Setting apart the trend of applying for spot Bitcoin ETF from major wealth management companies, a reputable investment firm, First Trust Portfolios L.P. has submitted its Form N1-A to the United States Securities and Exchange Commission. They’re promising something new: the Bitcoin Buffer ETF.

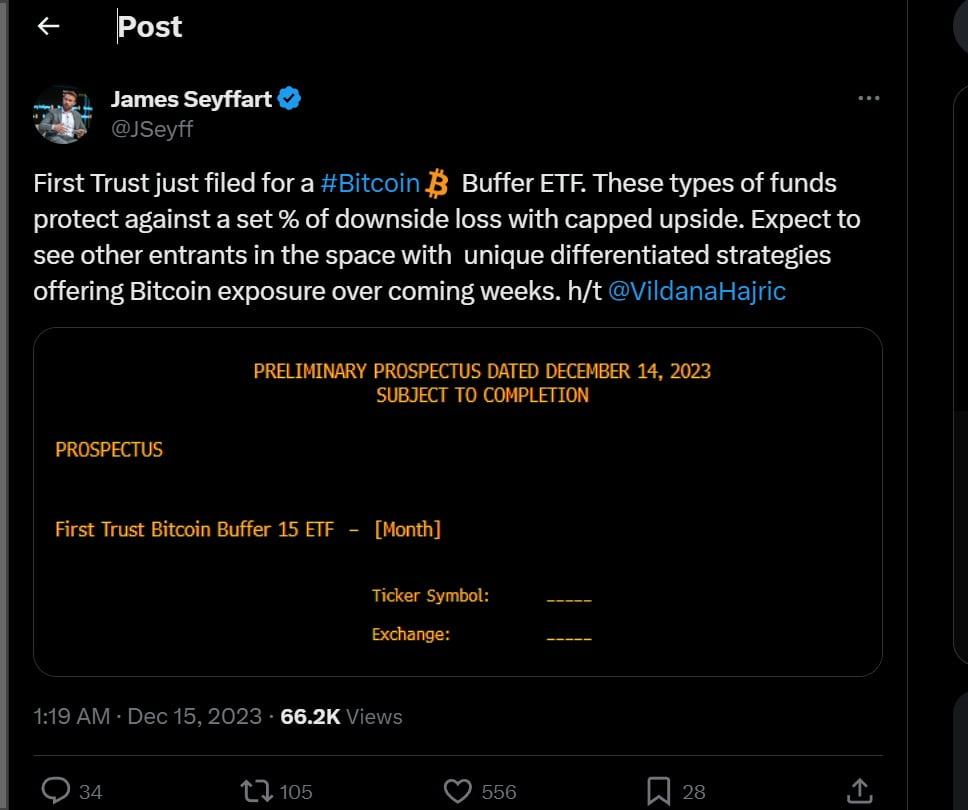

James Seyffart, a Bloomberg Intelligence analyst, mentioned in his X post, “First Trust just filed for a Bitcoin Buffer ETF. These types of funds protect against a set % of downside loss with capped upside. Expect to see other entrants in the space with unique differentiated strategies offering Bitcoin exposure over coming weeks.’

This distinct fund aims to capitalize on positive price movements in the Grayscale Bitcoin Trust (If approved) or a similar ETF that mirrors Bitcoin. What makes it unique is its special feature—a buffer designed to protect against the first 30% of potential losses in the underlying ETF during the specific period known as the “Target Outcome Period.”

This buffer serves as a safety measure, shielding investors from the initial 30% decline in the underlying ETF’s value. However, it’s important to note that this protection doesn’t account for the Fund’s fees and expenses, which could alter the percentage.

Even with this planned safety measure, investors should be aware that they could still potentially lose everything. The Fund acknowledges this risk and aims to limit losses to not more than 70% for shareholders who hold throughout the Target Outcome Period.

Furthermore, the filing outlines various risks associated with such investments, including the absence of an active market, fluctuations in Bitcoin or other crypto ETF prices, buffered loss risk, cap change risk, cash derivatives risk, and more.

Since BlackRock initiated this trend by applying for a physical Bitcoin ETF in June 2023, many major players like Fidelity, Wisdom Tree, Valkyrie, and Invesco have followed suit with similar applications. While awaiting decisions from the SEC, the introduction of the Bitcoin Buffer ETF by First Trust indicates a growing market for innovative products offering regulated exposure to cryptocurrencies.

As the cryptocurrency landscape continues to evolve, investors encounter new opportunities and products. However, it’s crucial to carefully assess and understand the associated risks in navigating this ever-changing market.