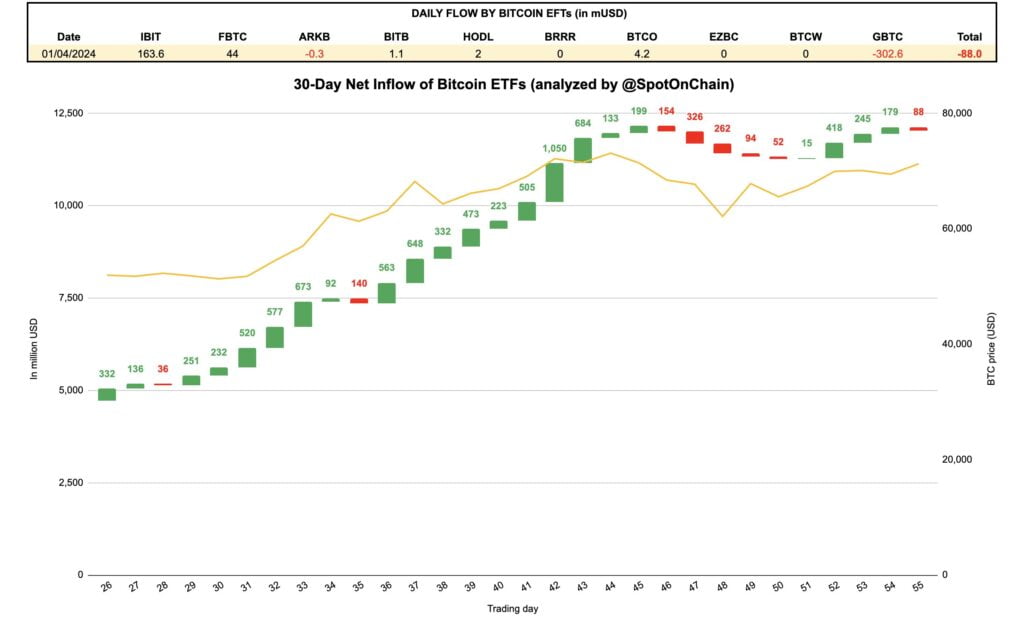

Reflecting the pre-halving jitters of Bitcoin investors, this week has been marked by a flurry of developments. According to a post from Spot On Chain published on the social media platform X (formerly Twitter), spot Bitcoin exchange-traded funds (ETFs) have taken center stage, offering a glimmer of optimism for investors. These funds saw a significant uptick, with $39 million pouring in on April 2nd and a substantial $113.5 million on April 3rd, compared to a notable outflow of $88 million on April 1st.

However, not all investors joined the rush to buy despite the prevailing optimism. A major player in the investment arena, ARK Invest, notably moved against the tide by withdrawing a net sum of $87.5 million on April 2nd. Similarly, Grayscale Bitcoin Trust (GBTC), a widely utilized investment option holding actual Bitcoin although not recognized as a genuine ETF, continues to witness capital outflows. While these outflows have slowed down, hitting a 26-day low at $75.1 million on April 3rd, they are still overshadowed by a much larger outflow of $302.6 million recorded on April 1st.

The differences in investor behavior suggest a potential change in strategy during the pre-halving period. The increasing interest in spot Bitcoin ETFs might suggest that investors are seeking a more direct and potentially cost-effective way to access Bitcoin compared to GBTC’s fee structure.

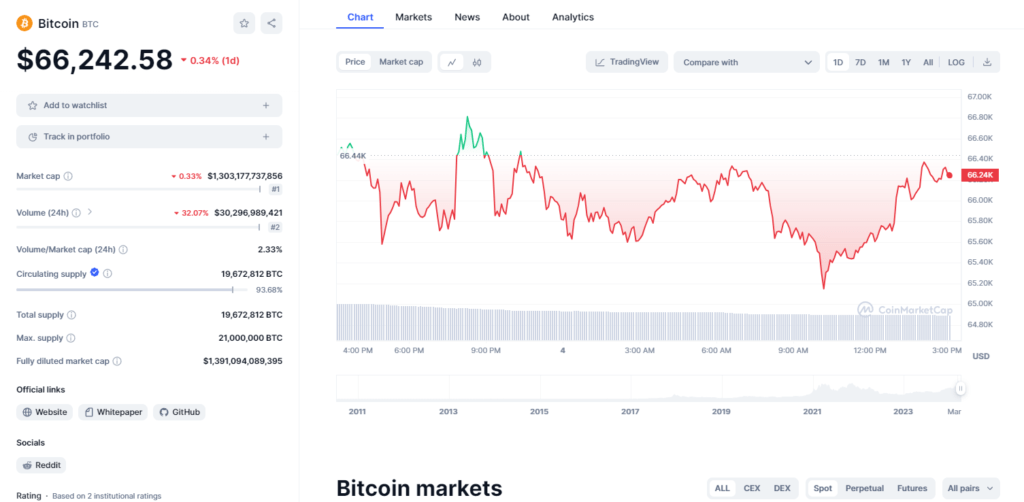

While this surge in spot ETFs brings a glimmer of positivity, there’s a catch: a recent downturn in the price of Bitcoin. Over the past week, Bitcoin has experienced a 6.33% decline, currently hovering around $66,200. Analysts speculate that this dip could be a precursor to a pre-halving adjustment, a historical trend observed before a scheduled reduction in Bitcoin’s issuance rate.

With Bitcoin holding a dominant share of more than 52% of the overall cryptocurrency market capitalization, its future movements are anticipated to exert a significant influence on the broader market. Whether the recent rise in spot Bitcoin ETFs indicates a long-term upward trend or a short-lived fluctuation remains uncertain. The events of this week emphasize the complex dynamics at work within the crypto sphere, where investor sentiment can change rapidly and established market participants must adjust their strategies accordingly.

Also See: ENA Token Defies Crypto Downturn, Amber Group Accumulation Sparks Speculation