Hong Kong’s debut of Bitcoin and Ethereum ETFs witnessed a morning session trading volume of $6.3 million, marking a new chapter for Asian crypto markets. However, this positive development comes amidst a contrasting trend in the US, where Bitcoin ETFs have experienced their fourth consecutive day of outflows.

On Monday, April 29th, US Bitcoin ETFs experienced a combined net outflow of $51.6 million, continuing a trend observed over the past week, signaling changing investor sentiment. Grayscale’s Bitcoin Trust (GBTC) saw a substantial withdrawal of $24.7 million, while ARK Invest’s ETFs also saw a notable decrease of $31.3 million. Surprisingly, Blackrock’s ETFs remained unchanged, with no reported outflows.

Amidst mixed signals in the market, the Bitwise Bitcoin ETF stood out with inflows of $6.8 million, suggesting a potential resurgence. However, this positive note was countered by Fidelity Wise’s FBTC, which saw a substantial outflow of $6.9 million. The market witnessed further mixed signals with inflows for Valkyrie’s BRRR Bitcoin ETF ($2.7 million) and Franklin Templeton’s EZBC ETF ($1.8 million).

Looking at the bigger picture, the past week has been the worst-performing period for Bitcoin ETFs, with total outflows across various funds exceeding $328 million. Grayscale’s GBTC again led the pack with significant withdrawals, while Blackrock’s Bitcoin ETF continued to report zero flows.

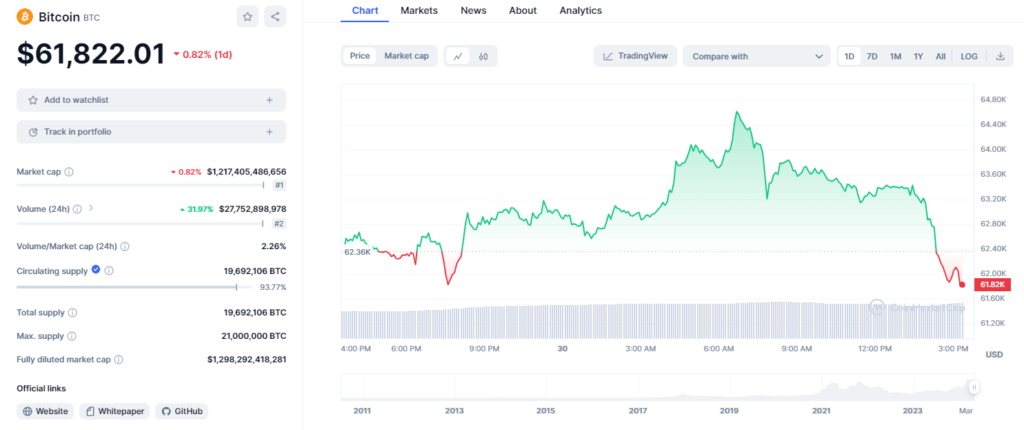

Reflecting the ongoing outflows, the price of Bitcoin has plunged to around $61,500. However, the recent launch of Hong Kong Bitcoin and Ethereum ETFs has introduced a new element of market dynamics. The initial trading hours witnessed buying and selling activity likely fueled by anticipation.

Bitcoin advocate and MicroStrategy CEO, Michael Saylor, continues to be a bull on Bitcoin, recently adding another 112 BTC to his holdings at an average price of $64,000. Saylor’s consistent buying strategy, along with similar actions from entities like Tether and El Salvador, is seen as a potential driver for future price increases.

Furthermore, the launch of the Hong Kong Bitcoin ETF appears to be influencing the price positively. Among 6 Bticoin and Ethereum ETFs launched, ChinaAMC’s Bitcoin took the lead generating HKD 22.97 million and HKD 10.47 million from Ethereum ETF. Similarly, Harvest Investment generated HKD 8.11 million trading volume from spot Bitcoin ETF and HKD 2.18 million in Ethereum ETF. The last in the row is Bosera HashKey generating the trading volume of HKD 3.59 million from spot Bitcoin ETF and HKD 1.53 million from Ethereum ETF.

Although Hong Kong Bitcoin and Ethereum ETFs had a promising start, Bitcoin’s price experienced a slight decline on Tuesday, April 30th. It dropped by 0.76% to $61,834. Despite this decrease, there was a notable increase in trading volume. Bitcoin’s daily trading volume surged by 31.97% to reach $27.752 billion.

The coming days will be crucial in determining whether the Hong Kong launch can spark a sustained turnaround in investor sentiment or if the US outflows continue to dominate the market.

Also See: Hong Kong Bitcoin and Ethereum ETFs Set to Launch 30th April