BlackRock recently resubmitted revised documents for the Bitcoin Exchange Traded Fund (ETF) to the U.S. Securities and Exchange Commission (SEC). This update could be a part of the SEC’s evaluation process of documents required before approval or disapproval.

In its second submission, BlackRock has submitted revised documents related to the Bitcoin spot ETF S-1 filing. This move underscores BlackRock’s steadfast commitment to launching a Bitcoin ETF in which there is substantial interest among investors and the financial community at large.

Similarly, Bitwise, a significant player in digital asset management, also amended its application for a Bitcoin ETF shortly before BlackRock. This update is in the realm of Bitwise’s strategic push to introduce a Bitcoin ETF, meeting the increasing demand among investors for crypto investment options on regulated exchanges.

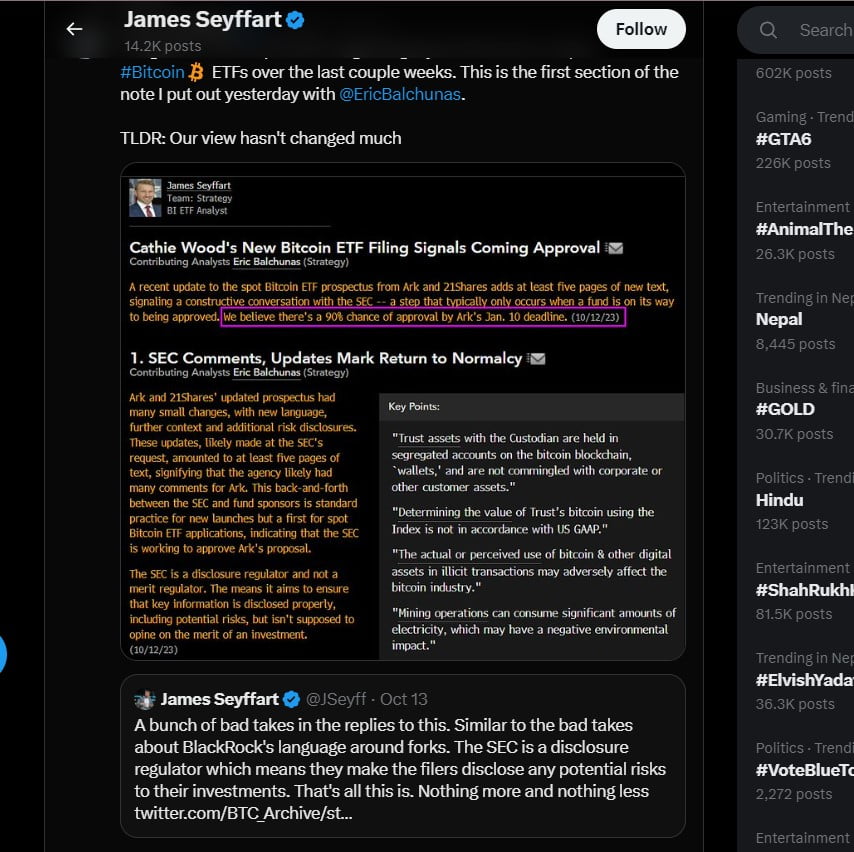

According to Bloomberg Intelligence ETF analyst James Seyffart, the flurry of filings indicates ongoing activity. However, their contents and implications remain unclear without a detailed review.

Establishments like BlackRock and Grayscale have been engaging with the SEC concerning their Bitcoin ETF filings. A recent memorandum highlighted an SEC meeting with BlackRok and Nasdaq on November 28, where BlackRock revised its In-Kind model design to address SEC concerns and outstanding queries.

Seyffart noted that both the SEC and these companies are working rigorously to resolve matters, suggesting that these filings reflect extensive discussions and significant efforts from both sides.

Additionally, BlackRock disclosed receiving $100,000 as “seed capital” for its proposed Bitcoin ETF, an investment made by an undisclosed entity. This funding, received on Oct. 27, 2023, will facilitate the creation of underlying units for the ETF, enabling shares to trade on the open market. The “iShares Bitcoin Trust” proposed by BlackRock is among 13 applications awaiting SEC approval. Analysts anticipate at least one spot Bitcoin ETF gaining approval in January, with a high likelihood of around 90%.

Meanwhile, Taiwan’s Financial Supervisory Commission (FSC) is contemplating allowing cryptocurrency exchange-traded funds (ETFs) but is observing their progress in other markets before making a decision. The FSC had previously blocked crypto-ETF proposals due to concerns about market volatility. Recent regulatory developments in Taiwan include a 30-page document outlining regulatory requirements for the industry, focusing on practical obligations for virtual asset service providers without mandating stablecoin issuers to maintain a 1:1 reserve fund ratio.