New York, January 1st, 2024: 2023 marked a triumphant return for global stocks, with the MSCI World Index delivering its best performance since 2019. Investors rejoiced as central banks halted interest rate hikes and hopes for future cuts sparked a two-month rally that pushed the index 16% higher since October and 22% overall, according to the Financial Times.

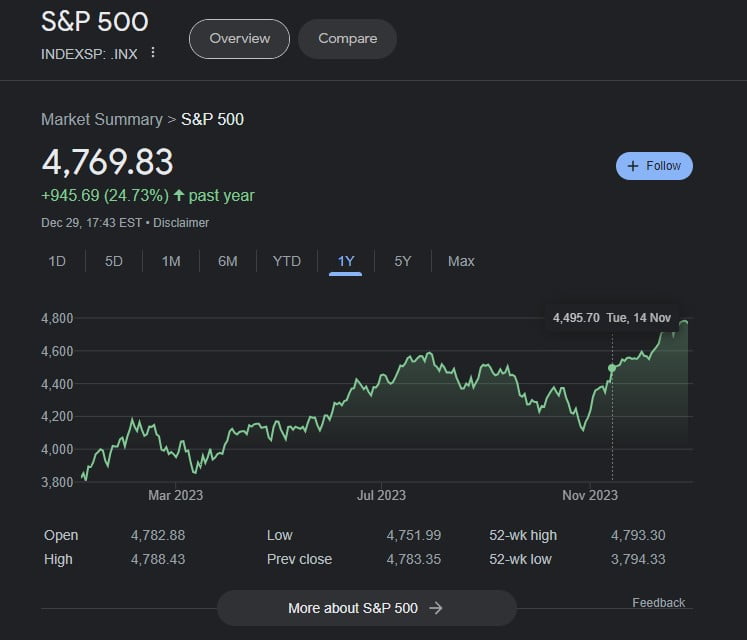

The surge was largely fueled by Wall Street’s S&P 500, which soared 14% in the final quarter and 24% for the year, closing near record highs. Western economies witnessed a dramatic shift in interest rate expectations after inflation cooled faster than anticipated. This dovish outlook spurred a significant rebound, with the tech-heavy Nasdaq Composite enjoying a stellar 43% gain – its best in two decades.

However, not all markets shared the exuberance. London’s FTSE, with its exposure to traditional sectors, lagged behind, mustering a modest 4% rise.

Key Takeaways:

- Global stocks surged in 2023, with the MSCI World Index posting its best performance since 2019.

- The rally was fueled by hopes for lower interest rates in the face of easing inflation.

- US markets, led by the S&P 500 and Nasdaq, outperformed, fueled by strong corporate earnings and a tech-driven rebound.

- European markets, including London’s FTSE, lagged behind due to their focus on traditional sectors.

Looking Ahead:

The 2023 rally leaves investors optimistic for 2024. However, much hinges on central bank decisions and the trajectory of inflation. Should the dovish turn hold, continued market momentum is likely. But if inflation resurfaces or central banks tighten their stance, the party might be short-lived.