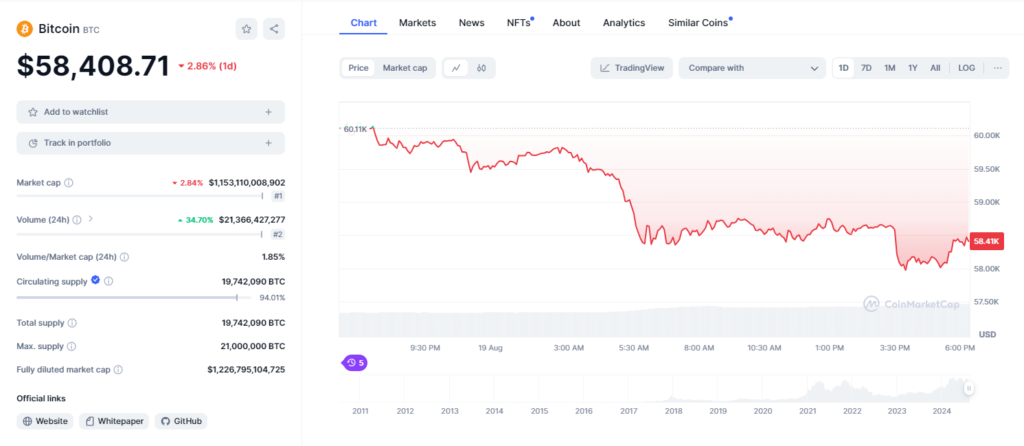

Bitcoin’s effort to surpass the $60,000 level on Sunday was suddenly interrupted as an increase in Bitcoin short selling activities drove the price back down. As of now, Bitcoin is trading at $58,408.71, marking a 2.86% decline over the past 24 hours. Since August 8, only one green candle has closed above the $60,000 mark.

Bitcoin Short Sellers Step In

Bitcoin bullish traders have repeatedly faced setbacks from Bitcoin short sellers, whose activity has surged across multiple exchanges. In just 24 hours, the total short v olume soared by 118%, surpassing $18.3 billion. Analysts at HODL15Capital noted a significant imbalance in short positions on major platforms like Deribit, Bitmex, and Binance.

The analysts also pointed out that some of the highly leveraged bets on Binance, with leverage levels of 50x or 100x, could soon be forced to liquidate. This means these traders might have to sell their Bitcoin holdings if the price moves unfavorably, which could further impact the market.

Over $95 million wiped out in crypto liquidations

Cryptocurrency investors suffered losses of over $95 million in the past day due to prices reversing wildly. Most of these losses came from traders in the long positions. Bitcoin and Ethereum traders were the major losers in their bet for long. Their combined losses were nearly $46 million with Bitcoin $18.26M and Eth $27.22M. While not as severe, traders who bet on prices falling (short positions) also faced liquidation of $17.85 million, with Bitcoin and Ethereum contributing 37% of the total short liquidation. Bitcoin short sell position valued $3 million and Ethereum’s $3.3 million short sell positions were closed due to opposite movement of price.

ETF Inflows Remain Weak

Meanwhile, investments in Bitcoin and Ethereum exchange-traded funds (ETFs) have remained sluggish over the past two weeks. Bitcoin ETFs recorded a net inflow of just $32.5 million last week, with some major funds even experiencing outflows. Ethereum ETFs, on the other hand, saw a net outflow of $1.4 million. Despite this, some analysts believe that Ethereum ETFs could eventually attract more investments that are currently being directed toward Bitcoin ETFs.

Key Events to Watch

Looking ahead, investors will be closely monitoring several key events this week. The Federal Open Market Committee (FOMC) meeting and statements from Federal Reserve Chair Jerome Powell are expected to draw significant attention. Additionally, the annual Jackson Hole meeting of central bankers is on the radar, as these events could influence the broader financial market and potentially impact Bitcoin’s price movement.

As the market watches these developments, the future of Bitcoin remains uncertain, with both bullish and bearish forces at play.

Also Read: Toncoin and Notcoin Ignite Crypto Market Revival