Contrary to the initial market dip following the U.S. presidential debate, publicly traded crypto stocks (Crypto exchanges and Bitcoin mining companies stock) rebounded, suggesting that the market’s reaction to Kamala Harris’s performance was not as negative as anticipated. This recovery occurred despite post-debate polls favoring Harris. The day ultimately concluded with only minor losses, indicating a resilient market sentiment towards the crypto industry.

On September 11th, crypto stocks prices dipped following the presidential debate between Kamala Harris and Donald Trump as the polls conducted by YouGov and FiveThirtyEight indicated Harris’ stronger performance over Trump. However, crypto stock prices recovered throughout the day, with most closing slightly lower than their opening prices.

Performance of Crypto Stocks

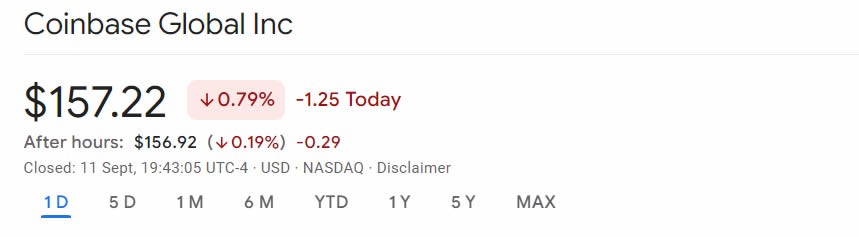

Coinbase (COIN), one of the largest cryptocurrency exchanges, saw its stock price fall to $150 in early trading. However, it regained 5.3% and ended the day at $157.22, down only 0.79%. The company’s strong recovery reflected investor confidence, despite concerns triggered by the political debate.

Source: Google Finance

Similarly, the largest Corporate Bitcoin holding company MicroStrategy (MSTR) experienced a drop to $122 following the debate. The company recovered most of its losses, closing the day at $129.30, down just 0.26%.

Performance of Bitcoin Mining Company Stocks

Shares of Bitcoin miners also saw early losses. Marathon Digital (MARA) fell nearly 1% during the day but recovered to close down 0.94%. Riot Platforms (RIOT) experienced a larger dip, dropping over 2% in early trading, but ended the day down 2.07%.

Meanwhile, Hut 8 (HUT), a major Bitcoin mining firm, stood out as the only crypto-linked stock to end the day with gains. After dipping to a low of $9.76, the stock surged to close at $10.58, up 1.29%. The company’s unique performance was attributed to recent operational improvements and strong investor confidence.

Political Influence on the Crypto Market

The debate highlighted the growing influence of politics on the cryptocurrency market. Trump has been a vocal supporter of cryptocurrencies, making several pro-crypto policy promises during his campaign. In contrast, Harris has not publicly shared her stance on the issue, leading to uncertainty among investors.

While Trump’s debate performance did not fare well in the polls, his support for the crypto industry may have helped crypto stocks recover from their early losses.

Polling Data and Market Reactions

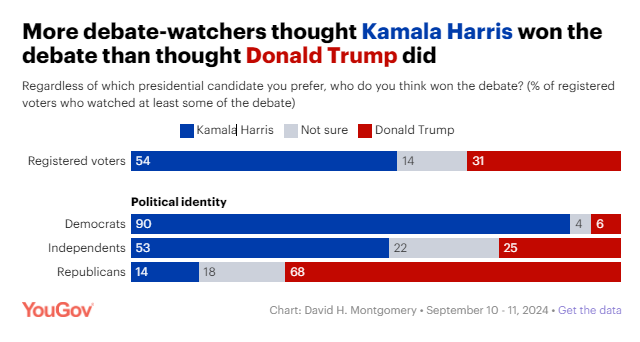

Polling data from a YouGov survey released on September 11 showed that 54% of registered voters believed Harris won the debate, while 31% felt Trump performed better.

Source: YouGov

Similarly, national polling conducted by FiveThirtyEight on Sept. 11 also shows Harris led the debate by 2.6%.

Despite Kamala Harris’s lead over Donald Trump in the September 10 debate, the market’s recovery by the end of the day indicates investors’ reconsideration of the debate’s long-term effects on the crypto sector.

At the time of writing, the overall cryptocurrency market capitalization has increased by 2.31% in the past 24 hours. Bitcoin, the top cryptocurrency, is currently trading at $58,108.80, reflecting a 4.56% rise from its intraday low of $55,573 on the day of the debate.

Also Read: CFTC Partners With Federal and Private Groups to Tackle Crypto Investment Fraud