In a move solidifying its commitment to Bitcoin, MicroStrategy (NASDAQ: MSTR) announced a fresh purchase of 3,000 Bitcoins for approximately $155.4 million, bringing its total holdings to 193,000 BTC. This strategic acquisition by MicroStrategy, led by its executive chairman and co-founder Michael Saylor, comes ahead of the highly anticipated Bitcoin halving event and the potential influx of Bitcoin accumulation through spot Bitcoin ETFs.

Expanding Bitcoin Holdings

The recent purchase, disclosed in a filing with the U.S. Securities and Exchange Commission, reflects MicroStrategy’s unwavering belief in Bitcoin’s long-term potential. Acquired at an average price of $51,813 between February 15 and 25, 2024, these additional Bitcoins bring compny’s total investment to nearly $6.09 billion, with an average acquisition price of $31,544 per Bitcoin.

Confidence in the Face of Change

Despite potential market fluctuations surrounding the launch of Bitcoin ETFs, Michael Saylor remains undeterred. He emphasizes MicroStrategy’s unique position as an operating company, distinct from unleveraged and fee-charging ETFs. This distinction, according to Saylor, sets MicroStrategy apart in the investment landscape.

Security and Diversification

For safekeeping, MicroStrategy entrusts 98% of its Bitcoin holdings to Fidelity Custody, while leveraging Coinbase Prime for robust asset management and security diversification. This approach underscores MicroStrategy’s commitment to secure and responsible management of its digital asset portfolio.

Market Response and Price Performance

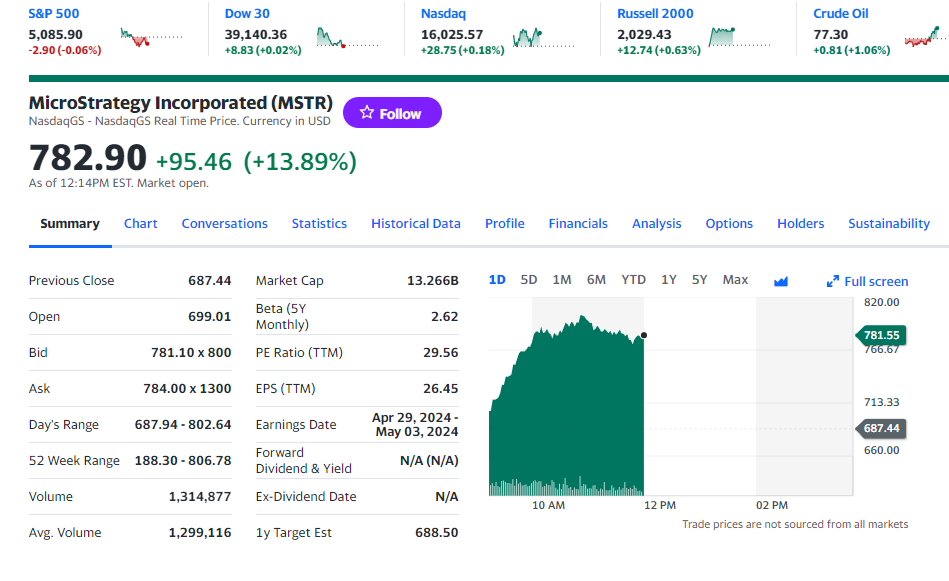

The news of MicroStrategy’s latest Bitcoin acquisition has sent positive ripples through the market. MSTR stock (NASDAQ: MSTR) witnessed a gain of 13.83%, with the price trading at $782.90. This momentum builds upon the impressive MSTR stock performance in recent months, driven in part by the Bitcoin rallies of 2023 and 2024. MSTR is currently up 39% in a month, 160% in a year, and a staggering 316% since the beginning of 2023.

Bitcoin’s Rise and Trading Activity

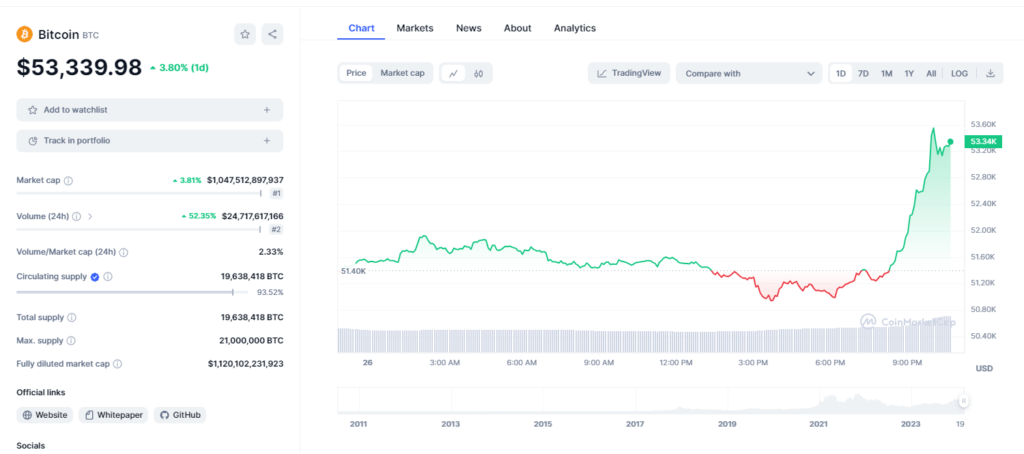

Bitcoin itself has shown positive signs, experiencing a 1% surge in the past hour, rebounding from a 24-hour low of $50,931. Currently trading at $53,410.69, the price demonstrates a potential upswing. Additionally, the 24-hour trading volume has increased by 51.35%, indicating renewed interest among traders.

MicroStrategy’s consistent investment in Bitcoin signifies the company’s strong conviction in the future of this digital asset class. As the Bitcoin halving and the emergence of spot Bitcoin.

Also See: OANDA Crypto: Expanding to the UK with 63+ Options