Wall Streets embrace of cryptocurrencies appears to be expanding beyond established players like Bitcoin. Investment firm VanEck, on Thursday, filed with the SEC to launch the first U.S. Spot Solana ETF directly tied to the spot price of Solana, a popular alternative cryptocurrency (altcoin).

This move follows the SEC’s recent approval of similar ETFs for Bitcoin and Ethereum. The VanEck Solana Trust aims to offer investors direct exposure to Solana and will determine its share price daily based on select trading platforms.

Matthew Sigel, the Head of VanEck’s digital asset research, disclosed the fact via his X post on June 27 about the filing of spot Solana ETF. Within his announcement, Sigel positioned Solana as a strong contender to Ethereum, claiming SOL as a commodity akin to Bitcoin and Ethereum.

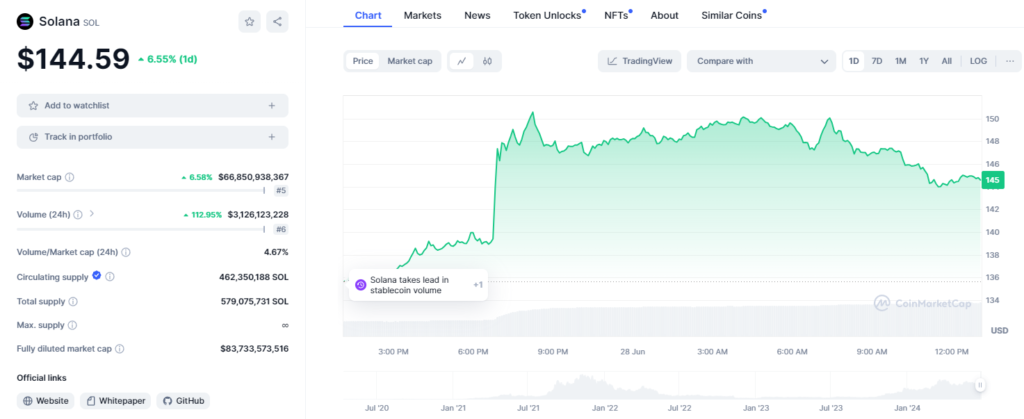

After the news, Solana experienced a staggering 6.55% surge in market capitalization over 24 hours. It is currently trading at $144.59 with an impressive 112.95% increase in trading volume within the same period.

Enthusiasm in Spot Solana ETF and Regulatory Hurdles

Anthony Pompliano, a prominent figure in the cryptocurrency world, sees this ETF as a sign of growing acceptance of altcoins by major financial institutions. He believes it reflects a broader shift on Wall Street towards a wider range of digital assets. However, regulatory hurdles remain. Analyst James Seyffart of Bloomberg cautions that a formal launch date for spot Solana ETF might not occur until mid-March 2025 due to the SEC’s approval process.

Mixed Reactions and Divergent Views

Industry experts hold mixed opinions on the proposal. Pompliano views VanEck’s spot Solana ETF as evidence of altcoins becoming mainstream on Wall Street. He expects it to reflect diversification in institutional interest in digital assets beyond Bitcoin and Ethereum, potentially leading to a more dynamic, but potentially volatile market.

However, not everyone shares Pompliano’s optimism. Social media user @AlyseKilleen, for instance, highlights the potential cooling of enthusiasm for altcoins. She cites ARK Invest’s shift away from an Ethereum ETF as evidence. This divergence of view underscores the complex and ever-evolving nature of cryptocurrency investment sentiments.

Solana’s Strong Position and Potential Regulatory Tailwinds

The Solana network boasts a robust $4 billion in total value locked (TVL), indicating high user activity. Additionally, its large stablecoin market cap attracts developers and projects. These metrics solidify Solana’s position within the cryptocurrency landscape.

Furthermore, the SEC’s decision to halt investigations into Ethereum for securities law violations could positively impact the regulatory environment for altcoins like Solana, potentially smoothing the path for similar initiatives in the future.

Also Read: Apple Bitcoin Buzz: Saylor’s Post Sparks Excitement