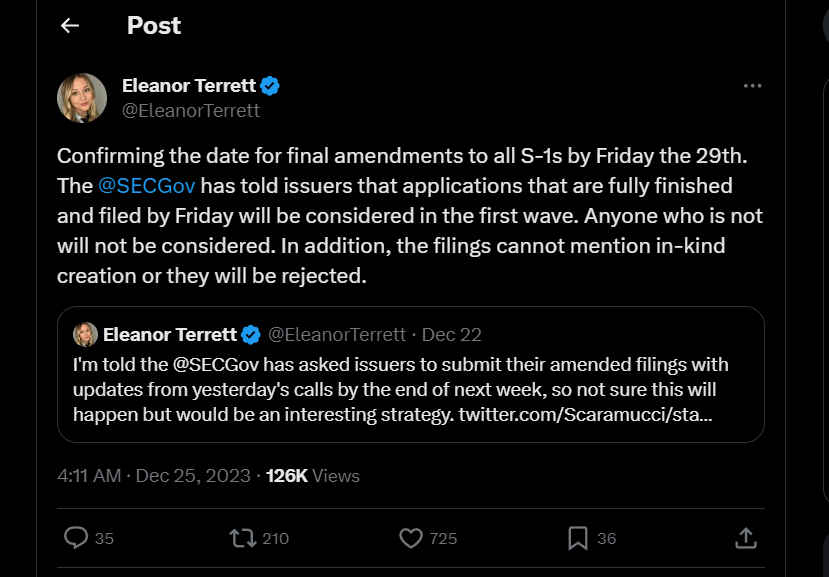

In an ongoing process of approving spot Bitcoin ETFs, the American Securities and Exchange Commission (SEC) has issued a circular specifying the deadline for submitting the amended spot Bitcoin ETF applications (S-1 forms) for those applicants who have applied for approval of spot Bitcoin ETF.

A highly awaited move from the SEC is at the brink of 2023 and called for potential spot Bitcoin ETF issuers for the amended spot Bitcoin ETF application (S-1 forms) to be submitted by the 29th of December, 2023 to be considered as part of the first wave. The warning from the SEC is that any issuer unable to submit the amended file is not accepted later.

In addition to the cutoff date for submission of the amended S-1 file, the SEC had made it clear that any filing employing an ‘in-kind’ creation model would be rejected outright. Instead, applicants are subject to adhere to the SEC-preferred ‘Cash Creates’ redemption model.

According to Ruiters, the SEC held meetings with representatives from at least seven companies, including BlackRock, Grayscale Investment, ARK Investments, and 21 Shares last Thursday. At least 2 companies were instructed to submit final amendments by next week

Moreover, the SEC’s position on the approval of spot Bitcoin ETF involves implementing the Prime Execution Agent model, which acts as an intermediary between investors and the various markets or trading venues.

As the year 2023 draws to a close, the crypto market is creating a buzz with excitement and anticipation. Crypto enthusiasts are closely watching how the approval process of the spot Bitcoin ETFs unfolds in the coming days.

Related News: Hong Kong SFC Moves Towards Mainstream Adoption of Spot Crypto ETFs