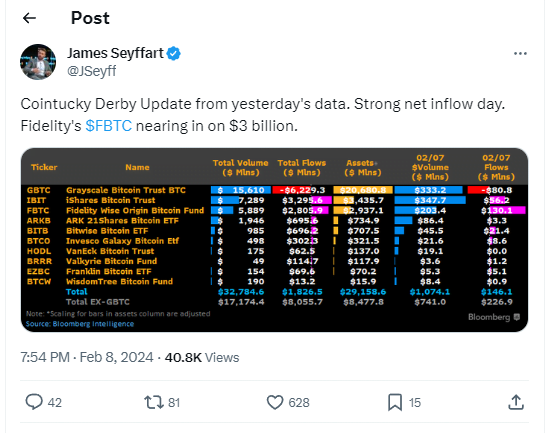

Bitcoin exchange-traded funds (ETFs) are defying the odds, experiencing a nine-day streak of net inflows despite ongoing legal uncertainties. On February 7th alone, a remarkable $146.1 million poured into these investment vehicles, showcasing investor confidence.

Fidelity’s FBTC Emerges as Undisputed Champion

Leading the charge is Fidelity’s FBTC, boasting a staggering $130 million net inflow this period. This surge catapults its total net inflows to a dominant $2.8 billion, solidifying its position as the market leader.

BlackRock’s IBIT Makes its Mark: While not quite matching FBTC’s dominance, BlackRock’s IBIT still attracted a noteworthy $56 million net inflow, adding to its $3.29 billion cumulative total. This highlights investor interest in diverse options within the Bitcoin ETF space.

Legal Challenges Fail to Deter Investors

The ongoing COPA versus CSW case casts a shadow, but investors remain unshaken. The $1.7 billion net inflow into Bitcoin ETFs over nine days signifies unwavering belief in their potential, despite legal and regulatory uncertainties.

Analysts See Broader Trend

This resilience reflects a growing trend: cryptocurrency investment vehicles are gaining mainstream acceptance. Bitcoin ETFs are seen as convenient gateways, mirroring the wider integration of digital assets into traditional finance.

Established Institutions Drive Market Dynamics

Fidelity’s FBTC reigns supreme with its $2.7 billion net inflows, showcasing its strategic influence. BlackRock’s IBIT, though smaller, contributes significantly with its $56 million inflow and $3.3 billion total, highlighting the growing role of established players in shaping the crypto investment landscape.

Confidence Breeds Momentum

The success of FBTC and IBIT goes beyond numbers. Established institutions like Fidelity and BlackRock lending their weight to Bitcoin ETFs validate their potential, attracting a wider range of investors.

Uncertainties Remain

However, legal and regulatory hurdles, along with inherent market volatility, pose challenges. The COPA versus CSW case exemplifies the ongoing legal complexities surrounding cryptocurrencies.

The Future is Bright

Despite these uncertainties, the current momentum surrounding Bitcoin ETFs is undeniable. The combined influence of established institutions, growing investor confidence, and increasing mainstream acceptance suggest a bright future for these investment vehicles. As the legal landscape evolves and the cryptocurrency market matures, Bitcoin ETFs are likely to play a pivotal role in bridging the gap between traditional finance and the exciting world of digital assets.

Also See: 10 Dominant Cryptos Propel Market Cap Soar by 3.38%