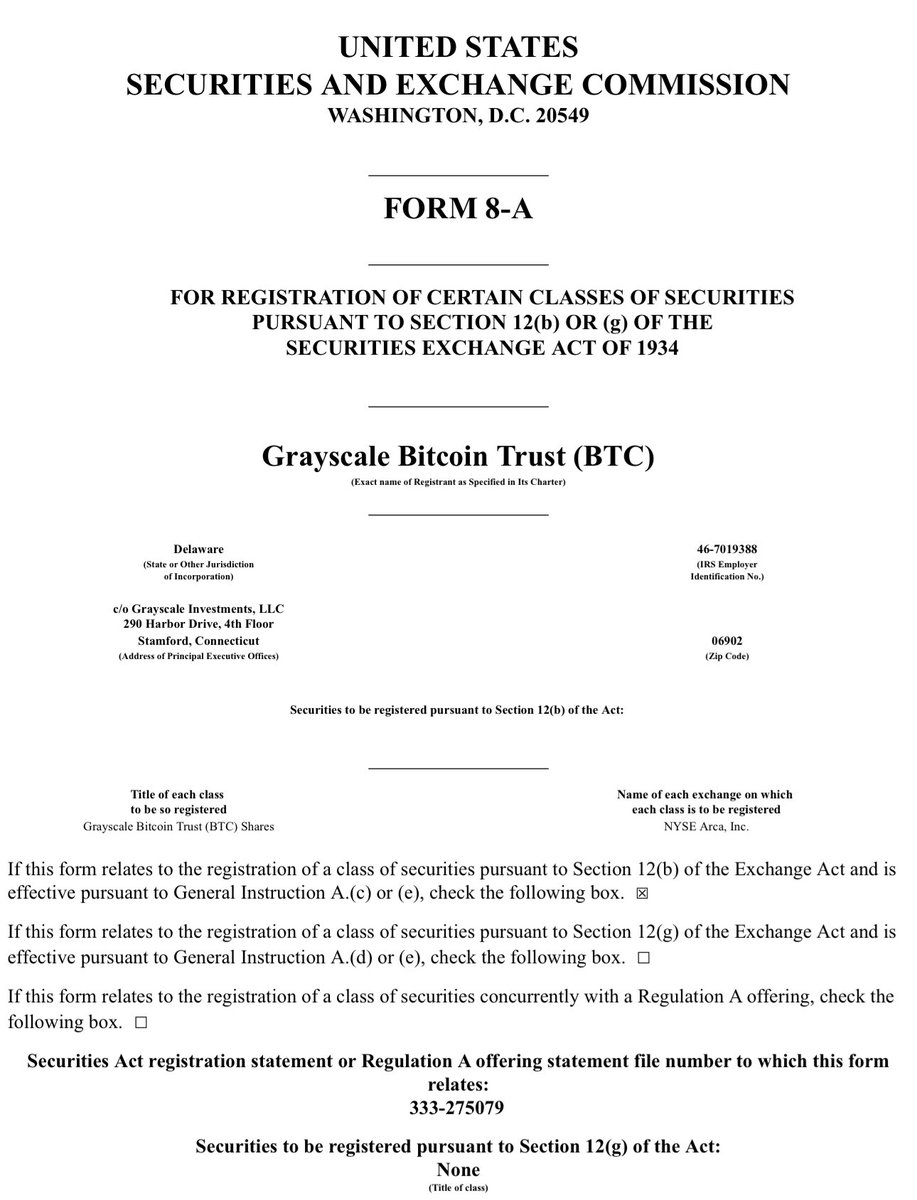

In a pivotal step for the cryptocurrency industry, Grayscale Investments, a subsidiary of Digital Currency Group, has filed form 8-A and securities registration for a US spot Bitcoin ETF with the Securities and Exchange Commission (SEC). This proposed ETF, with the ticker symbol “BTC,” would offer investors a way to track Bitcoin’s price without directly buying and storing the cryptocurrency itself.

This landmark move comes after Grayscale’s March announcement exploring potential conversions of its existing investment products into ETFs. Notably, the SEC has yet to approve any Bitcoin ETF applications, making Grayscale’s proposal a significant leap forward. The Bitcoin ETF is in line to become the first US spot Bitcoin ETF listed on a major US stock exchange

Key Takeaways:

- Grayscale files for the first U.S. spot Bitcoin ETF.

- This is a significant step forward for the industry.

- Other major players are also pursuing similar ETFs.

- Converting GBTC to an ETF could boost liquidity and attract institutional investors.

- The SEC’s decision holds major implications for the future of Bitcoin and cryptocurrency.

