Bitcoin reached its peak for the year on the back of mounting excitement over the potential approval of a Spot Bitcoin ETF by the American Securities and Exchange Commission (SEC). Analysts James Sayffartf from Bloomberg, suggest the anticipated clearance might come between January 5 and 10, 2024, but there’s also a significant possibility of rejection by the SEC.

The surge in Bitcoin price was initially expected due to investors anticipating an interest rate cut announcement from Federal Reserve Chairman Jarome Powell. However, the Fed dashed these hopes, maintaining its current stance. Powell stated that the central bank requires more evidence that inflation will return to the Fed’s 2% target.

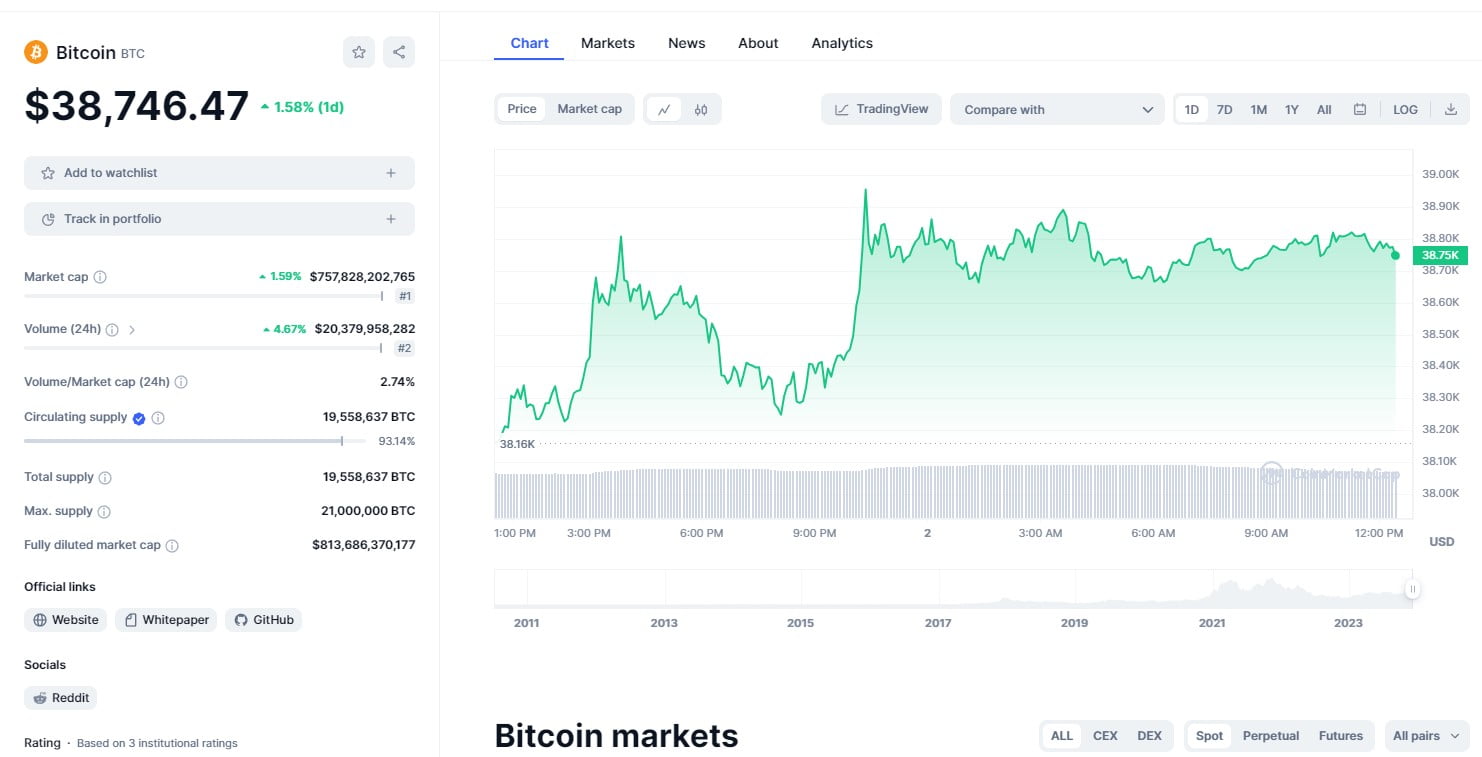

On Friday, Bitcoin opened at $37,762.5 and soared up to $ 38,954.11. It is now trading at $38,746.47, marking a 1.58% increase in market capitalization and 4.67% rise in trading volume over the past 24 hours.

Bitcoin price surged by a staggering 134.85% in 2023, hinting at a potential return to its previous high. Strating the year at $16,497.35, it’s now trading at $38,746.47, with the monthly trend favoring bullish sentiments among investors.

Amids In the midst of heightened attention, the SEC is currently reviewing more than 10 spot bitcoin ETF applications from wealth management firms. Engaging in formal meetings with asset managers, the SEC ais to assess the potential approval of these spot Bitcoin ETFs. According to a recent CNBC report, the SEC met with Grayscale from Grayscale Bitcoin Trust on Thursday, and SEC officials held similar discussions with representatives from BlockRock and Nasdaq.

The ongoing discussions between the SEC and wealth management firms suggest a possibility of simultaneous approval for these applications. However, the delay in decision-making has led to suspense regarding potential rejections.

Despite SEC Chairman Gray Gensler’s vocal criticism of cryptocurrency, his recent statements during public appearances, where he mentioned considering his staff’s input on a Bitcoin ETF, offer a glimmer of hope for approval.

Ultimately, the increasing confidence among crypto investors in the market concerning the potential approval of spot Bitcoin ETFs appears to be blistering the price of Bitcoin.