The Spot Bitcoin ETF had an impressive start to April, initially experiencing total net outflows but rebounding to achieve weekly total net inflows of over $480.9 million by the end of the week. Despite this rebound, Bitcoin ETF inflows have decreased by half compared to the strong influx of the previous week. Nevertheless, the rebound is noteworthy and could potentially stimulate a recovery in the BTC price.

The week kicked off with a net outflow of $88 million on April 1st, according to Spot On Chain data. Grayscale’s GBTC led the outflows with a significant $302.6 million, while other funds saw mixed results. BlackRock’s IBIT bucked the trend with a net inflow of $163.6 million. Fidelity’s FBTC also posted a net inflow of $44 million. Similarly, smaller inflows were recorded by Bitwise Bitcoin ETF ($1.1 million), VanEck Bitcoin Trust ETF ($2 million), and Invesco Galaxy ETF ($4.2 million). Ark Invest was the only exception with a minor net outflow of $0.3 million.

Despite fluctuations, cumulative net inflows for Spot Bitcoin ETFs soared to an impressive $12.04 billion within just 59 days of SEC approval. This underscores the sustained investor interest in this asset class.

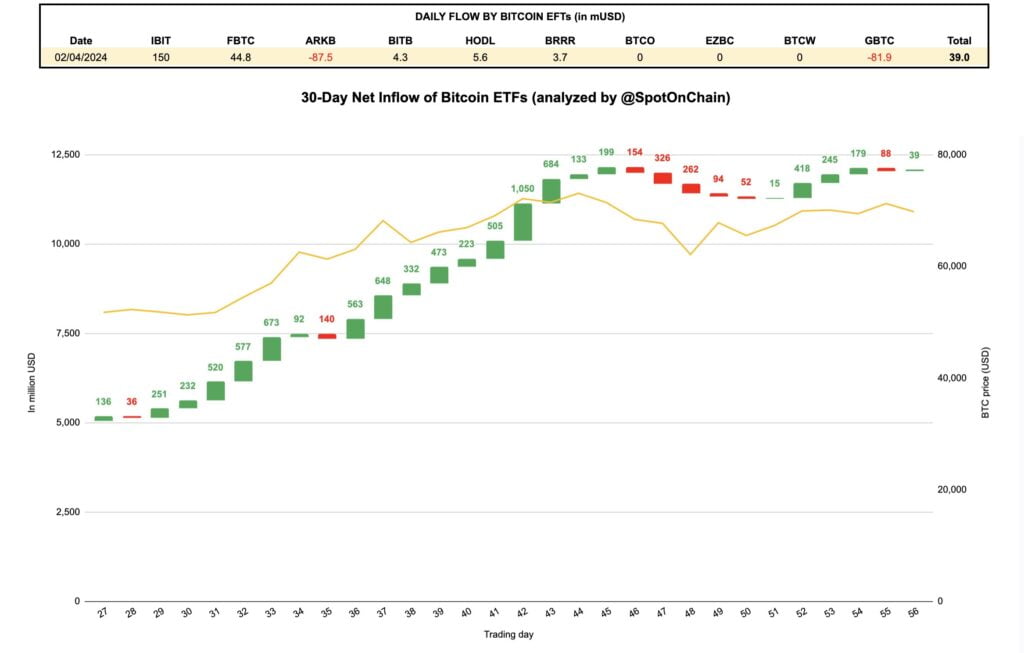

Tuesday, April 2, Spot Bitcoin ETFs experienced total net inflows amounting to $39 million. However, Ark Invest’s ARKB’s graph of net outflow climbed to $87.5 million whereas GBTC’s single-day net outflow dropped to $81.9 million from the previous day’s net outflow of $302.6 million, countered by IBIT’s net inflow of $150 million and FBTC’s net inflow of $44.8 million.

On Wednesday, the downward trend in outflows persisted, resulting in a cumulative net inflow of $113.5 million, up from the previous day’s $39 million. FBTC witnessed a significant increase in net inflow to $116.7 million from $44.8 million, while Grayscale’s GBTC saw total net outflows decrease to $75 million. BlackRock’s IBIT experienced a slight decrease in net inflow but remained positive at $42 million. This surge in total net inflow indicates a heightened level of investor interest across all Bitcoin ETFs.

