In the recent upsurge within the broader cryptocurrency market, Ethereum outpaced Bitcoin in terms of growth rate. Ethereum has experienced a remarkable weekly price surge of 29.25% Vs 12.78% weekly surge of Bitcoin, largely driven by burgeoning optimism surrounding the potential approval of a spot Ethereum ETF. This anticipation has energized the market, significantly boosting Ethereum’s value. Investors speculate that the approval of a spot ETF could attract substantial institutional capital, further elevating Ethereum’s standing in the crypto sphere.

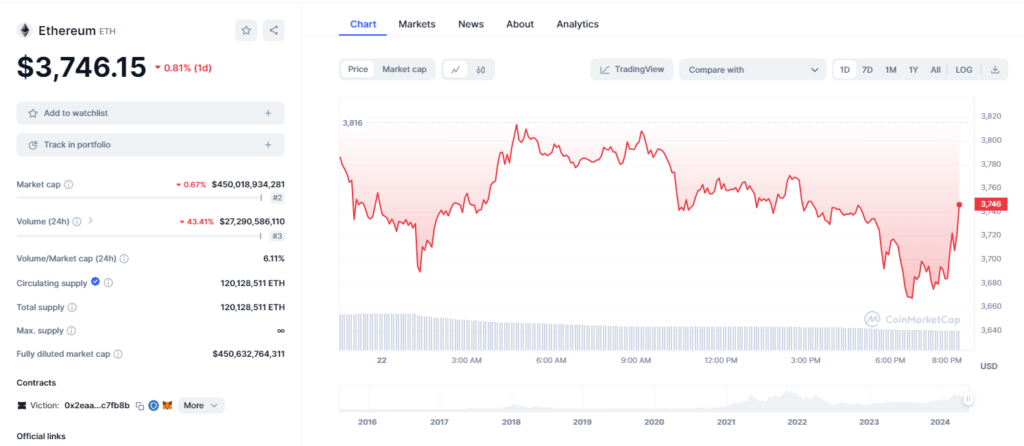

Reflecting positive effect of recent development, the price of Ethereum jumped by 19% to $3,661, and on Monday and Tuesday, it further surged by 3.49%. Currently Ethereum is trading at $3,347.15 reflecting 0.81% dip over the past 24 hours.

US SEC’s Evolving Posture on Spot Ethereum ETF Applications

According to Reuters, the Securities Exchange and Commission (SEC) has surprisingly asked Nasdaq, CBOE, and NYSE to submit the revised filings by the end of Tuesday. These changes in filings are usually requested from issuers before final approval. This marks a green signal for the approval process of pending spot Ethereum ETF applications indicating a 180-degree turn in the regulatory body’s stance.

Political Foundations and Varying Viewpoints

As the upcoming US presidential election rears up, crypto regulation has become a hot topic. President Biden may use the approval of spot Ethereum ETF as a strategic move to appeal to young voters. On the other hand, former President Trump has consistently articulated a pro-crypto stance, presenting a stark contrast to Biden’s approach. He has officially accepted Bitcoin for campaign donations. However, some observers posit that the SEC’s recent actions are a natural progression following the approval of futures ETFs, rather than politically motivated maneuverings.

Bitcoin Maximalists’ Alarms

Within the crypto community, Bitcoin supporters have raised their concerns regarding the SEC’s perceived favoritism towards Ethereum. This group harbors concerns that the regulatory body’s actions could disproportionately benefit Ethereum, thereby eclipsing Bitcoin’s dominance.

Legal Complications and Their Ramifications

The US House of Representatives is set to vote on a crypto bill this week. This event could profoundly influence the spot Ethereum ETF approval process. A legal officer from Coinbase claims that the ongoing legal discourse will be pivotal in shaping the regulatory framework, challenging the SEC’s current assertion that all altcoins are securities.

Prospective Approval Timeline

Speculations abound regarding the timeline for a spot ETF approval, with some experts projecting a possible nod by late July or early August. However, it’s crucial to acknowledge that these projections remain speculative, with no definitive confirmation from the SEC yet.

In conclusion, the confluence of regulatory shifts, political machinations, and market dynamics paints a complex picture of Ethereum’s recent price surge and the broader implications for the crypto market. As stakeholders navigate this evolving landscape, the interplay between legal considerations, investor sentiment, and political strategies will undoubtedly shape the future of spot Ethereum ETFs and their impact on the cryptocurrency ecosystem.

Also Read: Grok AI: Fun Mode Ignites AI Battle With OpenAI!