Japan’s leading stock market index, the Nikkei 225, broke through a historic barrier on Thursday, reaching a new all-time high of over 39,000 points for the first time since 1989. This milestone marks the culmination of a remarkable 35-year journey, one characterized by a meteoric rise, a devastating crash, and finally, a slow but steady recovery.

In the 1980s, fueled by aggressive lending and speculation, the Nikkei ballooned into a massive bubble. By 1989, it had climbed to 38,915 points, representing a staggering 45% of global market capitalization. However, the bubble soon burst, leading to a precipitous decline that lasted for decades. By 2009, the Nikkei had plummeted to a mere 7,500 points.

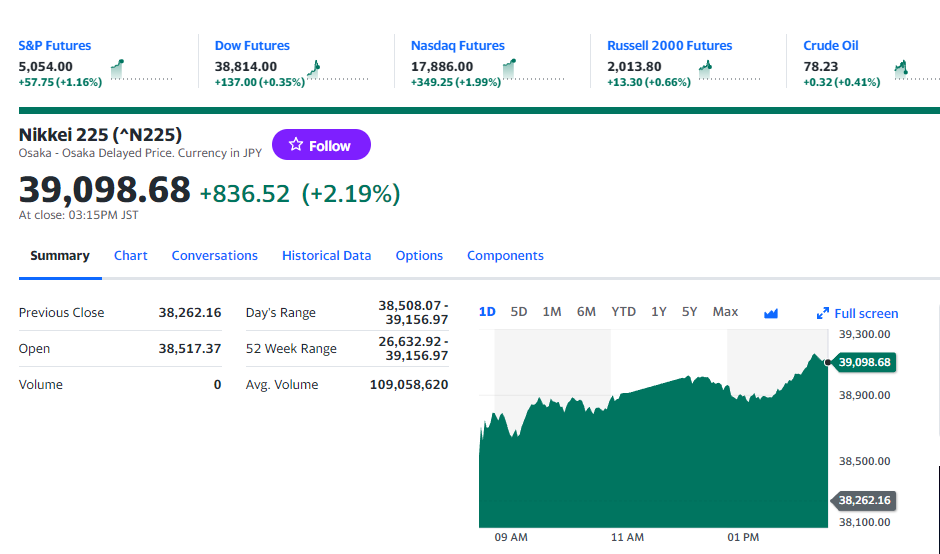

Since then, a gradual ascent has taken hold. Economic reforms, corporate restructuring, and a weaker yen have contributed to a renewed sense of optimism. On Thursday, the Nikkei finally surpassed its 1989 peak, closing at 39,060 points.

In recent months, the market has experienced significant increases, buoyed by robust enthusiasm from foreign investors who dominate the majority of trading activities on the Tokyo exchange.

In contrast to the United States, where stock values have been reaching unprecedented levels amid expectations that the Federal Reserve will initiate interest rate reductions once it deems inflation is genuinely contained, Japan has maintained its benchmark rate at a negative 0.1% for more than a decade.

Despite this achievement, the Nikkei’s global influence has significantly diminished. Its current share of global market capitalization stands at a mere 6%, dwarfed by the combined might of tech giants like Apple and Nvidia. This shift reflects the changing landscape of the global economy, where technology and innovation now play a dominant role.

While the Nikkei’s ascent is undoubtedly cause for celebration, it also serves as a reminder of the cyclical nature of markets and the ever-evolving global economic landscape. While Japan’s stock market has overcome significant challenges, the question remains: can it regain its former prominence in the face of shifting trends and fierce competition? Only time will tell.

Also See: Ripple vs. SEC: April Verdict or Marathon Trial? Insights and Predictions