Bitcoin has recently shown recovery from its lowest point in four months. However, analysts caution that a crucial indicator of retail interest in Bitcoin has plummeted to its lowest level in three years. They underscore the necessity for a resurgence in retail interest in Bitcoin to trigger what they term the “real bull run.”

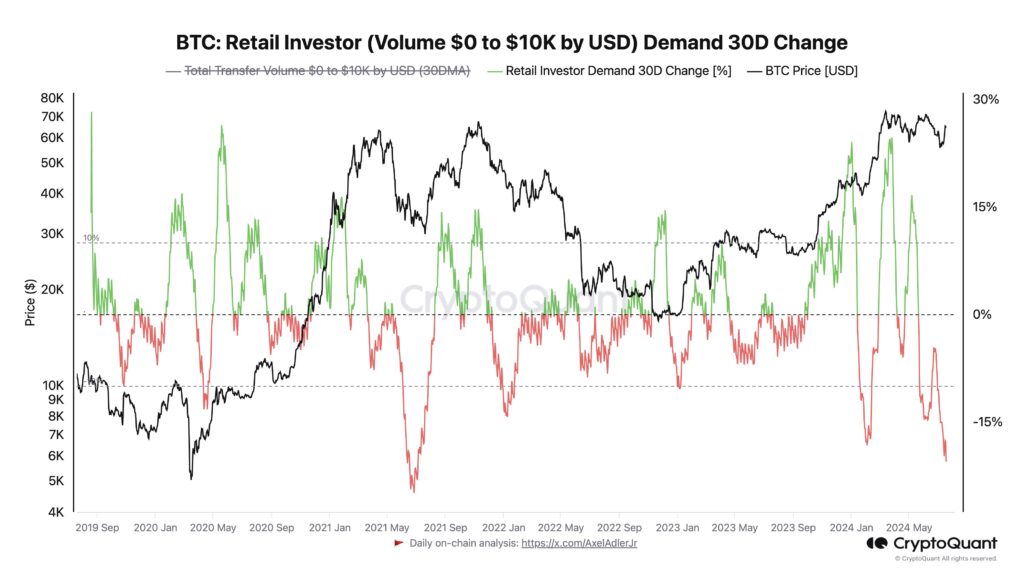

In his X post dated July 18th, Ki Young Ju, the founder and CEO of CryptoQuant, stated, “Bitcoin retail investor demand is at a 3-year low.” He highlighted that the 30-day total transfer volume of Bitcoin from retail investors holding less than $10,000 worth has fallen by a negative 15%.

“It’s measured by the 30-day change in total transfer volume for transactions under $10K,” Ju explained.

Whale trackers closely monitor large-scale whale transfers to forecast Bitcoin’s trajectory. Yet, analysts and traders often highlight that spikes in retail interest in Bitcoin play a pivotal role in driving Bitcoin price rallies.

Minkyu Woo, a verified author on CryptoQuant, echoes Ki Young Ju’s sentiments in his X post, stating, “The real bull run typically begins with massive buying volume driven by retail investors.” He emphasizes the crucial role of retail investors in bolstering market sentiment. He further stated, “We have not yet seen this volume from retail investors,” he added.

However, retail investors are reportedly playing a major role in the inflows of spot Bitcoin ETFs. According to VanEck CEO Jan van Eck, as of April, 90% of the contribution in the inflows into spot Bitcoin ETFs was from retail investors.

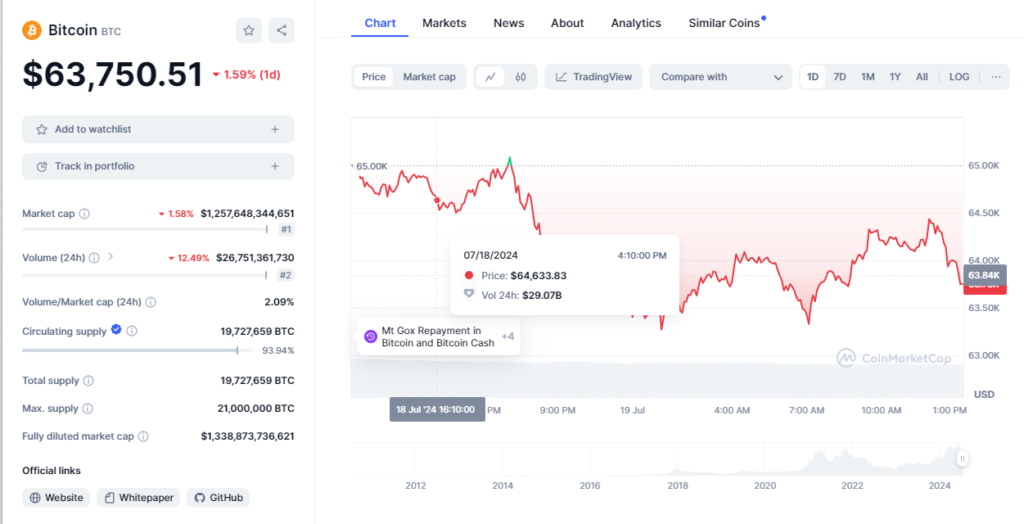

Investment into Spot Bitcoin ETFs in the US saw a sharp decline on July 17th. According to Farside data, net inflow on that day was only $53.3 million, a significant drop from the prior day. This was followed by a rise to $84.8 million on July 18th. The decline in ETF inflows coincided with Bitcoin’s struggles to break above $65,000, a price point seen as a potential trigger for another bullish trend.

Meanwhile, it was 27 days Bitcoin traded below $65,000 before Bitcoin crossed $65,000 to reach a high of $65,686 on 17 July. However, it quickly dropped below and has yet to climb back above that key level. As of writing, Bitcoin is trading at $63,750.51 marking a 1.59% drop in market capitalization, along with a 12.49% drop in trading volume to $26.75 billion over the past 24 hours according to CoinMarketCap data.

Corroborating the decline in retail interest in Bitcoin Google Trends data shows a significant drop in search interest for “Bitcoin” over the past three months. While comparing 12 months of search interest, the past three months experienced a drop of 44%. Similarly, search interest dropped by 57% since its all-time high of $73,679 in March. Search interest for Bitcoin often spikes during periods of major price movements, so this decline could be a sign that retail investors are becoming less enthusiastic about the cryptocurrency.

Also Read: Mt. Gox Repayments: 50% Creditors Show Strong Faith in Bitcoin’s Future