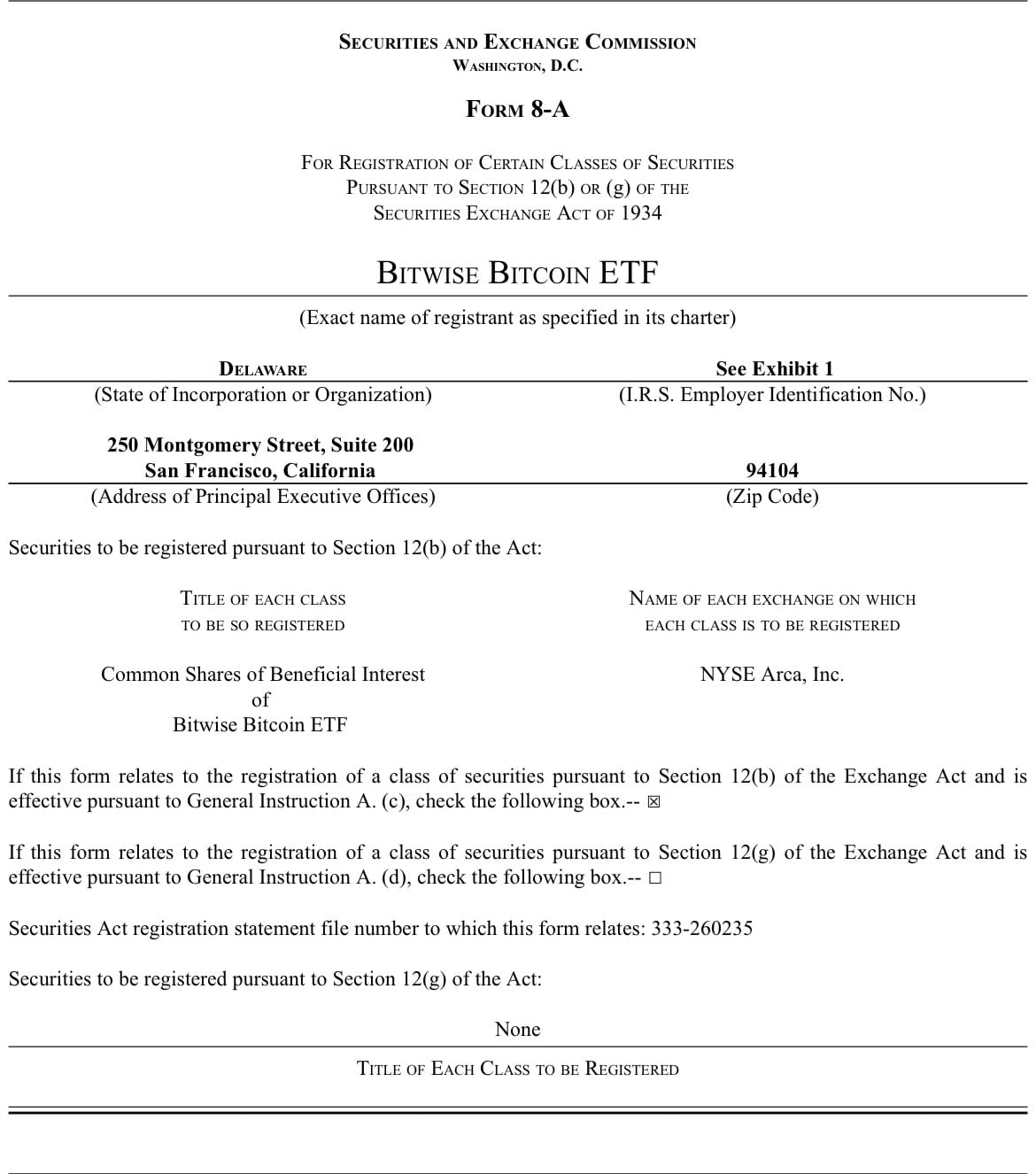

Grayscale isn’t alone in eyeing this lucrative market. Industry giants like BlackRock, Van Eck, Bitwise, and Fidelity have also expressed interest and filed their own ETF applications with the SEC.

Speaking of their existing product, Grayscale noted, “We are actively collaborating with the SEC to potentially up-list GBTC, our flagship Bitcoin Trust, to NYSE Arca as a spot Bitcoin ETF. Upon receiving regulatory approvals, Grayscale is fully prepared to operate GBTC as an ETF”.

Converting GBTC into an ETF would significantly enhance its liquidity and provide investors with a more regulated avenue to access Bitcoin’s price movements. This could potentially unlock massive institutional investment, propelling Bitcoin further into the mainstream financial landscape.

While the SEC’s decision timeline remains unclear, Grayscale’s bold move marks a crucial milestone in the quest for a US spot Bitcoin ETF. Its potential approval could reshape the entire cryptocurrency industry, opening doors for broader adoption and institutional involvement.

See Also: Bitcoin ETF Turnaround: From SEC Rejection Fears to Approval Buzz