ORDI has seen major price shifts, mainly due to statements made by Luke Dashjr, a key figure in the Bitcoin core development team. In the last 48 hours, these fluctuations have spotlighted big ORDI holders, sparking discussions about their impact on the market.

An extensive analysis by Lookonchain shows that a small group of whales holds most of the ORDI. Recent data indicates that the top 30 ORDI holders own about 16.78 million ORDI, valued at nearly $950 million, constituting roughly 79.94% of the currency’s total supply. This concentration has grown from previous numbers, indicating an increasing accumulation among these major investors. Notably, the top 50 holders now control about 12.4 million ORDI, valued at $143 million, which is almost 59% of the total supply.

Interestingly, two significant holders, identified as users on the OKX Exchange, have steadily acquired around 57,299 ORDI, worth about $3.15 million, since May. These acquisitions took place across various exchanges like Bybit, Gateio, KuCoin, and Binance. They currently rank as the 2nd and 10th largest ORDI holders, respectively.

Moreover, specific wallet addresses reveal intriguing patterns. For instance, one address bc1q8u received 149,999 ORDI, valued at approximately $2 million, from Binance and Gateio in May and November, averaging around $13.5 per ORDI. Another address bc1qrl received 184,637 ORDI, worth about $4.26 million, from Binance between November 17 and 23, when the price was around $23.

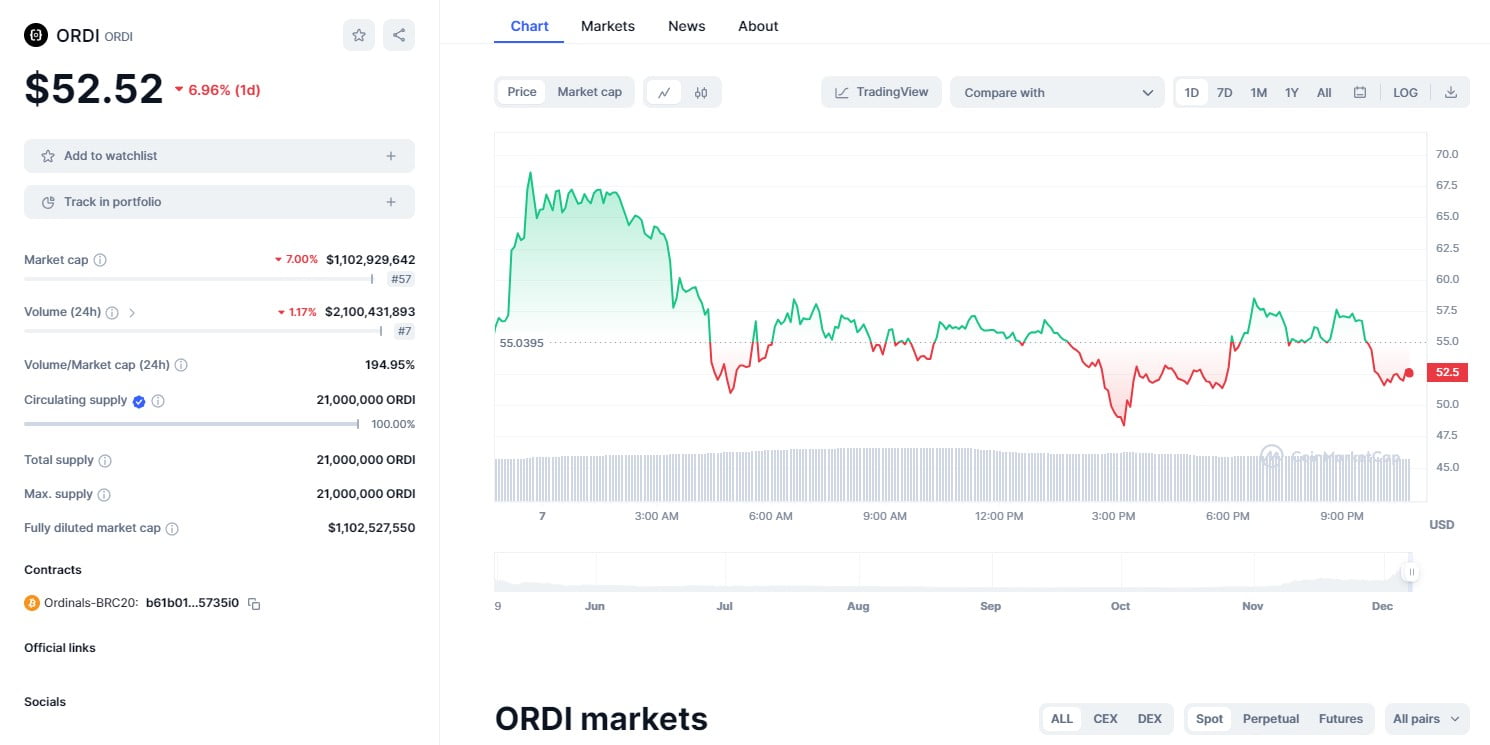

In contrast, some whales took advantage of increased prices by selling, particularly after Dashhr’s post on ‘X’. One investor sold 59,000 ORDI for approximately $3.54 million before a significant drop in ORDI’s price, making a profit of over $2.3 million. As of the current moment, the ORDI price stands at $52.52 reflecting a decrease of 23.77% compared to the price recorded on December 6 ($68.77).