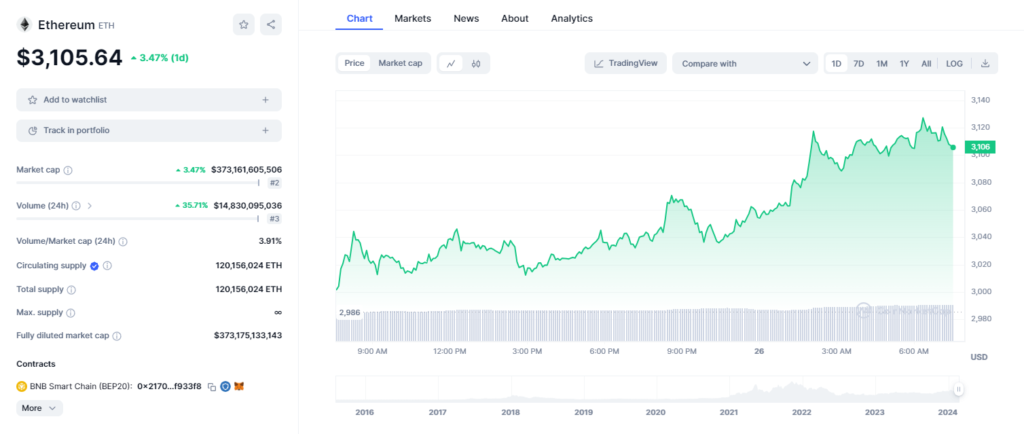

Ethereum (ETH) is celebrating a milestone, reaching its highest price point of 2024 so far, trading at $3,117.39. This marks a significant climb from its 2022 low of $881.56 in June, but it’s still 36% shy of its all-time peak of $4,868, set in November 2021.

This achievement follows a tumultuous period for ETH. Its price plummeted to a low of $881.56 on June 13th, 2022, after a rapid decline from its previous peak. However, the cryptocurrency showed resilience, attempting a comeback from $2,159 in January 2022 to $3,580 in March 2022, before ultimately falling again.

The remainder of 2022 witnessed a consolidation period for ETH, with its price remaining relatively stagnant. However, 2023 brought renewed optimism, with the cryptocurrency experiencing a remarkable 90.10% surge, rising from $1,200.34 at the end of 2022 to $2,281.87 at the close of 2023.

Several factors contributed to the recent surge in Ethereum’s value. First and foremost, the approval of Bitcoin ETFs by the SEC, combined with an expanding global acceptance of cryptocurrencies as an alternative asset class, created a positive environment for investors and drove up the price. Furthermore, the anticipated approval of an Ethereum ETF by the SEC, expected on may, has added fuel to the fire, contributing to further growth in Ethereum’s value. Additionally, the cyclical nature of the cryptocurrency market is believed to have played a role in the recent upward momentum.

Currently, ETH’s market capitalization and trading volume have both seen significant increases, registering surges of 3.47% and 35.71%, respectively, over the past 24 hours. This robust performance underscores the growing confidence in Ethereum and its potential for continued growth in the future.

While the future remains uncertain, Ethereum’s ascent to a new all-time high undoubtedly marks a significant chapter in its story and serves as a testament to its enduring potential in the ever-evolving cryptocurrency landscape.

However, investing in them carries significant risk due to their inherent volatility. Therefore, thorough research, portfolio diversification, and prudent investment with calculated risk are essential. Investors should practice responsible risk management and stay informed about market dynamics before considering cryptocurrency investment, which is inherently uncertain.

Also See: Changpeng Zhao’s Travel Under Intense Scrutiny as Sentencing Nears