Oil prices remained unchanged on Monday after Qatar announced that the temporary Israel-Hamas truce would be extended for an additional two days.

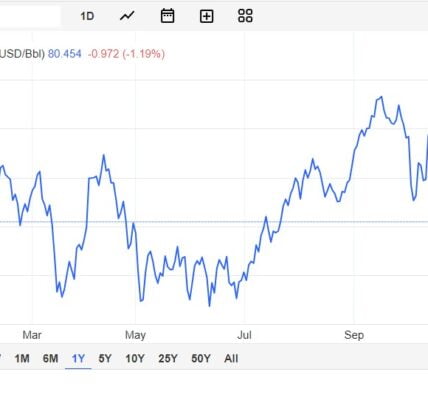

West Texas Intermediate (CL=F) futures were slightly lower in midday trading, staying above $75 per barrel. Brent (BZ=F) crude, the global benchmark price, was trading around $80.

Prices have been erratic since a surprise Hamas attack on Israel last month. A four-day-cease-fire was set to expire on Tuesday. Both Israel and Hamas have indicated a willingness to extend the truce in order to facilitate the release of more captives. Qatar is facilitating for the cease-fire between Israel and Hamas.

Another reason for wavering in oil prices is the market’s anticipation of the next moves by the OPEC+, on production cuts at a crucial meeting this Thursday.

OPEC+ meeting was scheduled final meeting of the year on November 26, but it surprisingly rescheduled its meeting from November 26 to Thursday, indicating disagreements among its members about future production cuts.

Saudi Arabia, the group’s largest member, has reportedly been pressuring other OPEC+ members to accept a larger share of the reductions. Riyadh has implemented unilateral production cuts of 1 million barrels per day through the end of the year, in addition to the cartel’s output cuts.

Andy Lipow, president of Lipow Oil Associates, said in an interview with Yahoo Finance on Friday, “As we move forward, there are now disagreements because you have countries that want to increase production,”. “These disagreements between Saudi Arabia and the others have led to these delays we’ve seen.”

Before the meeting was postponed, traders were expecting OPEC+ to announce an extension or even a deepen the current cuts in response to the growing supply in the marketplace.

The growing supply of crude oil from the United States of America and Guyana is adding more pressure to OPEC+ countries. The United States has reported a production of 13 million barrel per day, while Guyana has also shown a significant increase in oil production.

Andy Lipow in the interview believed that there will be continued pressure on these prices over the few months.

OPEC members’ cuts this year are aimed at limiting global supply and maintaining a floor under oil prices.

Despite the output reductions, crude is roughly 19% lower than the 2023 highs reached in late September due to concerns about increasing supply and slowing demand.

As Lipow stated, higher interest rates imposed by central banks are already causing slowdown in European oil demand ans China’s refinery activity.

The slowdown or hault in spending by the U.S. consumers, resulting from high-interest rates, certainly impacts the Chinese manufacturing industry, due to reduced demand from the U.S.