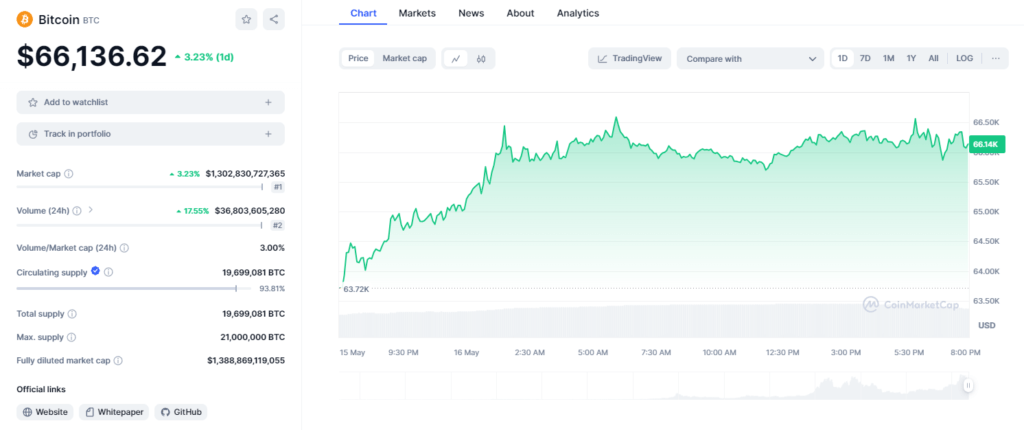

Bitcoin (BTC) surged over 3.23% in the past 24 hours, crossing @66,000 mark, fueled by a combination of macroeconomic factors and increasing institutional adoption this rise comes amidst positive U.S. inflation data and growing anticipation surrounding Bitcoin exchange-trade funds (ETFs).

Favorable Inflation Data Spurs Bitcoin Market Activity

The U.S. Consumer Price Index (CPI) data is a key drive of the recent surge, which revealed core inflation at a three-year low of 3.4%. This decrease in inflation has instilled optimism in the market, particularly among Bitcoin investors who view the cryptocurrency as a hedge against economic instability.

The Federal Reserve’s cautious approach to interest rates might change due to the lower inflation figures. However, some analysts express concerns that the slow inflation decline could limit potential rate cuts this year.

Institutional Interest and Bitcoin ETFs Fueling the Rise

Beyond inflation data, the rise in Bitcoin is heavily influenced by growing institutional interest, particularly in Bitcoin ETFs. Filing with the Securities and Exchange Commission (SEC) reveals significant investments from major banks like JPMorgan, Well Fargo, UBS, and the Bank of Montreal. Additionally, prominent entities like the State of Wisconsin Investment Board allocating $99 million to BlackRock’s Spot Bitcoin ETF further legitimize and stabilize Bitcoin’s position.

This trend is expected to continue, with anticipation high in the ETF market. The recent appointment of Salim Ramji, former head of global ETFs at BlackRock, as CEO of Vanguard, raises the possibility of a policy change towards spot Bitcoin ETFs at Vanguard. Increased institutional investment through ETFs in a potential force that could sustain Bitcoin’s upward trajectory.

CME Group Joins The Fray: Bitcoin Trading Initiative

Further underscoring the growing institutional demand, the Chicago Mercantile Exchange (CME) announced plans to launch Bitcoin trading. This move marks a significant milestone for cryptocurrency trading and could provide professional traders with new strategies by leveraging price discrepancies between futures contracts and the underlying asset. It also signifies a broader acceptance of Bitcoin as a legitimate tradable asset class.

Institutional Adoption Shaping Market Dynamics

The surge in institutional interest reflects a fundamental shift in how digital currencies are perceived. Major hedge funds and pension funds like Bracebridge Capital and the Wisconsin Investment Board have invested billions in cryptocurrency-linked vehicles managed by investment giants like BlackRock and Fidelity.

Rising Open Interest in Bitcoin Futures

This institutional adoption is further reflected in the growth of the Bitcoin futures market, particularly in the CME. The exchange boasts the largest Bitcoin futures market, with increasing trading activity and open positions. Overall Bitcoin Futures Open Interest (OI) surged by 8.39% to $32.16 billion, with OI on the CME alone rising by 6.90% to 137.58K BTC ($9.11 billion).

Bitcoin’s meteoric rise to $66,025.62, exceeding the $66,000 mark, is a clear indication of the confluence of positive inflation data and growing institutional interest. As the market anticipates further ETF approvals and the launch of Bitcoin trading on CME, Bitcoin’s future trajectory appears increasingly bullish.

Also Read: Hong Kong Crypto ETFs Suffer $39.3M Outflow, Erasing Gains