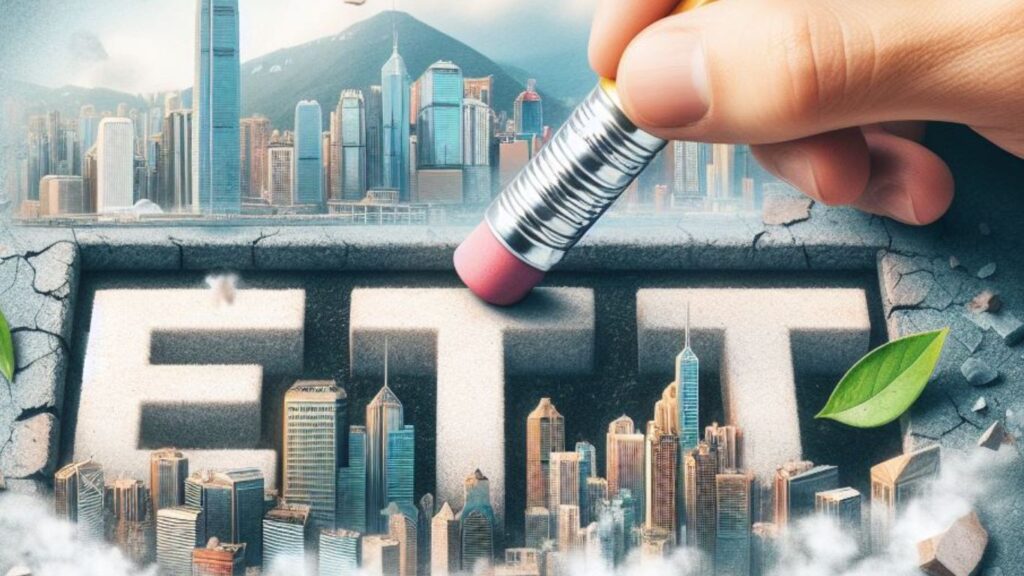

On Monday, May 13th, Hong Kong crypto ETFs (Bitcoin and Ether exchange-traded funds) faced a substantial setback, witnessing the largest-ever net outflow since their launch less than two weeks ago. Despite accruing a cumulative inflow of $18.4 million since their introduction on April 30th, these ETFs encountered a significant net outflow of $39.3 million on that fateful Monday, effectively erasing all gains achieved within the short span of their existence.

Data compiled by Farside Investors revealed that spot Bitcoin ETFs offered by Bosera, ChinaAMC, and Harvest Global collectively experienced net outflows amounting to $32.7 million on Monday. Among them, ChinaAMC’s Bitcoin ETF bore the brunt of the impact, witnessing a staggering single-day net outflow of $15.5 million. Meanwhile, Bosera and Harvest recorded respective net outflows of $7.4 million and $9.8 million on the same tumultuous day.

In tandem with the Bitcoin outflows, spot Ether ETFs from the same issuers witnessed a joint net outflow of $6.6 million. Harvest Global and ChinaAMC emerged as the frontrunners in Ether outflows, each facing withdrawals of $3 million.

This marked the third consecutive trading day where Hong Kong crypto ETFs experienced net outflows, culminating in a total withdrawal of $52.5 million from the funds since May 9th. Notably, it also marked the debut of outflows from Harvest Global’s Bitcoin ETF, amounting to $9.8 million.

On the contrary, Bosera stands out as the sole issuer to register a positive net inflow across both its Bitcoin and Ether ETFs, amounting to $1.5 million and $7.5 million, respectively. In stark contrast, ChinaAMC and Harvest grappled with overall net outflows across their Bitcoin and Ethereum ETFs. ChinaAMC faced substantial losses, with a net outflow of $16.8 million in its Bitcoin ETF and $5.2 million in its Ethereum ETF. Similarly, Harvest encountered setbacks, witnessing outflows of $3.3 million in its Bitcoin ETF and $4.6 million in its Ethereum ETF.

The recent tumult in Hong Kong crypto ETFs’ scene reflects broader concerns about the stability and sustainability of the cryptocurrency market, particularly in the wake of significant events such as halvings. While Bitcoin’s price fluctuations have long been a hallmark of the cryptocurrency landscape, the sharp outflows witnessed by Hong Kong’s ETFs serve as a reminder of the inherent volatility and uncertainty that investors must navigate in this space.

These outflow in Hong Kong crypto ETFs coincide with recent dips in Bitcoin price below the $61,000 mark, signaling what many perceive as a post-halving downturn. However, currently trading at $62,033.22, Bitcoin is showing strong resilience above $60,000 rejecting its downward trajectory. The key level to watch is trading above $64,000, according to crypto analyst Ali Martinez, for upward trajectory.

Also Read: Tether Trouble: Garlinghouse’s Warning, CTO Defends