invest.

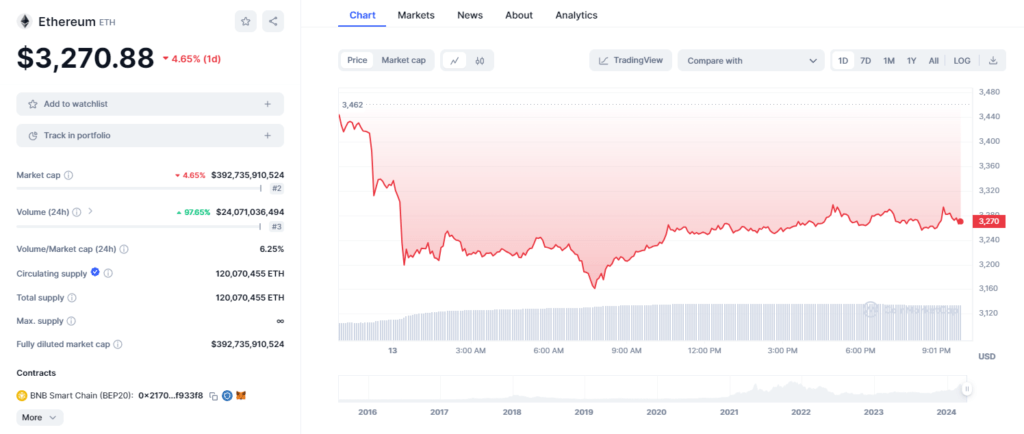

The recent drop of 4.65% pulled Ethereum’s value down to $3,270.88. Despite this, Ethereum’s trading volume saw a significant increase of 97.65% in the last 24 hours, reaching $24.071 billion. This surge highlights the growing interest in Ethereum, with both traders and investors actively engaging in the market.

Looking ahead, it will be crucial to keep an eye on the interplay between whale activity, market sentiment, and price fluctuations. Analysts and enthusiasts are closely monitoring these factors to assess Ethereum’s future path.

Also See: Hong Kong Poised to Approve Bitcoin and Ethereum ETFs!