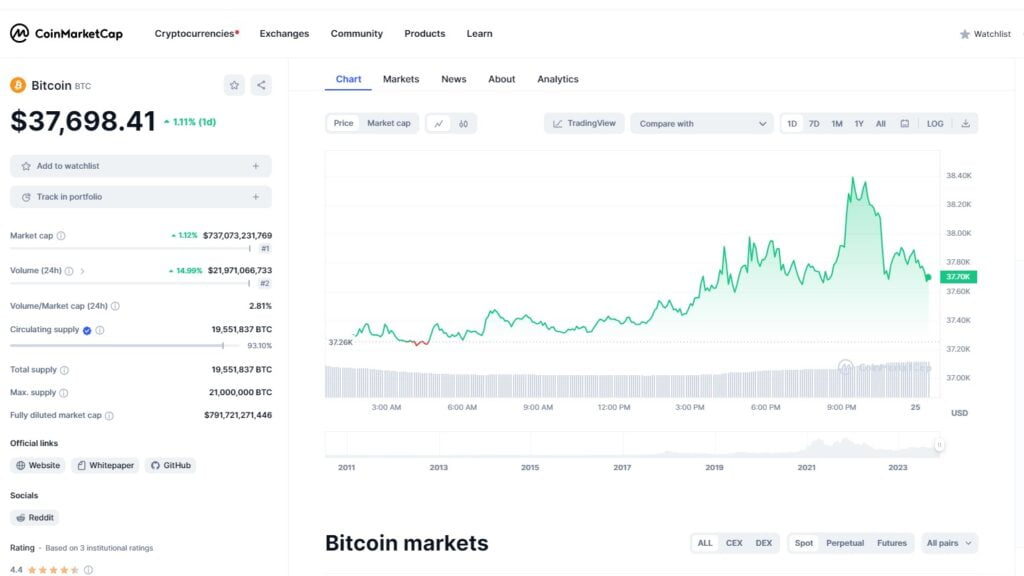

Bitcoin BTC has reached its peak, soaring approximately 127% increase adding its value by $21,100 within 11 months from its lowest point of $16,600 in January 2023. As of now, Bitcoin is trading at $37,700, maintaining its upward trend for the past 6 weeks.

Between June 15 and October 15, the price of Bitcoin BTC remained within the range of $24k to $26k. Upward movement in Bitcoin price could be linked, in part, to a gamma squeeze prompted by option dealers which was then followed by surge in spot trading volume, notably in exchanges like Binance and OKEx exchanges.

Markus Thielen, head of research at Matrixport, a crypto service provider, and founder of Defi Research, anticipates Bitcoin’s price surge persisting until the year’s end, potentially reaching $40,000 or ever $45,000 as an impact of Binance-USA agreement on BTC and Binance.

According to The Block , Markus Thielen said that Binance’s agreement Department of Justice and Changpeng Zhao’s resignation a Binance CEO within the scope of this agreement is a turning point in the crypto world.

Thielen’s note attributes this projection to market conditions and expectations of a relaxed stance by US Federal Reserve (Fed). Bitcoin BTC, the leading cryptocurrency by market cap, has more than doubled in value this year, surging nearly 40% in just four weeks.

Recent price movements have fueled demand for call options, allowing buyers to acquire an asset at a predetermined price. Thielen notes a surge in bullish bets, with market makers consistently taking the opposing side of customer trades, which further propels prices outward. Entities involved might purchase BTC and hedge as price rise, adding to the upward pressure.

Thielen highlights upcoming significant options expirations on 11/24 and 12/29, totaling billions in open contract balances. The dominance of call options, particularly those at the $40,000 strike, indicates more Bitcoin BTC purchases to hedge, potentially driving the price this mark.

Another supporting factor is the declining inflation rate, raising hopes for Fed rate cuts or increased liquidity. The Fed’s aggressive rate hikes until May 2023 curbed inflation but also hindered investment in risky assets, contributing to the previous crypto crash. However, recent data shows a slowdown in inflation, with October’s CPI rising by 3.2% year-over-year.

UBS suggests a potential rate cut by the Fed, predicting a 90 basis points decrease by 2024. Thielen notes a 2% inflation rate against a 5.25% interest rate, signaling a potential 200 basis points rate cut if this trend continues–an optimistic prospect.

Thielen forecasts CPI dropping below the Fed’s 2% targe by 2024.

Additionally, optimism surrounds the potential swift approval of ETFs, which could further bolster price hikes. Bloomberg analysts estimate a 90% chance that SEC will approve one or more spot ETFs by 1/10.