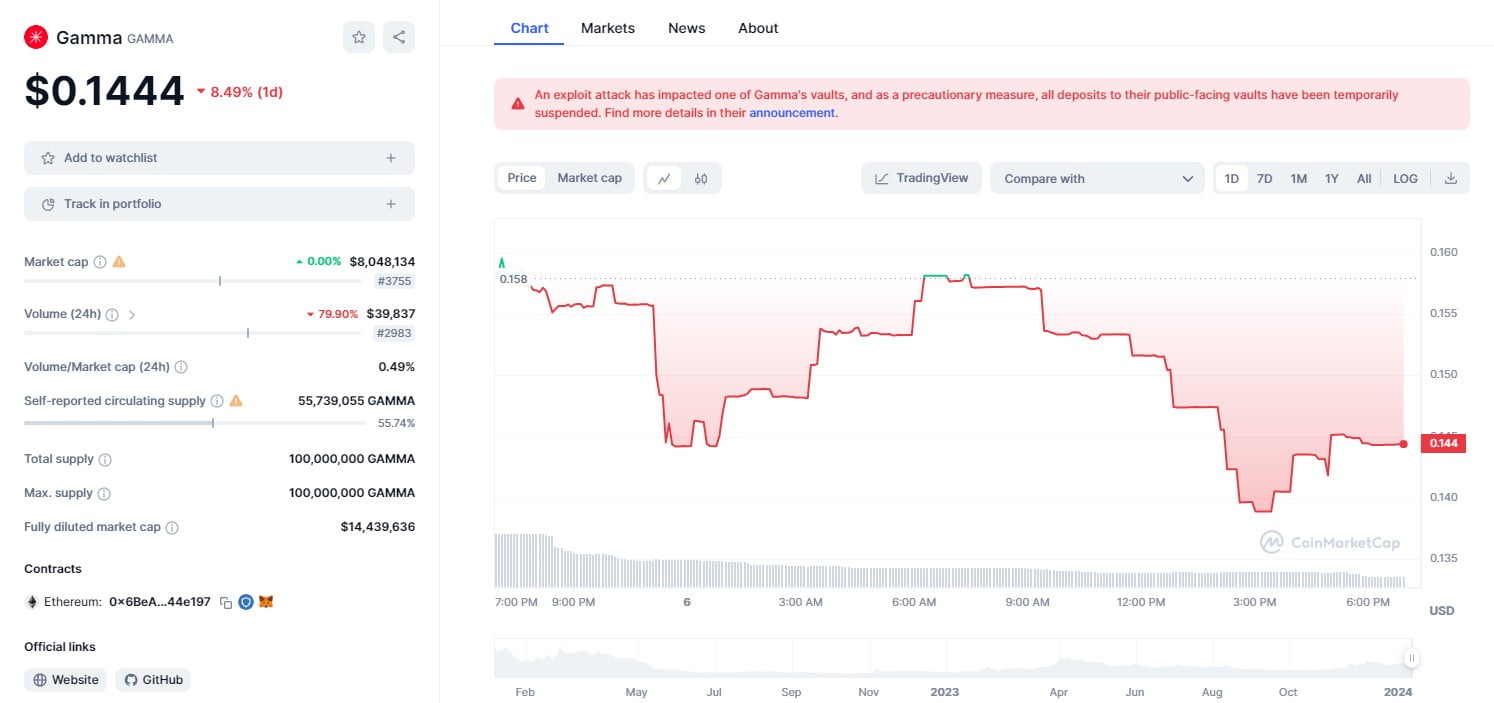

The serene world of DeFi faced a jolt on January 4th when Gamma Strategies, an Ethereum liquidity management protocol, encountered a $3.4 million hack. However, their response deviated from the norm – rather than pursuing legal action or typical defensive strategies, Gamma Strategies opted for an unconventional move: engaging in direct negotiation with the hacker.

The attacker, a clever crypto strategist, executed a sequence of intricate maneuvers to cover their tracks. The stolen funds swiftly transitioned from $USDT to $ETH and disappeared through a well-known currency mixer, Tornado Cash, creating digital chaos akin to a smoke bomb.

Yet, Gamma Strategies didn’t freeze in panic. They acted swiftly, briefly halting vault deposits while enabling withdrawals to safeguard user funds. Then, they surprised the DeFi community by initiating talks with the hacker’s wallet, proposing a negotiation to return the pilfered assets.

This unorthodox approach comes with risks and rewards. On one side, it offers a faster route to recovery, bypassing the sluggish legal process. It also demonstrates Gamma’s commitment to minimizing losses and prioritizing community trust.

However, it sets a risky precedent. Could negotiation become standard practice in DeFi security? Might it encourage future attackers, knowing they could bargain their way out of trouble? The implications are vast, and the crypto community watches closely.

Yet, despite uncertainties, Gamma’s swift actions earned begrudging respect. They identified the vulnerability and patched it by closing public-facing vaults, cutting off the exploit. Looking ahead, they’ve detailed a recovery plan: bolstered security measures, a thorough code review to prevent future breaches, and maximizing compensation for affected users.

Gamma’s experience serves as a warning for the broader DeFi system. It exposes the vulnerabilities within this evolving technology while showcasing bold solutions communities are willing to explore. As the dust settles, it’s evident: the landscape of DeFi security has entered uncharted territory, forcing players and onlookers to adapt.

In this digital gold rush, caution reigns supreme. Research thoroughly, grasp the risks, and invest wisely. The next chapter in this saga remains uncertain, but one thing’s certain: the DeFi narrative is far from concluded.

Slso See: Grayscale’s Milestone: First US Spot Bitcoin ETF Filing