In a landmark achievement for the cryptocurrency industry, spot Bitcoin ETFs have surpassed a monumental $10 billion in assets under management (AUM) within just one month of their launch. This surge reflects Bitcoin’s recent price rally and signifies a crucial step towards integrating crypto into mainstream financial markets.

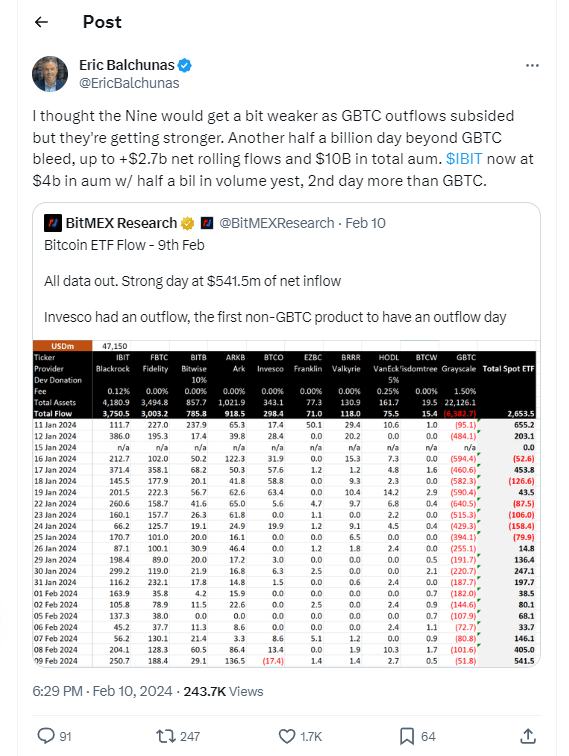

Out of 10 newly listed spot Bitcoin ETFs, nine have fueled this rapid growth, attracting significant investor interest. BitMEX Research data reveals a massive net inflow of $2.7 billion on January 9th alone, highlighting investor confidence in these regulated investment vehicles.

BlackRock’s IBIT and Fidelity’s FBTC lead the pack, holding $4 billion and $3.4 billion in Bitcoin assets respectively. Notably, ARK 21Shares’ ETF also crossed the $1 billion mark, demonstrating broader diversification within the industry.

However, Grayscale’s GBTC, a long-standing Bitcoin investment trust, faces a different reality. While it initially enjoyed a dominant position, it has experienced significant outflows totaling $6.3 billion in the past month. This trend signals a shift towards the newly approved and more transparent spot Bitcoin ETFs.

“I thought the Nine would get weaker as GBTC outflows subsided, but they’re getting stronger,” remarked Bloomberg analyst Eric Balchunas, emphasizing the growing investor preference for these regulated alternatives.

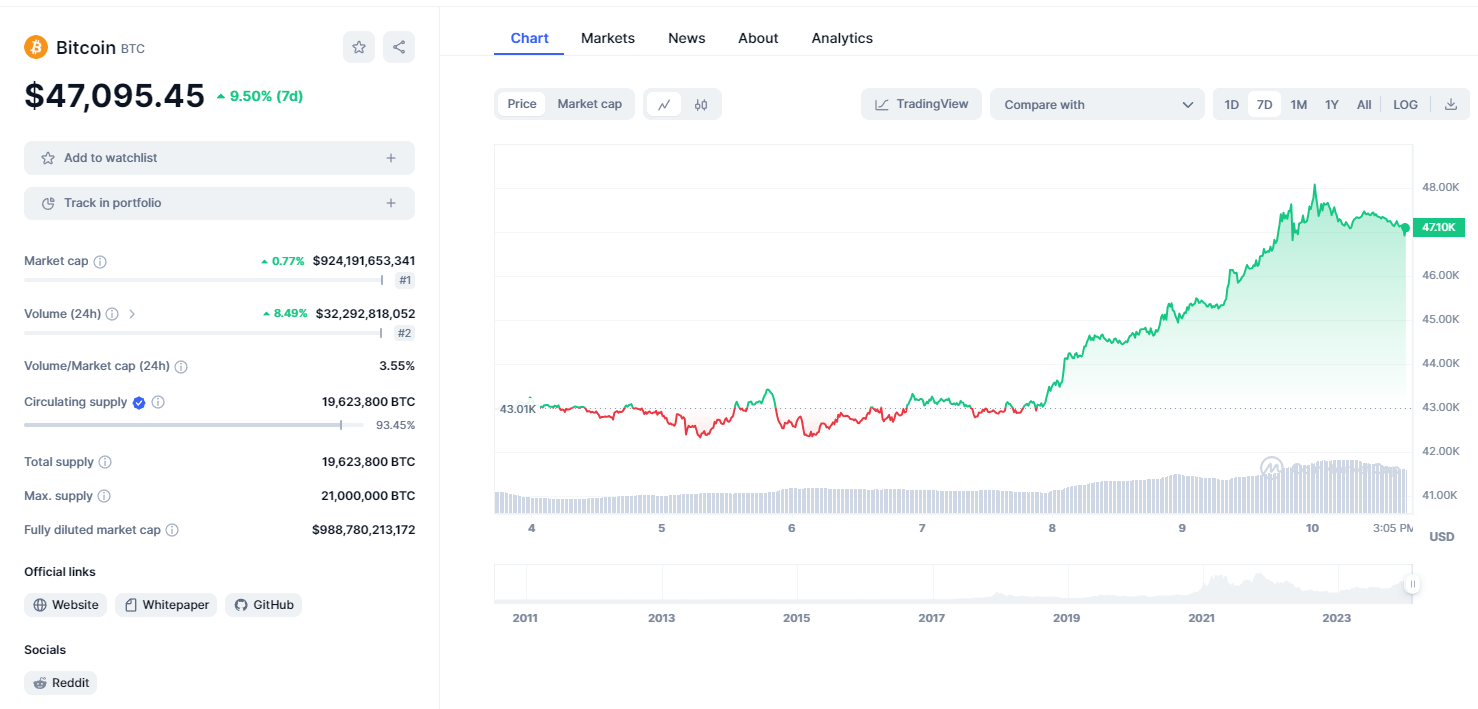

Analysts predict continued growth in Bitcoin ETF investments as institutions and investors conduct their research. Bitcoin’s current price performance, trading at $48,180.84 with a 2.17% surge in the last 24 hours, has remained steady above key technical support levels in January, also fuels optimism. Additionally, ARK Invest’s analysis positions Bitcoin as a potential “risk-off” asset, potentially replacing gold in some portfolios.

The SEC’s approval of Spot Bitcoin ETFs applications in 2023 marks a watershed moment for the cryptocurrency industry. After years of uncertainty, leading institutions like ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, and Grayscale can now offer regulated Bitcoin exposure to investors.

This milestone signifies a critical step towards the mainstream adoption of cryptocurrency and paves the way for further innovation and collaboration within the financial landscape.

Also See: Will Bitcoin Break $50k? Record ETFs Inflows Hint at Yes