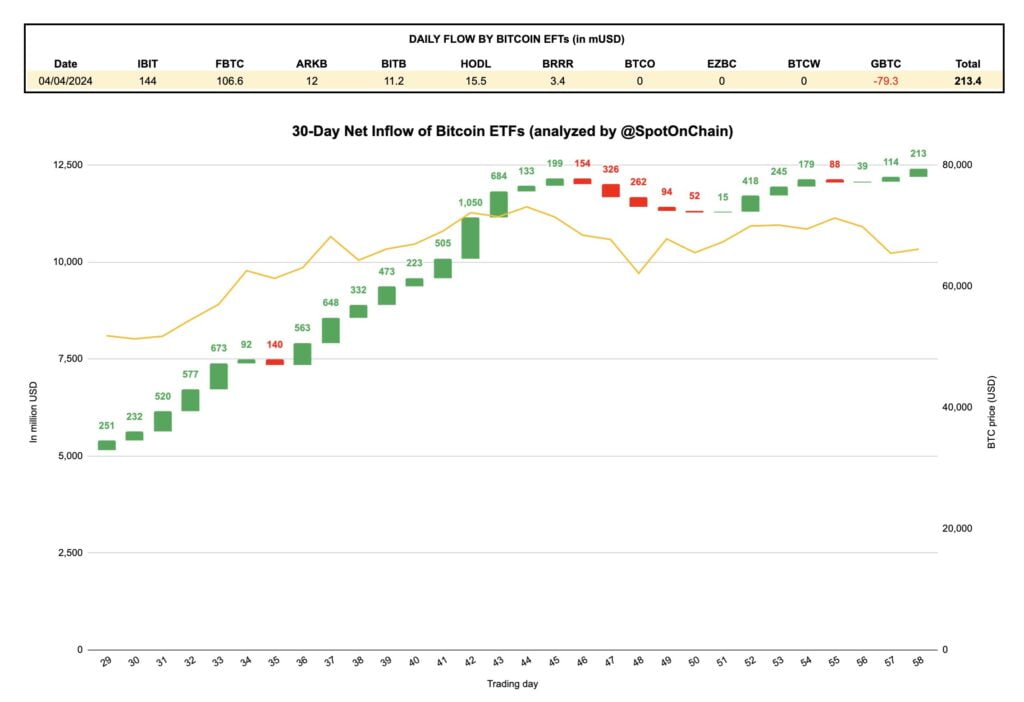

Thursday stood as the best day for Spot Bitcoin ETFs recording the highest cumulative net inflow of $213 million within the week. This marked the third consecutive day for Bitcon ETF inflows, indicating renewed investor demand following a recent decline. GBTC’s ETF was the only one to experience a net outflow ($79.3 million). The increase in spot Bitcoin ETF inflows just before the halving suggests strategic accumulation of BTC holdings by investors.

The week wrapped up on Friday, April 5, with consistent Bitcoin ETF inflows totaling a net inflow of $203 million. Notably, BlackRock led with $308.8 million in inflows, followed by Fidelity with $83 million. However, GBTC continued to experience outflows of $198.9 million, even after the completion of Genesis liquidation.

As Bitcoin ETF flows rebounded, the BTC price gained momentum, surpassing $69,000. At the time of writing, on Sunday, April 7, the Bitcoin price increased by 2.22% to $69,316.77. Conversely, crypto trading volume fell by 15.92% to $19.73 billion. Meanwhile, the BTC market cap stood at $1.36 trillion.

Michaël van de Poppe, a prominent crypto analyst, recently forecasted that if BTC breaks above $69,000, it could test new all-time highs. However, he expressed skepticism and suggested consolidation in the BTC price, concluding, “But to be honest, I think the most upside is skewed already pre-halving and consolidation is next.”

Due to the price rebound, Bitcoin witnessed significant short liquidations as traders bought back their positions to minimize losses. This could trigger a short squeeze, leading to further price increases before a potential downturn.

According to Coinglass, BTC experienced $24.96 million in short liquidations out of a total of $27.57 million in the past 24 hours.

Also See: Bitcoin: Pre-Halving Jitters? Spot ETFs Gain Despite Market Correction